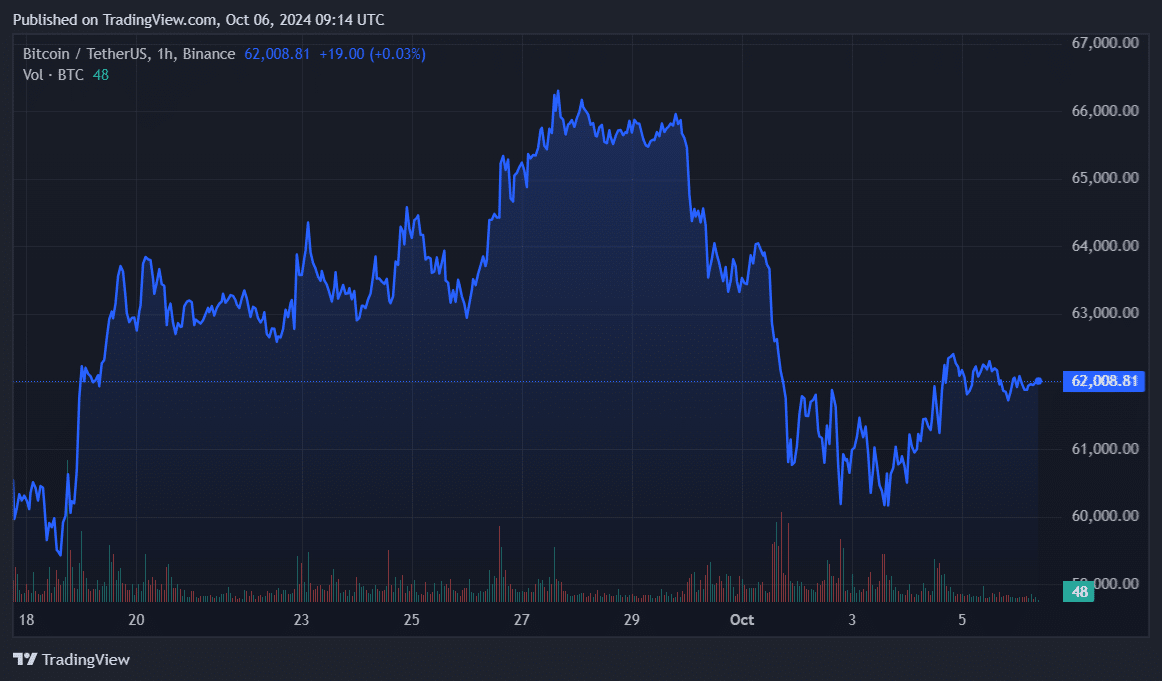

Bitcoin faces yet another correction after surpassing the $62,000 mark on Oct. 2. However, data shows that whales haven’t taken part in the latest selloff.

Bitcoin (BTC) consolidated around the $60,000 zone between Oct. 1 and 4 as the geopolitical tension between Iran and Israel heated up.

Right after the U.S. jobs report, the flagship cryptocurrency reached a local high of $62,370 on Oct. 5 as the broader crypto market witnessed bullish momentum.

Bitcoin declined by 0.2% in the past 24 hours and is trading at $61,950 at the time of writing. Its daily trading volume plunged by 53% and is currently hovering at $12.2 billion.

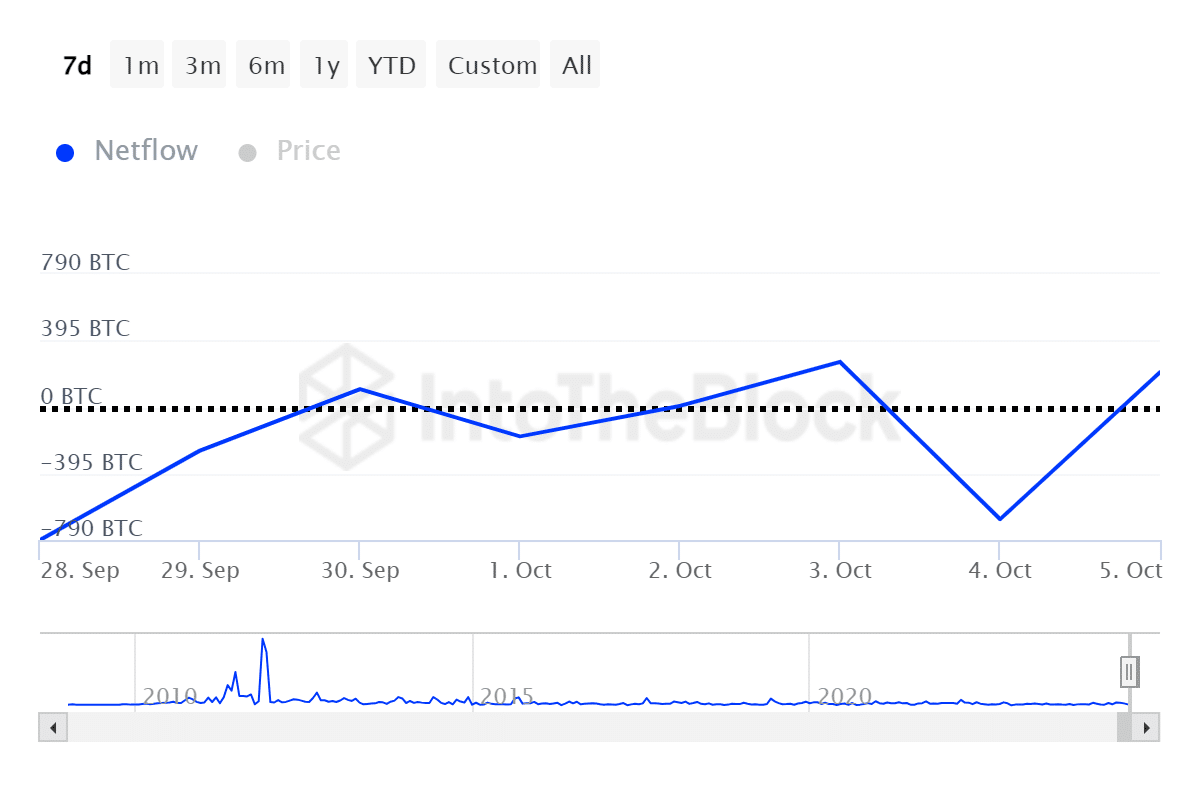

According to data provided by IntoTheBlock, large Bitcoin holders recorded a net inflow of 205 BTC on Oct. 5 as the outflows remained neutral. The on-chain indicator shows that whales didn’t sell Bitcoin as its price surpassed the $62,000 mark.

Meanwhile, Bitcoin’s whale transaction volume decreased by 48% on Oct. 5 — falling from $48 billion to $25 billion worth of BTC. Lower trading and transaction volumes usually hint at price consolidations and lower volatility.

Data from ITB shows that Bitcoin registered a net outflow of $153 million from centralized exchanges over the past week. Increased exchange outflows suggest accumulation as the bullish expectations for October rise.

It’s important to note that macroeconomic events and geopolitical tension can suddenly change the direction of financial markets, including crypto.

This article first appeared at crypto.news