As Valentine’s Day draws near and love is in the air, scammers are on the rise, targeting those looking for romantic connections.

In the world of digital courtship, love can be a click away, as can deception. In August 2023, crypto.news ran a story about a Minnesota man who got duped out of a fortune after being charmed by a seemingly benevolent connection on LinkedIn.

The man fell victim to a sophisticated romance scam promising quick riches and feigned affection. The scheme saw him funnel millions from his savings to shadowy accounts for what he believed were lucrative crypto investments.

The scam unraveled when the man’s supposed romantic partner demanded a $2.8 million fee to release the windfall from the alleged investment. The victim’s wife raised the alarm after her husband went on a liquidation spree of all their other assets to raise the fee demanded by his online paramour.

The case is merely one of thousands documented by the Federal Trade Commission (FTC), where victims have been lured in with promises of love and hefty crypto paydays. And with Valentine’s Day fast approaching and hearts becoming more susceptible to romantic gestures, it is only fitting to remind readers of the darker side of digital love.

Digital dating and crypto scams

The proliferation of online dating apps such as Tinder, Bumble, Hinge, and Match.com, as well as social platforms like Facebook and X, means that now, more than ever, it is easy for romance to bloom in the digital space.

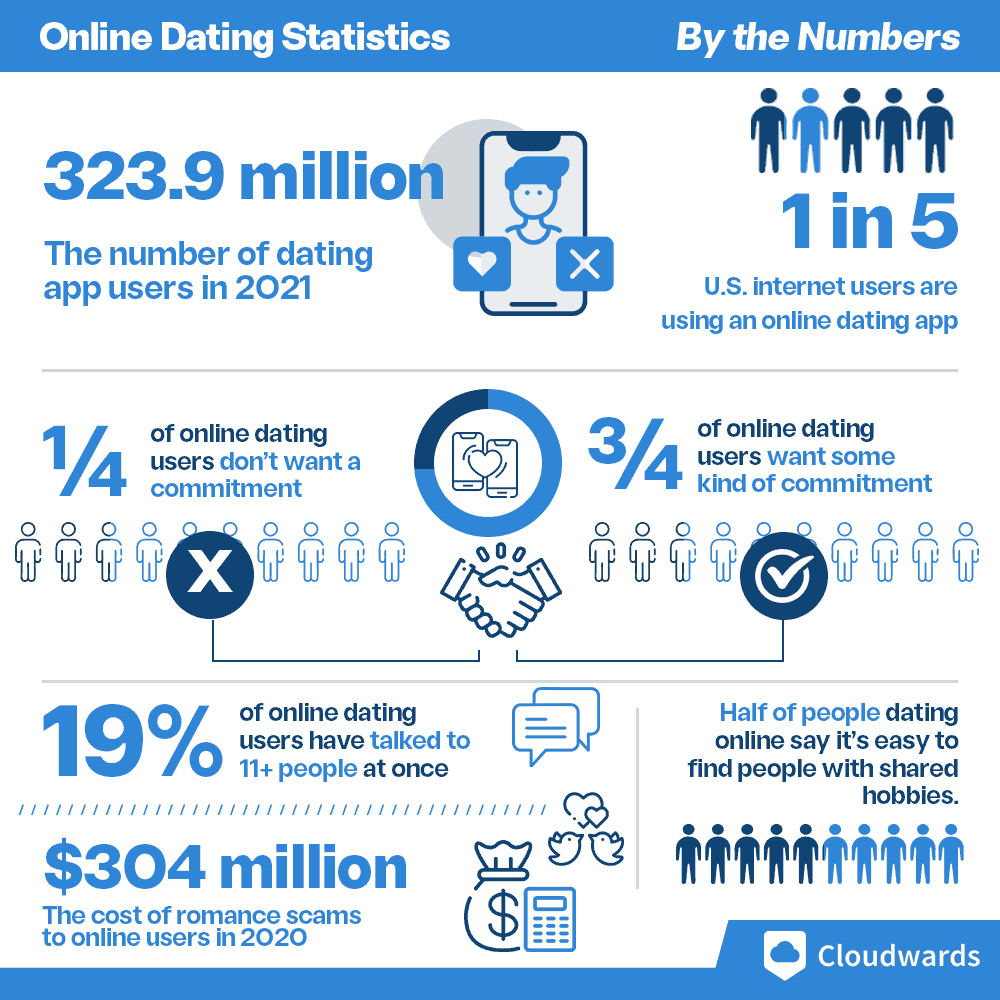

According to privacy platform Cloudwards, by 2021, there were nearly 324 million users of online dating platforms, with at least three-quarters of that number yearning for some commitment.

However, this vulnerability has given rise to a rogue’s gallery of swindlers looking to exploit it. The toll is staggering: in 2022 alone, approximately 70,000 lovelorn souls admitted to falling victim to romance scams, with the FTC documenting $1.3 billion in losses, echoing an alarming year-over-year increase.

The FTC indicated senior citizens were more vulnerable to romance scams, with reported median losses reaching $9,000—far outpacing the general average.

These deceivers have found a new ally in cryptocurrency—digital money’s allure lies in its decentralization and perceived anonymity, making it the scammers’ currency of choice.

Of the number that reported falling victim to romance scams, more than 53,000 claimed they were also lured into some form of cryptocurrency investment scheme, which inevitably turned out to be fake. These crypto deceptions led to victims losing over $1.4 billion to the fraudsters on top of getting broken hearts.

The figures presented by the FTC represent only a fraction of the number of romance scam victims and the amount lost since only a brave few are usually willing to report such scams.

Crypto romance scammer’s favorite lies

How do romance scammers work? They prey on your desires. Romeo and Juliet didn’t rush to tie the knot faster than some of today’s digital daters, who, driven by swift emotional escalations, may ignore the red flags.

Per the FTC, scammers pay close attention to the information you share on social media or online dating platforms. They make sure not to miss a beat to be your perfect match, liking the same things as you, having the same experiences as you, and being at a similar stage in life as you.

According to the trade agency’s report, about 40% of people who said they lost money to a romance scam in 2022 said the contact started on social media, while another 19% said it started on a website or app.

One thing the scammers don’t do, though, which should be the biggest red flag for anyone engaging with potential romance scammers, is that whenever the hopeful romantics want to meet these potential love interests in real life, they tend to bring up a plethora of excuses as to why they can’t.

These excuses were often baked right into the fake online identities. They could claim they work on offshore oil rigs or faraway military bases.

Upon gaining the victim’s trust and confidence, the scammers often create elaborate tales of distress—be it illness, legal trouble, or other emergencies—as a ruse to siphon funds from them.

However, law enforcement agencies have noticed a marked increase in tactics involving offers of supposed insider tips on cryptocurrency investments. In reality, the money handed over for these “investments” ends up being pocketed by the fraudsters.

Essentially, the criminal seduces the victim online and then gets them to make bogus investments in crypto.

Sadly, in addition to financial deceit, there is an alarming rise in threats made to distribute private, intimate photos unless money is paid—a practice known as sextortion, which has seen a notable increase among younger individuals, mainly through Instagram and Snapchat. Here also, the favorite medium of payment these criminals employ is crypto.

In 2022, crypto payments to romance extortionists accounted for 19% of reported cases and 34% of total reported losses. In both instances, it led other payment methods, including wire transfers, gift cards, and payment apps like Venmo and CashApp.

How crypto romance scams work

The typical scam unfolds methodically, with criminals scouring the web for potential victims before establishing contact through texts, dating apps, social media platforms such as Facebook and LinkedIn, or direct website messages.

Posing as young, attractive individuals with fabricated profiles, they start weaving a story of romance. They invest substantial time, possibly hours each day, sending sweet messages filled with terms of endearment, cultivating a relationship that could continue for weeks or months.

As the bond seemingly grows, the scammers coax their targets into making supposed investments in cryptocurrency, using images of luxury and wealth to tempt them. They might propose that a close relative of theirs with investment savvy could assist, while they themselves act like they know very little about crypto.

To collect funds, they might direct the unsuspecting victim to a crypto ATM or send them a phishing link that transfers money directly into the scammer’s crypto wallet. If victims consent to buy cryptocurrency, they are led to fake websites displaying fraudulent returns, perpetuating the illusion of a profitable investment.

Further amplifying the deceit, victims might initially succeed in extracting small sums but are soon duped into believing they need to pay certain taxes or fees to access their total returns, much like the Minnesota man at the beginning of this article was requested to do.

Strategies to defend against crypto romance scams

When it comes to hearts and crypto wallets, the best defense is often a good offense. Romance scammers often manipulate their victims, feigning interest in a relationship to defraud them. Spotting these bad actors requires keen observation and proactive measures.

Firstly, be wary of anyone insisting on crypto transactions, requesting gift card numbers, or persuading you to wire money. Such demands are major red flags, signaling a scam.

Consulting with friends or family about newfound romantic interests can also provide an objective viewpoint and uncover concerns that one might be too emotionally involved to notice.

The digital footprint of a persona can also be vetted by conducting a reverse image search on their profile pictures. Discrepancies between the search results and the details they’ve shared can often unravel a scam’s façade.

These strategies are not just protective measures but essential practices in online romance and finance, helping you navigate safely and avoid becoming victims of exploitation.

Pursuing love should never blind one to the reality of fraud; awareness and healthy skepticism can coexist with the excitement of finding genuine connections.

This article first appeared at crypto.news