The value of the stablecoin Pax Dollar (USDP), issued by the Paxos Trust Company, experienced a surge to a high of $1.28, triggering the liquidation of $529,000 in USDC for a market participant.

Like regular stablecoins, USDP is designed to maintain a stable value equivalent to a U.S. dollar, providing a safe haven for traders against the volatility often associated with cryptocurrencies. However, the recent unexpected increase in price, spotlighted by PeckShield, has raised concerns.

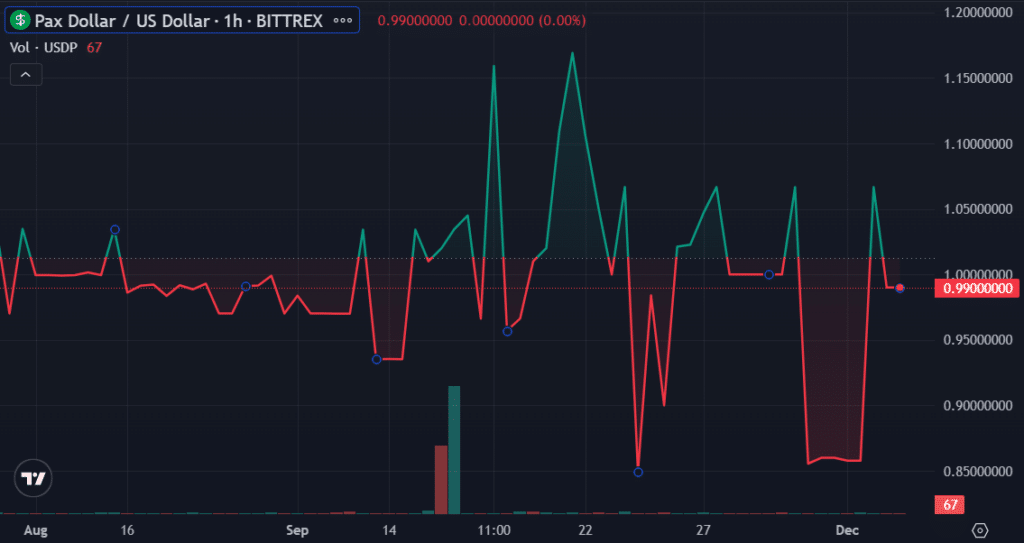

The stablecoin uncharacteristically spiked to $1.2848 yesterday at 16:10 UTC before eventually witnessing a subsequent drop to its usual price of $1 four hours later. While the depeg went unnoticed by most, it had far-reaching effects on a trader’s loan position, triggering liquidations.

The liquidation occurred on the decentralized finance (defi) platform Aave, where the trader had used USDP as collateral to secure a loan in USDC. Notably, in the defi ecosystem, loans are backed by other assets, with mechanisms in place to manage sudden shifts in market dynamics.

On-chain data confirms that the trader lost the 529,000 USDC across sixteen uneven transactions from 16:16 to 20:09 UTC, coinciding with the period USDP lost its peg. The transaction label indicates that the liquidation process was automatically initiated by Aave’s built-in risk management algorithms.

While the USDP value spiked, the platform likely predicted a possible correction or a return to its normal pegged rate. Such a forecast can prompt preemptive liquidation to mitigate potential losses, especially if the borrower’s loan-to-value (LTV) ratio becomes unfavorable.

Issued by Paxos, USDP has faced certain setbacks in recent times, marked by occasional depegs. A 2023 research from SP Global suggested that USDP records the highest deviations from the U.S. dollar among the top stablecoins, having witnessed 7,581 mild depeg events in the 24 months leading to June 2023.

This article first appeared at crypto.news