The XLM price staged a strong comeback on Nov. 27, forming a bullish engulfing candlestick pattern.

Stellar (XLM), the second-largest payment-focused network after Ripple (XRP) surged to an intraday high of $0.5311. This rebound reversed a two-day sell-off that had pushed it into a local bear market.

Stellar’s recovery coincided with a broader crypto market rebound, as Bitcoin (BTC) and other major coins like also bounced back.

Fundamentally, Stellar’s DeFi ecosystem continued to perform well this week. According to DeFi Llama, Stellar’s total value locked in DeFi reached a record high of over $56 million.

Total assets in the Stellar ecosystem, including those in the Real World Asset tokenization industry, are nearing $300 million. This growth is driven by the Franklin Templeton OnChain US Government Money Fund, which has accumulated over $400 million in assets.

Other significant decentralized applications in the Stellar ecosystem include DEX platforms such as LumenSwap, Aquarius Stellar, and Scoputy.

Stellar’s price increase was also supported by signs of regulatory clarity in the U.S. Recently, a court ruling found that OFAC had overstepped its authority when sanctioning Tornado Cash, noting that autonomous software cannot be classified as property.

U.S. courts have issued favorable rulings for the crypto industry in recent months. In 2023, a judge ruled that XRP was not a financial security, and Ripple was ordered to pay only $250 million, a fraction of the $2 billion the SEC had sought. These developments, along with Trump’s re-election, have raised speculation about a potential spot XLM ETF in 2025.

XLM price forms a bullish engulfing

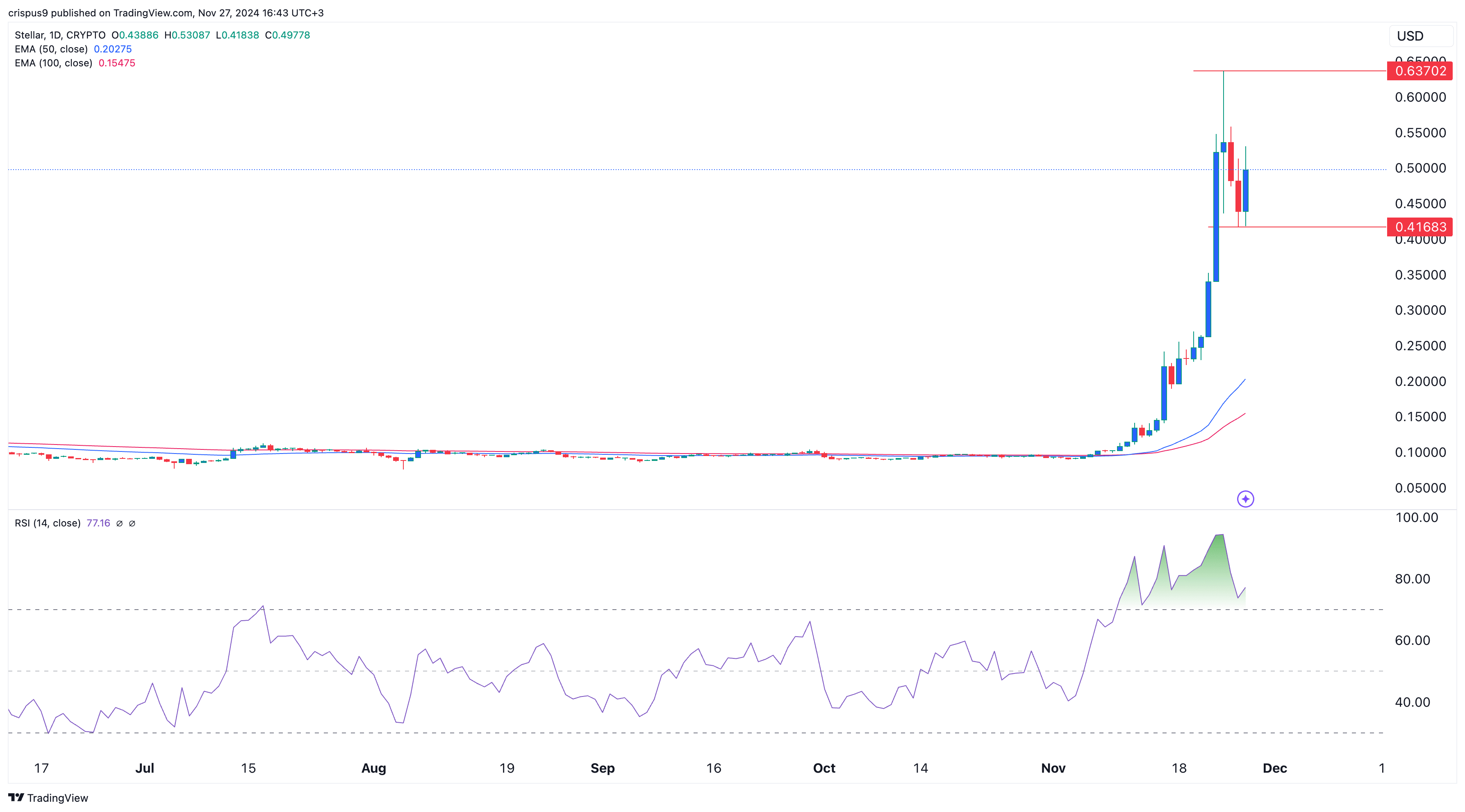

In an article published last week, we predicted that the Stellar price would suffer a harsh reversal, which happened. Stellar’s price dropped to a low of $0.4168 on Nov. 26, a 35% decline from its highest level this year. It has since formed a bullish engulfing candlestick pattern, a strong reversal indicator characterized by a large bullish candlestick fully covering a preceding bearish one.

If Stellar Lumens price closes above $0.50, this would validate the engulfing pattern and indicate further gains. Under this scenario, the price could retest its year-to-date high of $0.6370, the peak it reached earlier this month.

However, there is a risk that this rebound could be a dead cat bounce, a temporary recovery during a sell-off. This bearish view would gain traction if the price falls below $0.4168.

This article first appeared at crypto.news