VeThor token is witnessing a surge of over 80,300% after the token was listed on South Korea’s largest crypto exchange by trading volume, Upbit.

On Jan. 21, Upbit launched trading support for VeThor Token (VTHO) in both the Korean Won (KRW) and Tether (USDT) markets. As of Jan. 22, VTHO’s trading volume has surged by over 88,000% in the past 24 hours. According to CoinMarketCap, Upbit accounts for more than 66% of VTHO’s trading volume, with over $2.1 billion traded in just 24 hours.

As of this writing, VTHO is priced at $0.008981, reflecting over 300% increase in its value over the last 24 hours. However, it remains roughly 80% below its all-time high of $0.042, which was reached in August 2018.

VTHO was launched in July 2018 as part of the first phase of the VeChainThor blockchain, following its initial release as an ERC-20 token in 2015.

VeChainThor uses VTHO to power transactions and smart contract executions on the network. VTHO is generated by holding VeChain Tokens (VET) and is consumed during blockchain operations, ensuring efficiency and scalability within the ecosystem.

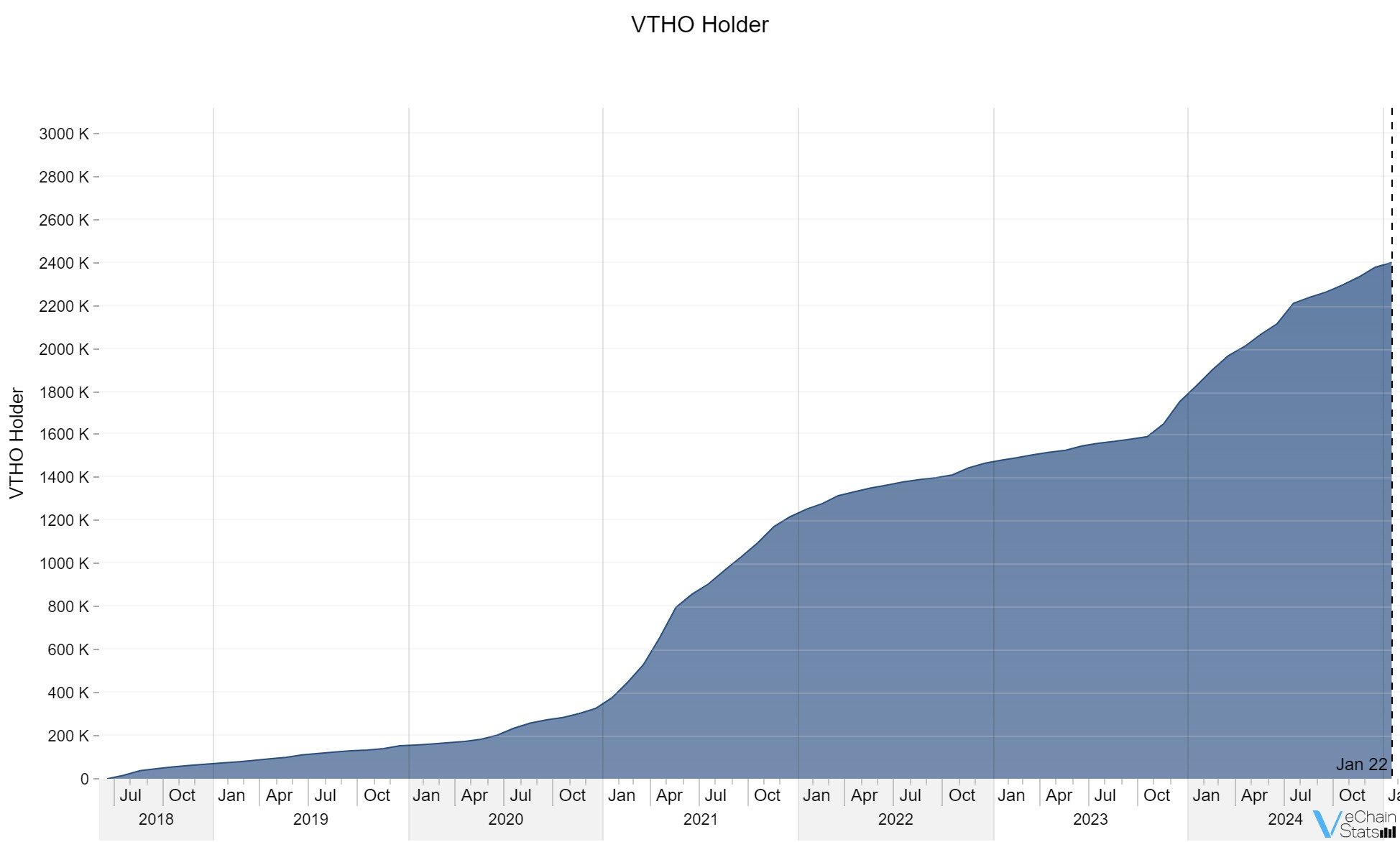

The number of unique addresses interacting with the VTHO on the VeChainThor blockchain continued to rise and in early January 2025 crossed the threshold of 2.9 million addresses as of this writing, as per VeChain Stats.

How far can VeThor rise this bull run?

The MACD is a technical indicator of bullish or bearish momentum, as well as trend direction. It includes MACD line, signal line, and histogram. The MACD analysis notes the recent crossover into bullish territory, which indicates an increase in bullish pressure.

As the histogram widens between the MACD and signal lines, bullish momentum continues to grow. This indicates an increased interest in VTHO which could continue driving performance in the near future. While it cannot predict specific prices, it does give insight into market directions.

Should momentum hold and the market remain bullish, the token may retest resistances in the $0.01–$0.015 range. These psychological barriers are common for tokens with prices below $0.01. However, nothing is certain. Do your own due diligence.

This article first appeared at crypto.news