The crypto market witnessed a sharp decline just hours after the Matrixport report on Jan. 3. However, data shows that investors believe this could be a local bottom.

According to data provided by CoinGecko, the global crypto market capitalization is down by 4.8% in the past 24 hours and is currently hovering around $1.73 trillion — registering a $70 billion decline.

On the other hand, CoinGecko data shows that the 24-hour global crypto trading volume recorded a 95% rally over the past day — rising from $94 billion to $183 billion.

The marketwide decline came after Matrixport published its analysis claiming that the U.S. Securities and Exchange Commission (SEC) will reject all the Bitcoin (BTC) exchange-traded fund (ETF) applications this month.

Just three hours after the Matrixport report, Bitcoin witnessed a 10% decline from around $45,500 to $40,800. However, the flagship cryptocurrency registered a notable correction and is currently trading at around $43,000.

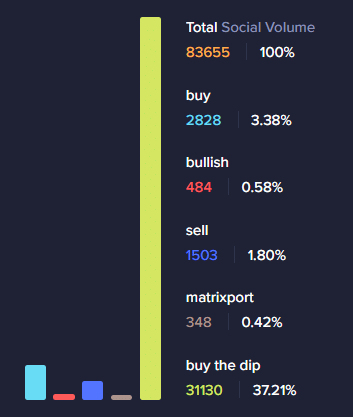

According to data provided by Santiment, the social media activity of the “sell” term witnessed a slight increase after the Matrixport proclamation and has cooled down as the market sees correction.

Moreover, data from Santiment shows a notable increase for the “buy” and “bullish” keywords — making up 3.3% and 0.5% of the global crypto conversations on social platforms.

Calls for “buy the dip,” on the other hand, have increased significantly over the past 24 hours. On average, more than 37% of the social activity around the crypto ecosystem includes the “buy the dip” term.

Per Santiment, the majority of the bullish signals come from Reddit and X while Telegram and 4chan also have a small share.

This article first appeared at crypto.news