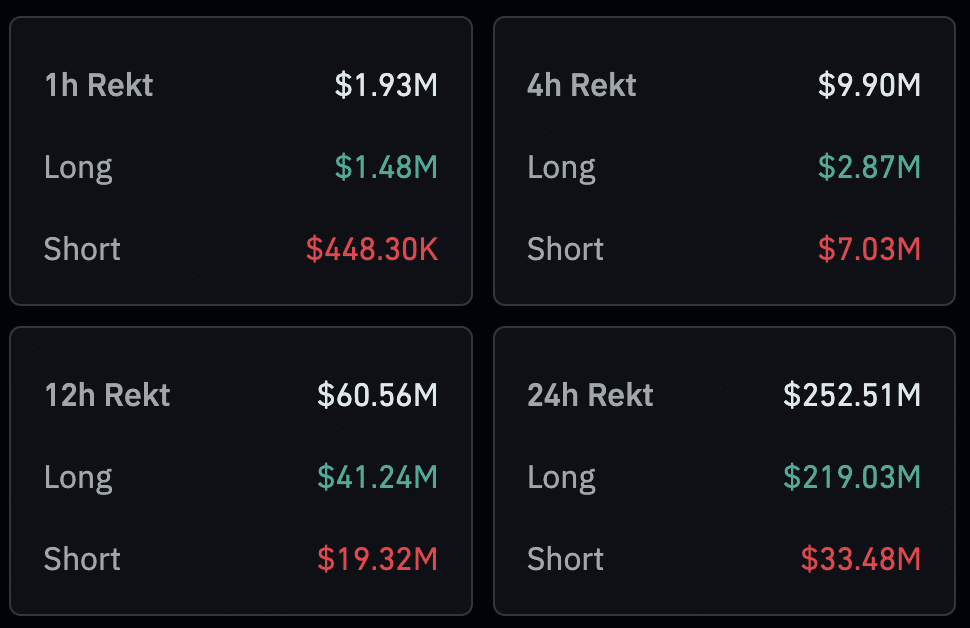

The total amount of liquidations on the crypto market over the past 24 hours exceeded $250 million.

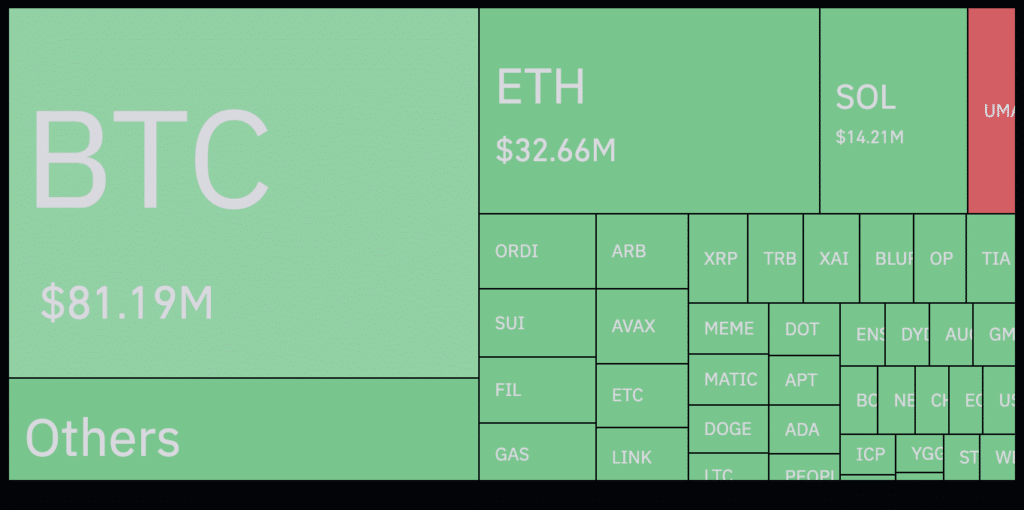

According to Coinglass, the volume of liquidations currently stands at $252.5 million. Most forced closed positions were in Bitcoin (BTC) and Ethereum (ETH).

Earlier, the price of Bitcoin dropped below $41,000, costing traders $81.1 million. Market participants who opened long positions in Ethereum also suffered significant losses – the price of the second largest cryptocurrency by capitalization to $2,400, costing traders $32 million.

Over 90% of liquidations were distributed between OKX, Bybit, Huobi and Binance. Binance executed the most significant order – the exchange closed a long BTCUSDT for $7.31 million.

At the time of writing, the rate of the largest cryptocurrency was $41,200. According to Coinglass data, in the last few hours, traders have opened more long positions than short ones, indicating market participants’ confidence in the further growth of BTC.

Crypto enthusiasts and market experts attribute the fall to asset managers Grayscale‘s active sale of BTC. Grayscale’s Bitcoin Trust (GBTC) previously experienced significant outflows totaling $594 million in light of the current downturn in the cryptocurrency market. In parallel, Grayscale moved 9,840 BTC to Coinbase Prime worth $418 million, bringing total volume to 41,478 BTC since Jan. 12.

This article first appeared at crypto.news