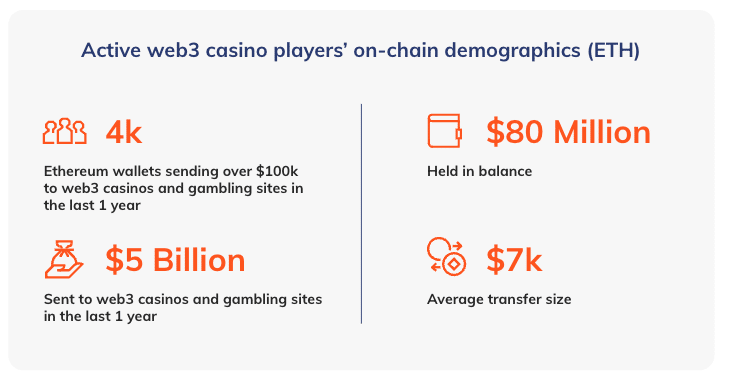

On-chain data shows that around 4,000 wallets enriched web3 casinos and gambling websites with $5 billion worth of crypto in 2023.

Web3 casinos and gambling platforms seem to be making enormous wealth as only 4,000 Ethereum (ETH) wallets deposited $5 billion worth of crypto in 2023 alone, data from Chainalysis shows.

The New York-headquartered blockchain forensic company revealed in an Aug. 5 blog post that high-frequency players make an outsized impact on web3 gaming businesses, transacting on average $7,000 worth of crypto.

While the number of crypto whales engaging with web3 casinos is relatively small, their financial contributions are immense. Approximately 500 such whales, each sending around $25,000 in crypto on average, collectively transferred $320 million in 2023, showing a stark disparity between the contributions of casual players and VIP clients.

Casino transactions mainly involve personal wallets

Chainalysis reports that most transactions on web3 casinos involve personal wallets, with the majority of players cashing in and out of their accounts through these means. The company added that many also “send and receive funds from exchange accounts.” Specifically, deposits and withdrawals related to web3 casinos from personal wallets account for 61% and 70%, respectively, while crypto exchanges make up 38% and 29%.

As many players do not care to hide their traces on-chain, businesses can analyze their behavior, Chainalysis says, adding that companies might get insights into “player holdings, spending habits, and engagement across blockchain platforms.”

“With this information, businesses benefit from more accurate segmentation, tailored strategies, and a holistic view of off-platform activities crucial for engaging users.”

Chainalysis

Over the past four years, web3 casinos have experienced a steady growth in inflows, accumulating $78.7 billion in crypto. However, despite this rapid expansion, Chainalysis has raised concerns about potential risks, saying some platforms “could also be a vector for money laundering.”

This article first appeared at crypto.news