Indian crypto exchange WazirX has unveiled a plan to mitigate the effects of a recent hack that resulted in the loss of approximately $235 million.

The breach, which affected 45% of user funds, has led the exchange to introduce what it’s calling a “socialized loss strategy” to ensure what it calls a more equitable resolution for its users and maintain platform stability.

WazirX’s July 27 blog post states that the firm plans to implement a 55/45 approach, where users can access 55% of their assets immediately, while the remaining 45% will be locked in Tether (USDT)-equivalent tokens.

The exchange says its strategy aims to distribute losses fairly among all users, preventing disproportionate impacts on any single group.

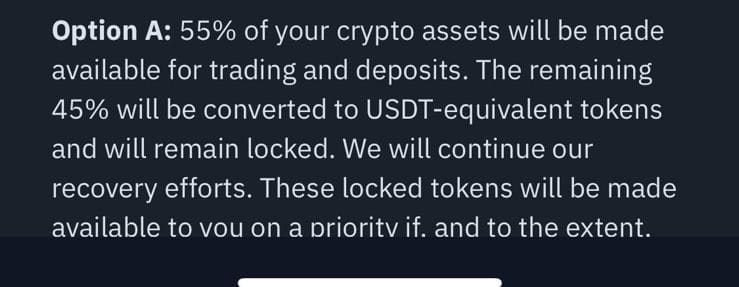

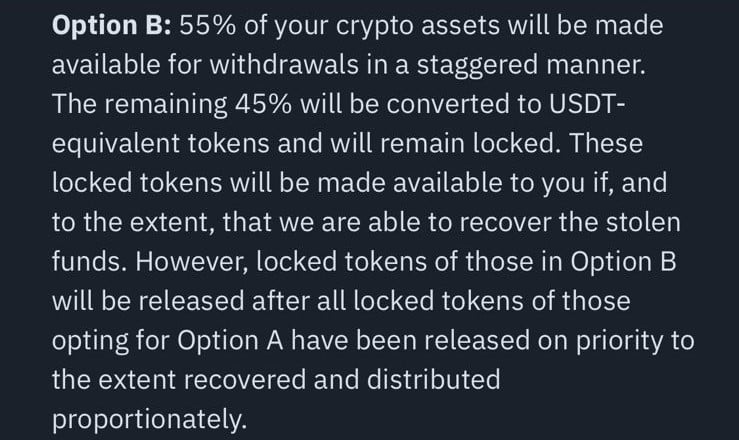

According to correspondence that WazirX sent to affected users — a copy of which was shared with crypto.news — the exchange presented a poll with two options to recover stolen funds. “Option A” lets users access 55% of their funds “for trading and deposits,” without withdrawal rights, but gives them priority in potential recovery proceeds. “Option B” lets users withdraw 55% of their assets “in a staggered manner,” albeit with lower priority in the recovery queue. In both cases, WazirX states that the remaining 45% of user assets will remain locked on the exchange as “USDT-equivalent tokens,” which would only be returned to users if the firm succeeds in recovering the stolen funds.

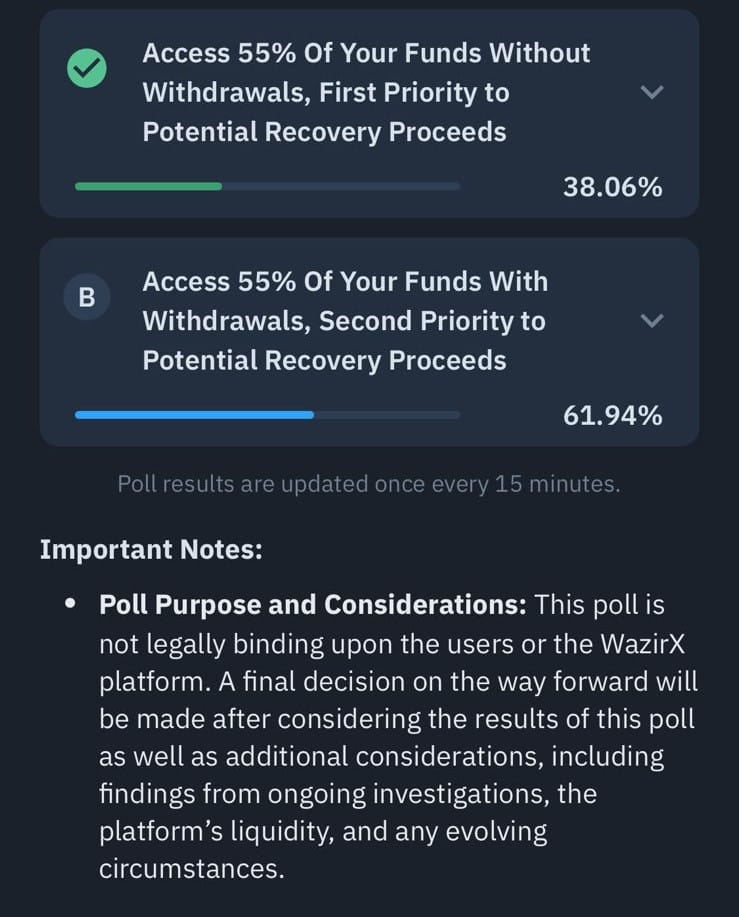

In their post, the exchange requested that affected users vote for their preferred option by Aug. 3, 2024.

According to poll results shared with the crypto.news team, at the time of writing, approximately 62% of the impacted users have selected Option B, which lets them make withdrawals. The other 38% have decided against this, choosing instead to forego immediate withdrawals in favor of securing first priority for any potential recovery proceeds.

Background on the massive hack

The breach at WazirX led to a substantial loss of around $235 million, ranking it as the second most significant hack of a centralized exchange recently. This incident was only outdone by the DMM exploit on May 31, where the losses amounted to $308 million.

Nischal Shetty, the exchange’s co-founder, took to X today to assure users of the exchange’s potential for recovery and growth following the significant hack.

Notably, Shetty outlined two historical responses to such crises: lengthy legal proceedings or adopting a socialized loss model coupled with rebuilding efforts. He advocated for the latter, emphasizing quicker recovery through operational growth and profit distribution.

Shetty also stressed the importance of community support, adding, “Only together, we can do this,” as he rallied for a unified approach to overcoming the platform’s challenges.

Community criticism

Meanwhile, there has been significant discontent among crypto users regarding WazirX and its co-founder, particularly concerning the socialized loss strategy. Many have labeled the approach a scam and have questioned why the burden of the exchange’s challenges should fall on the users.

Additionally, some affected users have voiced their preference not to have the 45% of their affected assets that will remain locked converted to a stablecoin like USDT, but rather to keep them in the original cryptocurrencies.

In response, Shetty acknowledged these concerns, arguing that maintaining a stable value in USDT is crucial for planning recovery strategies effectively.

Shetty noted that the cost of cryptocurrencies fluctuates constantly, with lower values in bear markets and higher in bull markets, making it challenging to determine a consistent recovery amount with volatile assets.

In 2023, crypto industry participants lost over $1 billion in various hacks.

This article first appeared at crypto.news