On-chain data shows a large amount of Pendle inflow into whale addresses a day after Arthur Hayes, co-founder of the BitMEX crypto exchange, sold the asset.

Lookonchain’s X post shows that Hayes sold 1.59 million Pendle (PENDLE) for $5.62 million last week. This brought a $1.29 million loss to the former CEO of BitMEX.

Data shows that Hayes deposited and sold the Pendle tokens on Binance, the largest cryptocurrency exchange by trading volume.

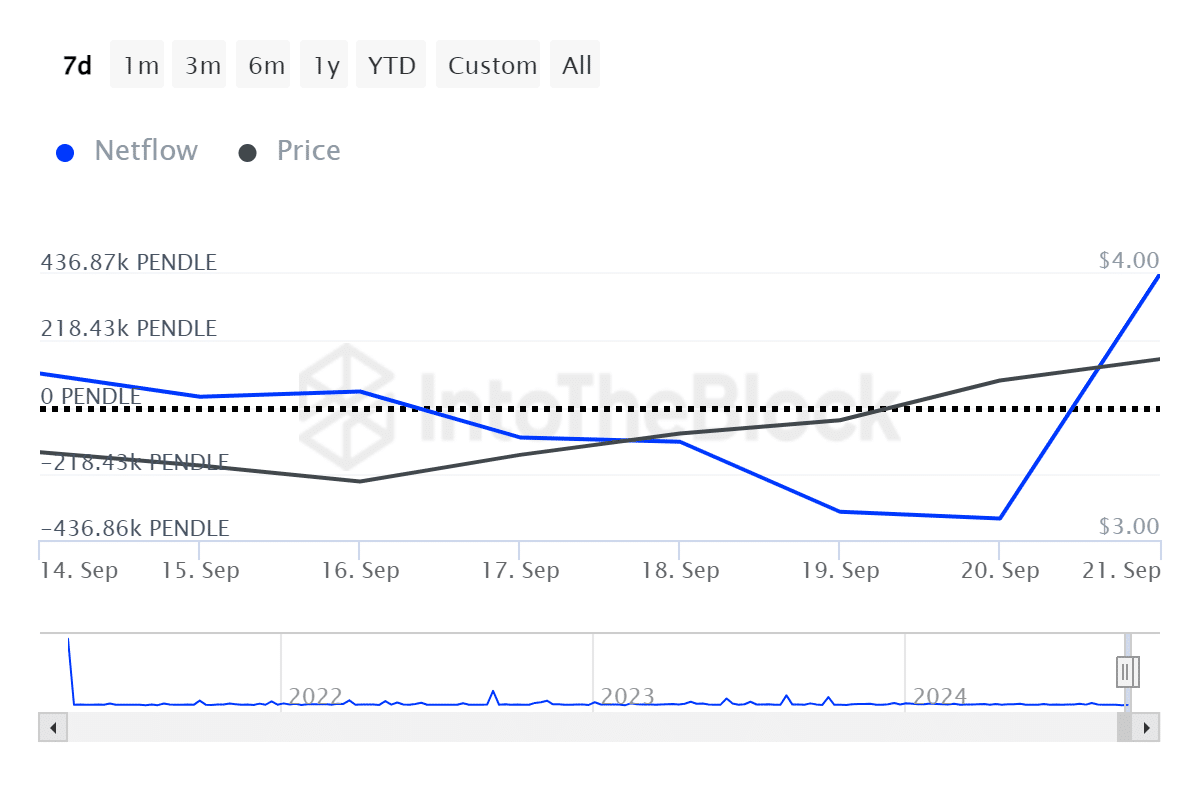

Since the selloff, Pendle witnessed increased on-chain movements from large holders. According to data provided by IntoTheBlock, the token’s whale net flows shifted from 366,310 PENDLE in outflows to 436,860 Pendle in inflows on Saturday, Sept. 21.

The indicator shows that large holders accumulating Pendle have dominated the whales selling the asset.

Meanwhile, the number of large transactions consisting of at least $100,000 worth of Pendle declined from 30 to 17 on the same day, per ITB data.

On the other hand, the volume of large transactions has steadily increased since Sept. 19. In simple terms, only a few of the largest PENDLE holders might have accumulated the token after Hayes sold most of his holdings.

Pendle gained 28% in the past 24 hours and is trading at $4.29 at the time of writing. The asset’s market cap is hovering around $690 million with a daily trading volume of $380 million.

Notably, whale-dominated movements could usually bring high price volatility to a cryptocurrency as many holders will try to aim for short-term profits.

This article first appeared at crypto.news