Trump speaking at Bitcoin 2024. Source: Bitcoin Magazine Livestream.

Key Takeaways

- Trump’s speech at Bitcoin 2024 led to a sharp increase and then a drop in Bitcoin prices.

- Nearly $24 million in Bitcoin longs were liquidated during the speech.

Share this article

Bitcoin prices experienced significant volatility during former U.S. President Donald Trump’s speech at Bitcoin 2024 in Nashville, where he unveiled plans to establish a “strategic national bitcoin stockpile” if re-elected.

The price of Bitcoin (BTC) saw dramatic swings as traders reacted to Trump’s remarks. Prior to the speech, Bitcoin rose above $69,000. However, the price subsequently dropped to as low as $66,700 before rebounding to over $68,000, according to data from CoinGecko.

Trump’s announcement of plans to create a national Bitcoin reserve if elected aligned with market expectations leading up to the event. The former president’s comments sparked a flurry of trading activity, with nearly $24 million in long positions liquidated during the speech alone.

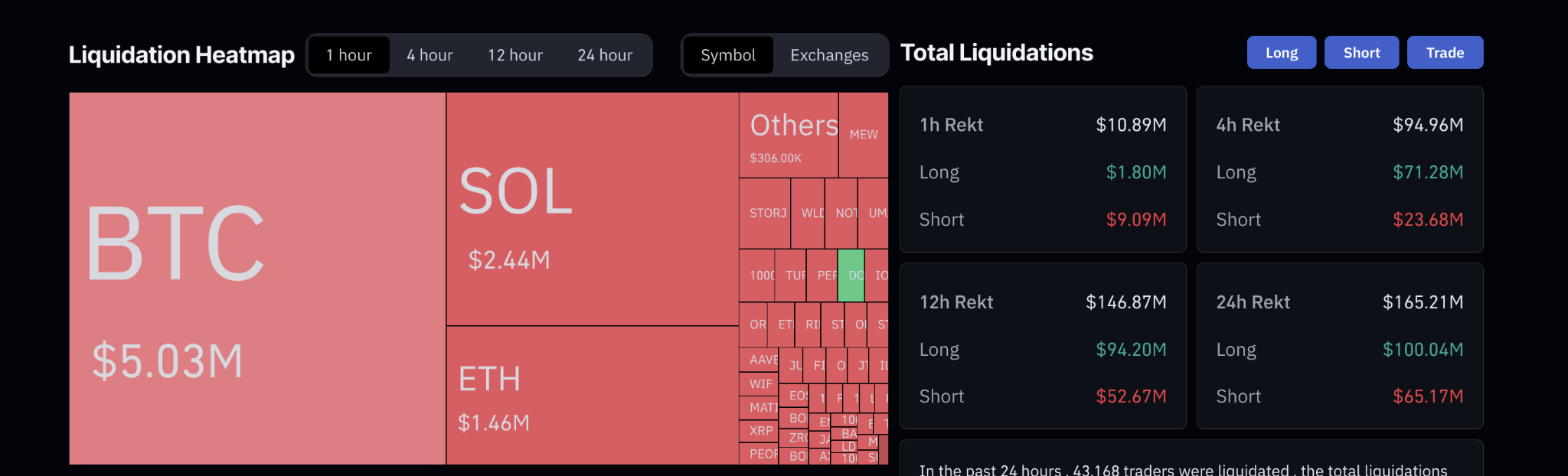

Liquidation data

Data from Coinglass indicates that BTC experienced the highest liquidation value at $5.03 million, followed by SOL with $2.44 million, and ETH with $1.46 million within the selected timeframe. This indicates a significant volume of forced selling in these cryptocurrencies, with BTC being the most affected.

On the right side, the sheet details total liquidations for various periods. In the past hour, total liquidations reached $10.89 million, with $1.80 million in long positions and $9.09 million in short positions. Over four hours, liquidations amounted to $94.96 million, with long positions accounting for $71.28 million and short positions for $23.68 million.

The 12-hour liquidation total was $146.87 million, with $94.20 million in long positions and $52.67 million in short positions. For the 24-hour period, liquidations totaled $165.21 million, with long positions at $100.04 million and short positions at $65.17 million. These figures highlight that liquidations have been more significant for long positions across all timeframes, indicating higher losses for long traders.

The broader crypto market mirrored Bitcoin’s price movements throughout the event. This volatility highlights the significant impact high-profile political figures and policy announcements can have on crypto markets.

The rapid price fluctuations and substantial liquidations underscore the ongoing sensitivity of cryptocurrency markets to regulatory and political developments. Trump’s proposal for a national Bitcoin stockpile represents a potential shift in the relationship between traditional government institutions and digital assets, should it come to fruition.

Earlier this month, Donald Trump advocated for all future Bitcoin mining to be conducted in the US to counter central bank digital currencies and enhance national energy dominance.

Analysts also observed a notable rise in Bitcoin options implied volatility, speculating about significant announcements by Trump at the upcoming Bitcoin 2024 conference.

Donald Trump’s proposed policy for a weaker US dollar if re-elected was analyzed for its potential to elevate Bitcoin values, marking a shift from traditional strong dollar policies.

Share this article

This article first appeared at Crypto Briefing