XRP’s price rose for two consecutive days as traders awaited the closely watched U.S. election, which could have significant implications for Ripple.

Ripple (XRP) rose to an intraday high of $0.52 on Nov. 5, up 5% from its lowest level this month. However, it remains in a local bear market, having fallen 23% from its October high.

Some crypto analysts believe XRP has more upside potential. In an X post, Brett, a crypto analyst with 58,000 followers, noted that the coin may be on the brink of a new bull run.

In another post, Dark Defender, an analyst with over 110,000 followers, argued that XRP could bounce back. Notably, the coin’s oscillators indicate the price is currently trading within the oversold zone. He expects the coin to rise to $0.5286, followed by $0.60 and $0.66.

Another popular crypto analyst said that the XRP/ETH price had formed an inverse head-and-shoulders pattern on the four-hour chart and was in the oversold level.

These forecasts for XRP came shortly after Ripple Labs released their third-quarter report, noting the SEC case as a major obstacle. The report also highlighted institutional interest in XRP, with companies like Bitwise, Canary, and 21Shares filing for Ripple ETFs.

Tuesday’s U.S. presidential election could impact XRP in a potential Donald Trump administration. Notably, a new Securities and Exchange Commissioner is more likely to end ongoing litigation, which represents a positive catalyst for XRP.

XRP price analysis

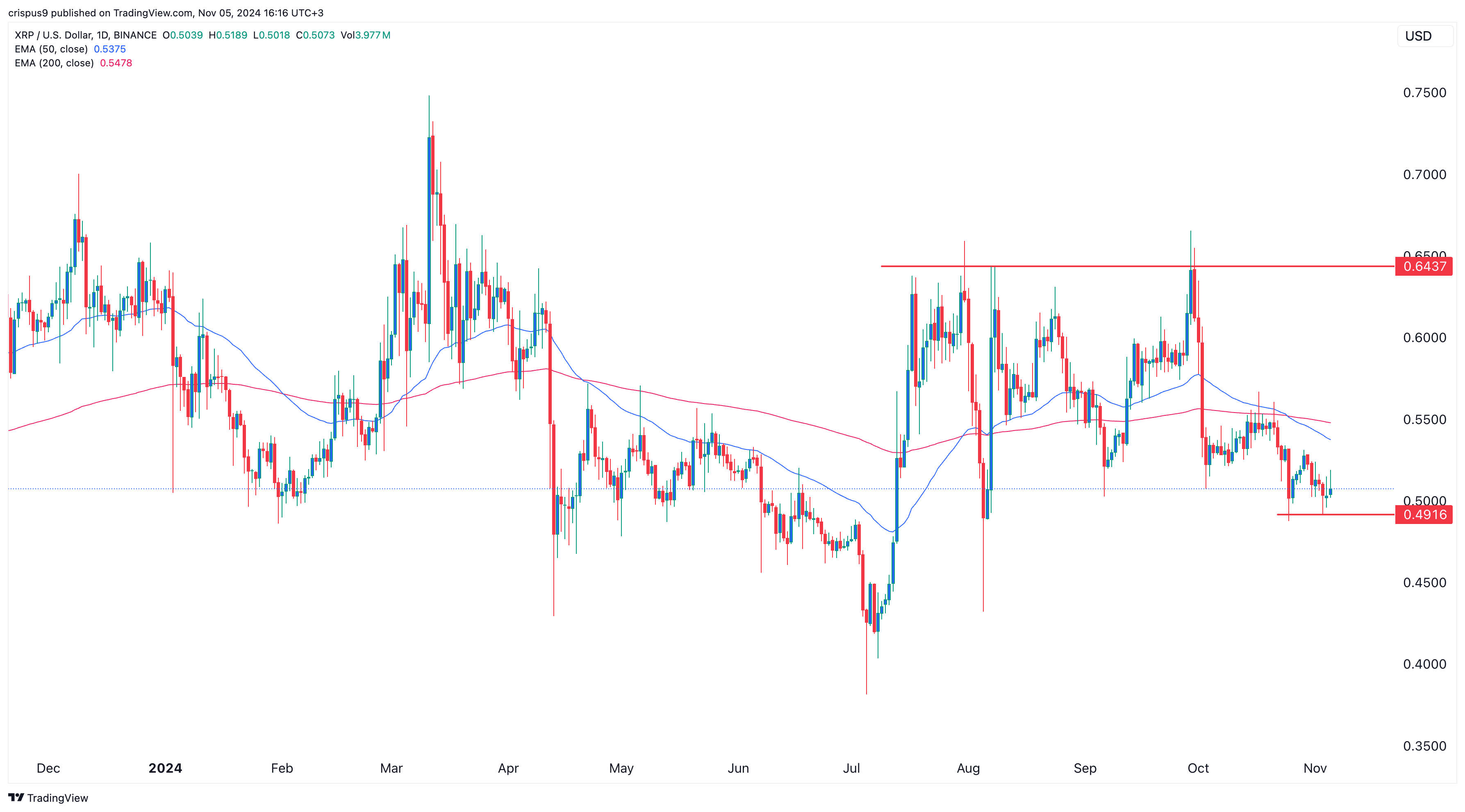

The daily chart shows that XRP formed a small double-bottom pattern at $0.4916, a pattern that often precedes a bullish breakout.

However, a risk remains, as XRP has formed a death cross, with the 200-day and 50-day Exponential Moving Averages crossing.

Additionally, Ripple has formed a double-top pattern at $0.6437, indicating the possibility of a bearish breakout in the near term. This view will be confirmed if XRP drops below the double-bottom level at $0.4916. Conversely, a move above $0.5300 could signal further gains, invalidating the double-bottom pattern.

This article first appeared at crypto.news