Tron’s price continued its strong downward trend, reaching its lowest level in over four weeks as founder Justin Sun urged investors to buy the dip.

Tron (TRX) fell to a low of $0.2200, down more than 50% from its December high. This decline has pushed TRX’s market cap from over $26 billion to $19 billion.

In an X post on Monday, Sun recommended buying the dip, maintaining his long-held view that Tron remains highly undervalued.

Sun’s bullish stance is backed by Tron’s strong fundamentals. The network ranks as the third-largest player in decentralized finance after Ethereum and Solana with a total value locked of $6.69 billion.

Tron is also the market leader in Tether transactions because of its more affordable transaction costs than Ethereum. On Monday, Tron’s USDT transactions surged by 91% to $137 billion, making it one of the largest payment processors globally. The Tron blockchain currently has over 59.2 million USDT holders.

Tron also ranks high in the decentralized exchange industry. Since its inception, its DEX protocols have handled almost $100 billion in volume. In the last seven days, they processed tokens worth over $782 million, making it the 10th chain.

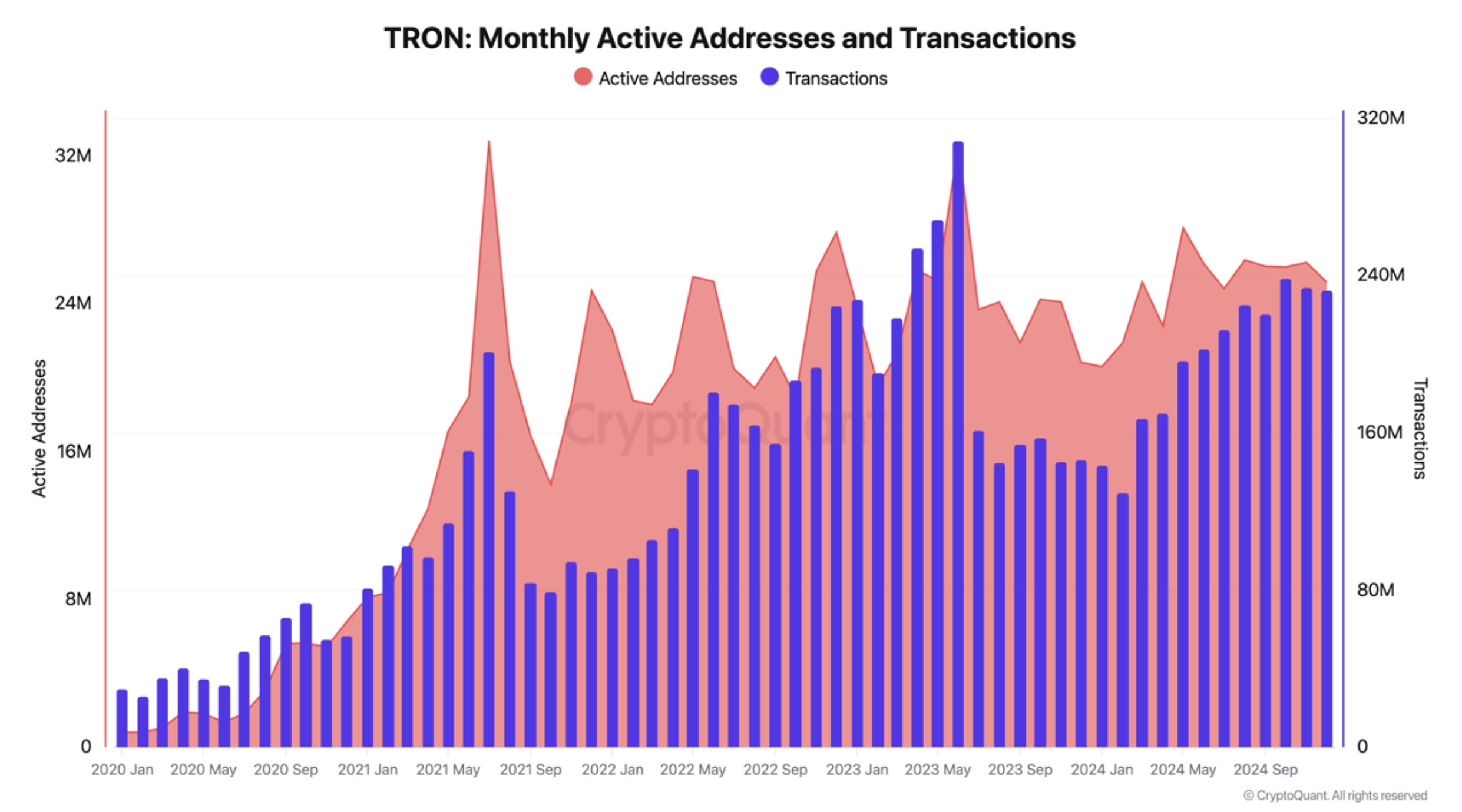

Tron is also highly popular among users as monthly active addresses and transactions have remained steady in the past few months. It has over 2.17 million active addresses, making it the second-biggest chain after Solana, which has 4.27 million.

Tron offers competitive staking yields, making it an attractive option for holders. The network’s staking yield is currently 4.52%, supported by rising network fees and a declining circulating supply.

According to TokenTerminal, Tron collected $2.21 billion in fees in the last 12 months. It even flipped Ethereum this year, making $116 million versus Ethereum’s $60 million. Tron’s circulating supply has continued falling, moving from 88.1 billion in January last year to 86.17 billion today.

Tron price analysis

The daily chart shows that Tron has dropped from $0.4487 on Dec. 4 to $0.2245 amid the broader crypto sell-off. TRX has moved below its 50-day and 100-day weighted moving averages, while key oscillators such as the MACD and Relative Strength Index (RSI) have signaled bearish momentum.

However, on a positive note, Tron has formed a bullish double-bottom pattern at $0.2245, with the neckline at $0.2760. A double-bottom pattern often precedes a bullish breakout.

If TRX remains above the $0.2245 support level, it suggests that the double-bottom is holding, which could lead to a recovery. However, a break below this level could push TRX down to $0.20, aligning with the ascending trendline connecting the lowest swings since June last year.

This article first appeared at crypto.news