Blockchain venture capital firm Animoca Brands said it plans to purchase more WAT tokens from the open market, propelling the token’s price up by 40%.

Hong Kong-based game developer and venture capital firm Animoca Brands is planning to buy more WATCoin tokens from the open market to support WATCoin’s (WAT) role in the broader The Open Network ecosystem, the company revealed in an Oct. 17 blog announcement.

“Through the token purchase, Animoca Brands reinforces its commitment to WatBird’s role in supporting the broader TON ecosystem.”

Animoca Brands

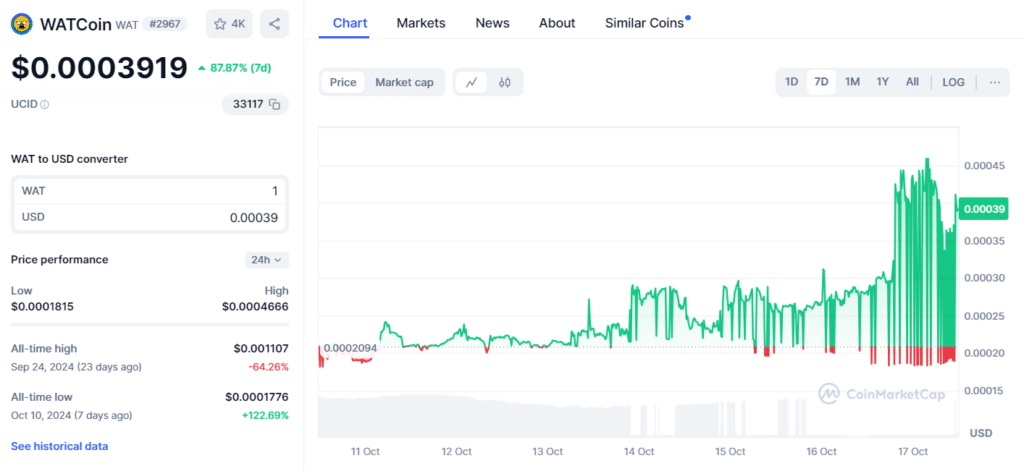

While specifics regarding the timing and quantity of the WAT tokens to be purchased remain undisclosed, the announcement has already driven WAT’s price by 40% to $0.00039.

Data from price aggregators shows that WAT has been an increasingly volatile token lately, pumping and dumping by more than 140% over the past few days. Although the token gained over 85% over the past week, it’s still down 64% from an all-time high, reached earlier in September.

WATCoin is the utility token based on the TON network and backed by TON Ventures for WatBird, a mini app launched on Telegram by Animoca Brands’ subsidiary GAMEE. In late August, GAMEE secured an undisclosed investment from Pantera Capital, a California-based venture capital firm, to extend its reach across multiple blockchain networks.

That investment marked Pantera Capital’s ongoing commitment to the TON ecosystem as earlier in May, the venture capital firm announced its “largest investment ever” in the network, highlighting its confidence in TON’s potential amid the fallout from the bankrupt FTX exchange.

This article first appeared at crypto.news