A Solana validator, with a history of price fall, unstaked a large amount of the asset again as the market saw a mild correction.

On-chain data shows that a Solana (SOL) whale unstaked 200,000 tokens over the past three days. The validator then deposited the assets, worth roughly $30 million, to Binance, the largest cryptocurrency exchange by trading volume.

According to data from Solscan, the validator unstaked and sold 1.2 million SOL, worth $178 million, between June and July. That caused the Solana price to plunge from $170 to $125 in less than three weeks.

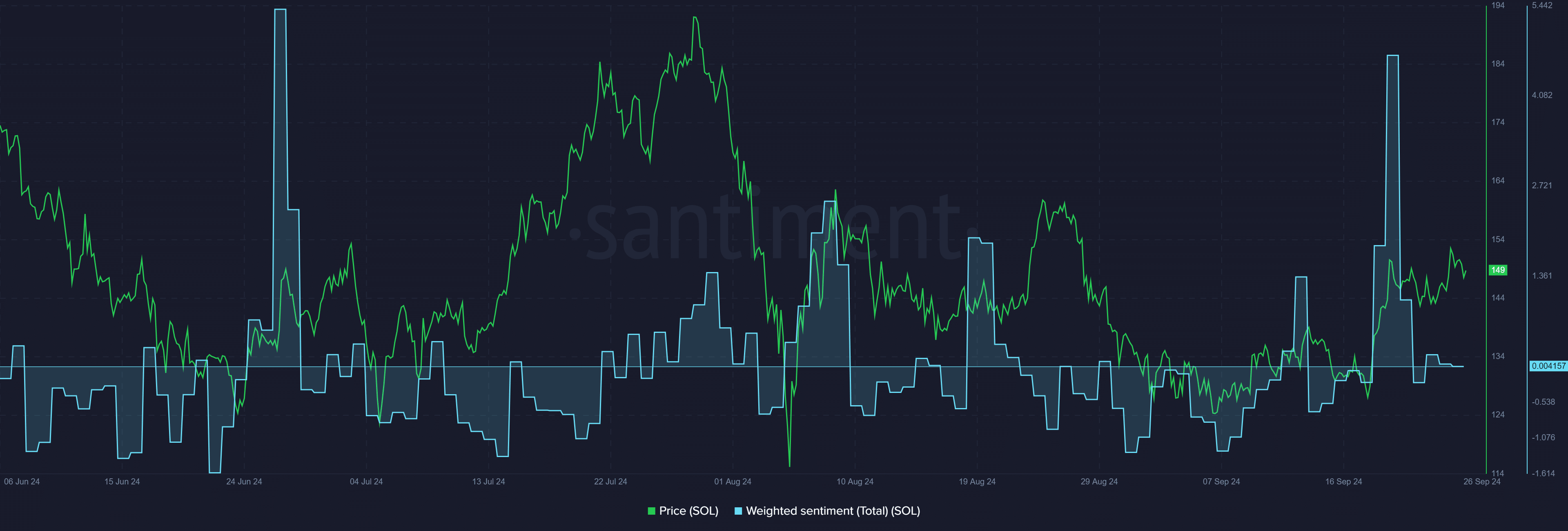

Solana witnessed a pretty similar sentiment to the whale’s movements. According to data provided by Santiment, the weighted sentiment around Solana on social platforms on June 7, when the validator started unstaking.

The social sentiment around the asset has been constantly declining over the past week and is currently seeing a neutral momentum.

It’s important to note that the current $30 million is almost six times lower than the $178 million selloff four months ago.

Solana recorded a 9% price hike over the past week and has been consolidating around the $150 mark in the past 24 hours despite the market-wide correction.

So far, there have been no signs of a massive SOL selloff and the asset’s daily trading volume decreased by 33%, currently hovering at $1.9 billion.

Per data from crypto.news, the SOL Relative Strength Index is sitting at 48. The indicator shows that Solana is in a neutral zone — neither overbought nor oversold — at this price point.

If the broader crypto market continues its upward momentum, SOL’s price fall is unlikely, but caution would be advised.

This article first appeared at crypto.news