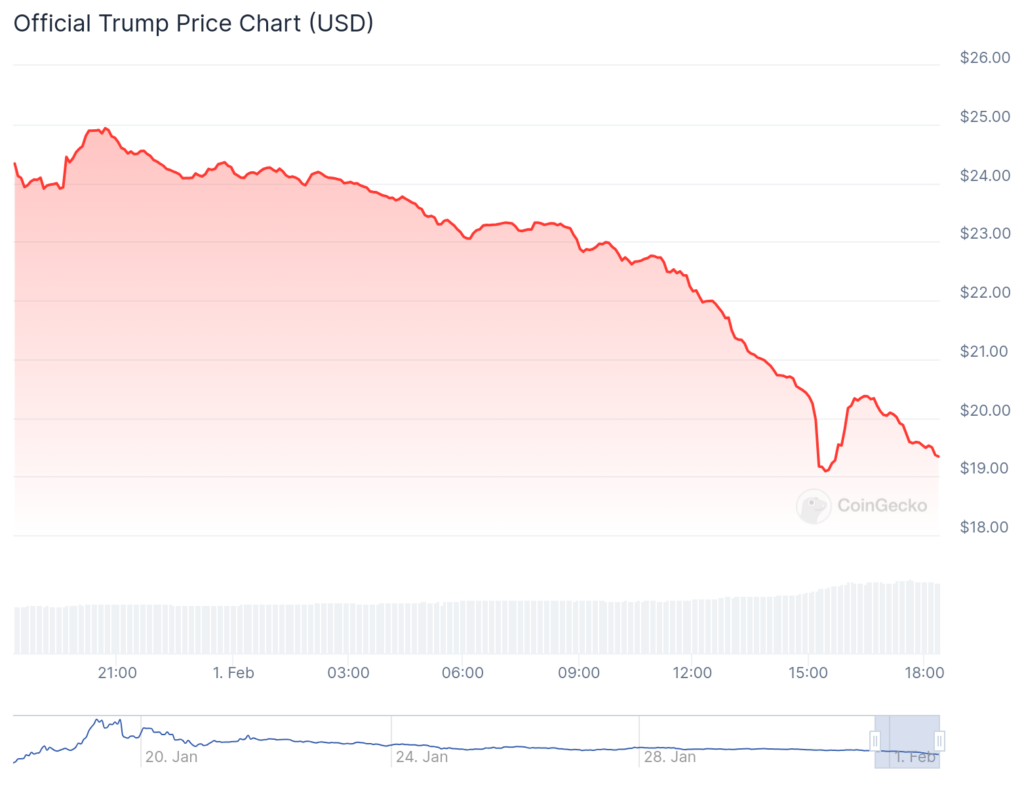

The Official Trump meme coin reached its all-time high of $75.35 on Jan. 19, 2025, shortly after its launch on Jan. 17 — three days before Donald Trump’s second term as U.S. president began. Since then, the coin’s value has fallen off a cliff.

As of Feb. 1, TRUMP is trading at approximately $19.38. That’s almost a 74% plummet from its peak.

The coin’s market capitalization remains substantial, with a fully diluted valuation of around $2 billion (80% of the tokens are held by Trump Organization affiliates).

SkyBridge Capital founder Anthony Scaramucci — a Trump ally-turned-critic — is calling out the president for what he alleges is a pump-and-dump scheme.

“President Trump posted on Truth Social last night in an attempt to ‘pump’ his $TRUMP memecoin (yes that’s a real sentence that many have normalized),” Scaramucci posted Saturday on X. “The result has been an acceleration of the ‘dump,’ now down 70% from its peak. The jig is up.”

Wall Street worried?

Trump, who owns Truth Social through his company Trump Media & Technology Group, frequently hawks items on his personal account (i.e., non-fungible tokens, or NFTs).

And, in September, Trump helped promote World Liberty Financial, a decentralized finance platform for investors to borrow and lend using cryptocurrencies. He and his sons are not considered owners of the company, but they have an agreement to be paid for promoting it, according to the New York Times.

The Official Trump meme coin is just the latest money-making attempt (MAGA-branded bibles and sneakers were also promoted).

Scaramucci, whose hedge fund was among the first to delve into crypto back in 2020, posed a question to his 1 million-plus followers on X: “Could someone please explain to me on Crypto X How the President pumping his own meme coin is a good thing?”

Scaramucci, who started his career at Goldman Sachs, isn’t the only Wall Street pro scrutinizing the now meshed-together world of cryptocurrency and Trump’s White House (Melania has an official meme coin, too).

According to the Financial Times, a memo from New York-based hedge fund Elliott Management suggests that Trump’s warm embrace of digital coins is fueling a speculative frenzy that could “wreak havoc.”

The irony? Elliott’s founder, Paul Singer, is no stranger to Trump-world. Despite being a longtime crypto critic, he donated $56 million to conservative candidates in 2024, including $5 million to the “Make America Great Again” PAC.

Since Trump’s election, Bitcoin has shot past $100,000, fueled by his vow to make America “the Bitcoin superpower of the world.” Not one to miss an opportunity, Trump wasted no time signing an executive order to promote a national crypto stockpile.

Meanwhile, Elliott’s memo questions why the U.S. would encourage alternatives to the dollar at a time when other countries are scrambling to ditch it.

This article first appeared at crypto.news