Key Takeaways

- WisdomTree has filed for a spot XRP ETF with the SEC.

- The ETF would track XRP’s price, and Bank of New York Mellon is proposed as the trust administrator.

Share this article

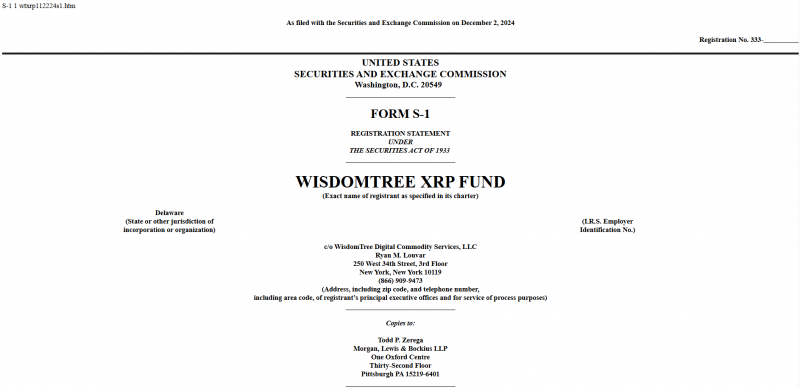

WisdomTree has officially filed a Form S-1 registration statement with the Securities and Exchange Commission for a spot XRP exchange-traded fund, marking its entry into the growing field of asset managers seeking to launch XRP-based investment products.

Bank of New York Mellon will serve as the administrator for the proposed trust, according to the December 2 filing. The planned ETF would track XRP’s price, which currently ranks as the third-largest crypto asset by market value.

WisdomTree joins Bitwise and Canary Capital in pursuing XRP ETF products. The asset manager has not yet specified an exchange venue or ticker symbol for the proposed fund.

The filing follows WisdomTree’s recent establishment of a trust entity in Delaware for the proposed fund. The move comes amid uncertainty over the SEC’s stance on XRP products, particularly given Ripple Labs’ ongoing legal disputes with the regulator.

Industry observers suggest that SEC Chair Gary Gensler’s planned resignation could prompt a reevaluation of the agency’s approach to litigation, potentially creating a more favorable environment for XRP ETFs under future leadership.

This is a developing story.

Share this article

This article first appeared at Crypto Briefing