The global crypto market has been witnessing bearish sentiment over the past week after the leading cryptocurrency reached a new all-time high (ATH).

According to data provided by CoinGecko, the total crypto market cap has declined by over $450 billion since March 13 and is currently sitting at $2.44 trillion.

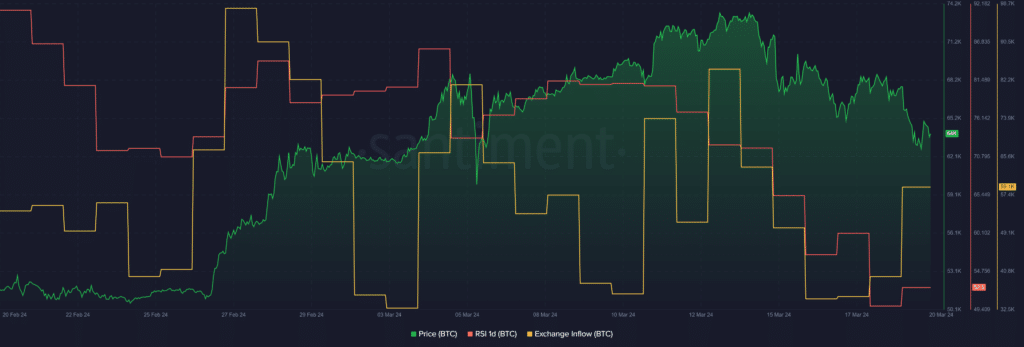

The fall comes after Bitcoin (BTC) touched a new ATH of $73,750 — with a market cap of $1.45 trillion — on March 14. The flagship cryptocurrency recorded a 16% decline since reaching its ATH and is currency trading at $61,780.

Data from Santiment shows that Bitcoin’s Relative Strength Index (RSI) has sharply declined since March 14. According to data from the market intelligence platform, the BTC RSI is currently hovering around the 52 mark.

The indicator suggests lower price volatility for Bitcoin and high price fluctuations are expected to be far-fetched.

Terms “dip” and “buy the dip” are also trending as investors are exploring buying opportunities during the market downturn, per Santiment.

It’s important to note that the BTC exchange inflow increased from 39,731 to 59,101 coins over the past 24 hours, indicating that some investors might be trying to get short-term profits if the asset’s price surges.

According to a crypto.news report, Bitcoin’s fall below the $70,000 mark has brought concerns among traditional investors as the recent price dip is the largest market-wide pullback since the start of the year.

This article first appeared at crypto.news