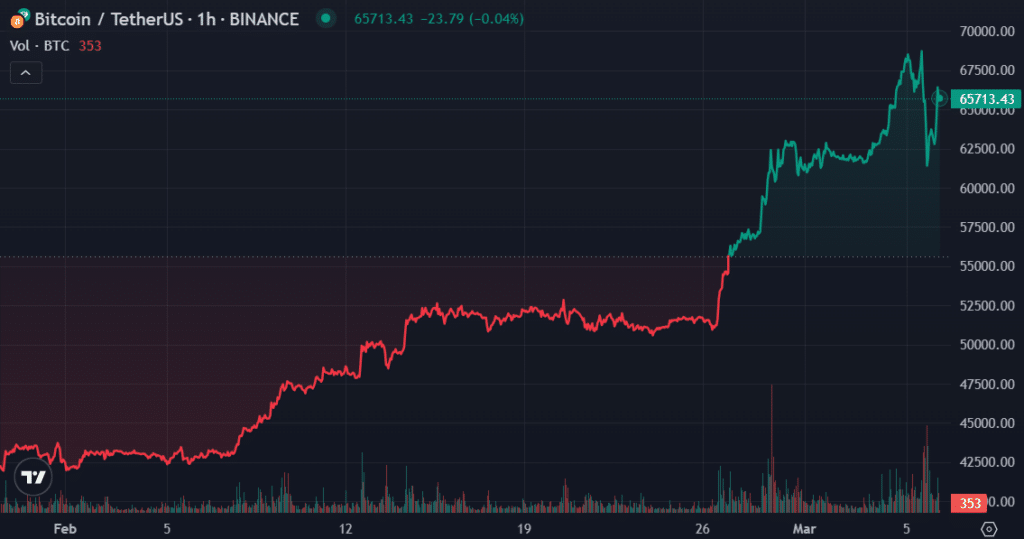

The global crypto ecosystem witnessed a notable decline after recording consecutive green days over the past month.

On March 5, Bitcoin (BTC) reached a new all-time high of $69,170 with a total market cap of over $1.4 trillion. However, the flagship cryptocurrency took a deep dive below the $60,000 mark as the market started to cool down.

CryptoQuant’s head of research Julio Moreno showed a chart on X that indicated the Bitcoin heatmap since the start of the year. As BTC surpassed the $60,000 mark, data showed the leading digital currency in the overheated zone.

Moreover, following the Bitcoin price drop, the global crypto market cap also declined by 1.4% over the past 24 hours — falling from $2.68 trillion to $2.58 trillion.

On the other hand, the daily crypto trading volume increased by 27%, reaching $317 billion in the past 24 hours, according to CoinGecko.

According to data provided by Santiment, many users on X and Reddit are currently discussing holding their crypto assets during the recent price dip. Some users, per the market intelligence platform, believe the price dip might be the “time” to “buy” Bitcoin and are aiming for a further price rally.

Furthermore, Santiment data shows that Bitcoin is currently hovering between neutral and slightly bullish investor sentiment at the current price point.

Despite the market-wide decline, Shiba Inu (SHIB) is still standing in the bullish zone, according to Santiment. Notably, SHIB recorded a 230% rally over the past seven days and reached levels not seen since late 2021.

This article first appeared at crypto.news