Ethereum PoW (ETHW) registered a notable increase over the past day while the Ethereum (ETH) staking market cap slid.

ETHW is up by 27% in the past 24 hours and is trading at $3.4 at the time of writing. The asset’s market cap surpassed the $365 million mark with a daily trading volume of $72.6 million. EthereumPoW is currently standing at its seven-month-high, last seen on April 20 this year.

ETHW is a separate blockchain that emerged as a result of a fork from the main Ethereum blockchain. This fork occurred in September 2022, in response to Ethereum’s transition from a Proof-of-Work (PoW) to a Proof-of-Stake (PoS) consensus mechanism through an upgrade known as “The Merge.”

Data shows that ETHW registered a 150% surge over the past 30 days. Despite the recent rise, EthereumPoW is still down by 97% from its all-time high (ATH) of $141.3 in August 2022.

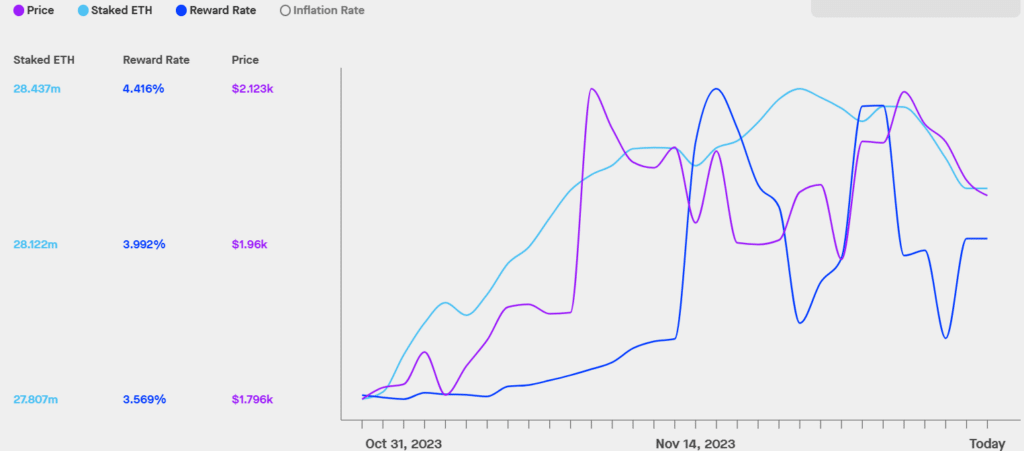

On the other hand, data provided by Staking Rewards shows that the total ETH staking market cap declined by 0.7% over the past week — currently standing at $56.8 billion. The downward momentum started with Ethereum’s decline from the $2,100 mark.

Per Staking Rewards, the number of staked Ethereum reached an ATH of 28.44 million ETH and has declined to 28.23 million coins at the time of writing. This movement could indicate that the Ethereum network validators might have been trying to swap their assets for profit.

While the amount and value of staked ETH dropped, the reward rate increased by 28% over the past two days — rising from 3.73% on Nov. 26 to 4.01% at the time of writing.

According to a crypto.news report Nov. 27, Ethereum co-founder Vitalik Buterin shared his plans to renovate and repair the ETH staking. He added that the problem of centralization in Ethereum staking will be addressed in the Dencun update.

Following the decline in the amount of staked Ethereum, the asset’s price registered a 1.5% decline in the past 24 hours. ETH is currently trading at around $2,010 with a total market cap of $242 billion.

However, Ethereum’s 24-hour trading volume witnessed a 20% surge, surpassing the $10 billion.

This article first appeared at crypto.news