The newcomer into the meme coin space, dogwifhat, recorded a massive decline in its open interest amid increased price fluctuations.

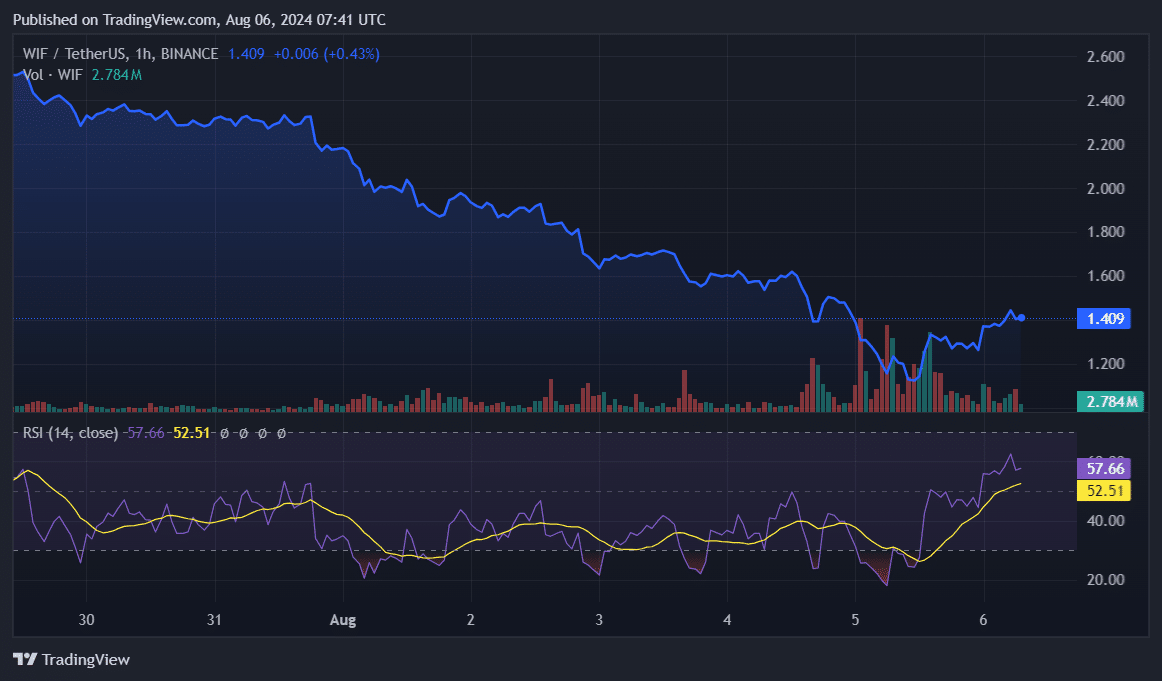

Data shows that dogwifhat (WIF) is still down by 40.6% over the past seven days despite the recent 24% price rally. WIF is trading at $1.42 with a market cap of $1.417 billion at the time of writing.

On Aug. 5, the meme coin plunged to a five-month low of $1.08 as the market wandered in uncertainty.

Following the price hike, WIF’s Relative Strength Index (RSI) surged from 26 (the oversold zone) to 52 (the neutral zone) over the past day.

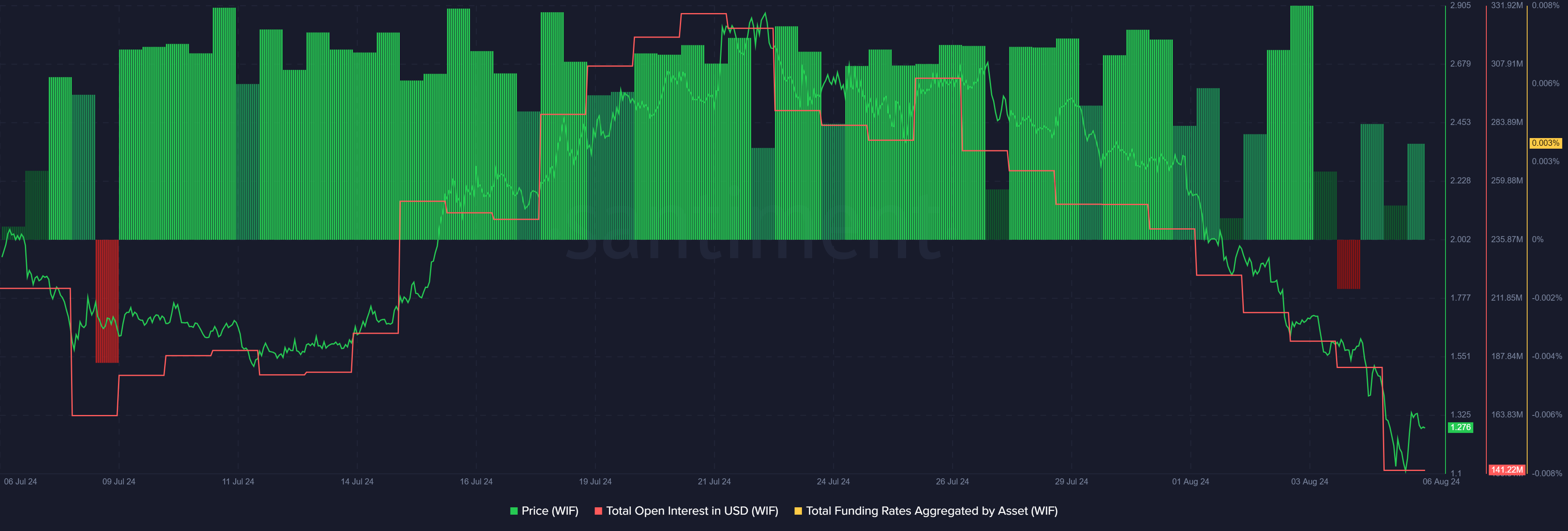

According to data provided by Santiment, the WIF total open interest dropped from $183.4 million to $141.2 million over the past two days. This level hasn’t been recorded since March 1.

The decline in the meme coin’s open interest shows that more traders are taking a small-risk approach due to market-wide fluctuations. This can lead to lower price volatility for dogwifhat since lower liquidations would be expected.

Data from the market intelligence platform shows that the funding rate aggregated by WIF on all exchanges rose from 0.001% to 0.003% over the past 24 hours. The indicator shows that traders are betting on WIF’s price hike.

However, major macroeconomic events could change the direction of the cryptocurrency markets despite bullish technical and on-chain indicators.

One of the most important events that triggered a market-wide downturn on Aug. 4 was the geopolitical tension between Iran and Israel, and the expectations of a potential war.

This article first appeared at crypto.news