Key Takeaways:

- A surge in the number of new altcoins has made it difficult to adhere to the idea of an ‘altcoin season’ as we know it.

- Exchanges may have to make changes in their listing policies because of the overwhelming number of new tokens.

- More focus on engaging the community with analysis and integrating with DEXs (Decentralized Exchanges) is noticed.

The crypto market is undergoing a significant transformation, causing uncertainty about the future of altcoins. Every year, people eagerly wait for an “altcoin season” to come, which is when alternative cryptocurrencies see an increase in their values. However, the rapid increase of new tokens is leading thought that it could be the end of these parabolic market cycles.

An Ocean of Tokens: The Overwhelming Supply

Formerly during altcoin seasons, the price of non-Bitcoin cryptocurrencies would rise significantly. The 2017-2018 cycle was a case in point; it was a time when coins like Ether (ETH), XRP, and Litecoin (LTC) – the ones that have never been so expensive – got a chance to experience unprecedented growth. However, time has brought about a drastic change.

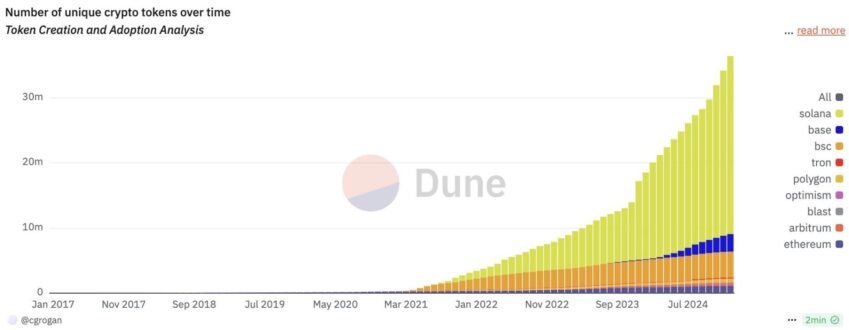

A well-known crypto analyst, like Ali Martinez, highlights the open-world nature of the crypto market, conducting how the total number of tangible coins has increased dramatically. The industry expert proclaims that “Today, there are over 36.4 million altcoins,” quoting Dune Analytics figures. In contrast, there were nearly 3,000 altcoins during the 2017-2018 altseason, and the figure was even less than 500 in 2013-2014. Martinez believes that such a wide supply of tokens will surely have a noticeable impact on market dynamics, and it may preclude a long-lasting altseason. Due to the ever growing number of options, it has become extremely difficult for investors to figure out the real value and potential of the coins and thus the coins which may grow.

Number of tokens over time. Source: Dune Analytics

Economist Alex Krüger is of the same opinion, emphasizing the way market behavior is influenced by the oversupply of tokens. He is of the opinion that “supply of tokens is greater than demand.” This disbalance contradicts the idea of a time period in which “everything goes up” will be the case. In the future, altcoins are thought to be shorter in duration and may last only two to a few weeks at most. Krüger mentions the difficulty encountered by the investors at present: “Being a good coin picker is now very hard. Just as being a good stock picker is also very hard.” The multitude of tokens available complicates the effectiveness of a portfolio manager.

Dilution and the Rise of Meme Coins

Adding to the worry, there is the opinion of the pseudonymous crypto trader Ash Crypto – he discredits the spreading out of the altcoin market, attributing the blame to the meme coins and low-quality tokens that entered the market. The exchanges are reprimanded for the fact that these meme coins are listed mainly to increase the volume and user base, usually at the cost of the retail investors who suffer massive losses. Ash Crypto singled out this type of token, the price of which one week is $50 and another week, $10 in the negative, which is said to be ‘buying these memes and down 80% in a week and then quitting.’ Meanwhile, this behavior is mostly believed to have an adverse effect on the general picture of the altcoin market in the long term.

Crypto community refers to the fact that the CEO of CryptoQuant Ki Young Ju solidifies the aforementioned idea by comparing altcoins to Bitcoin. In his view, “Only a few altcoin projects with strong use cases and narratives will survive.” The question raised by him is if those tokens without intrinsic value would be able to anchor the market after some corrections, which would more impact such low-performing ones.

On the other hand, Bitcoin has doubled its market cap for this period from 2021 to $2.07 trillion, thus breaking its own record. In contrast, the total altcoin market capitalization is still far below its peak. Altcoins, despite a short-lived upsurge, are currently valued at around $1.6 trillion compared to $1.9 trillion, the all-time high, down by 15.8%. Its diversity has been a clear indication since everyone would prefer using a single asset – Bitcoin over the rest. The argument is that Bitcoin is seen as the more inferior and riskier asset as compared to other cryptos.

Institutional Interest and Select Altcoin Success

But there are some analysts who are not that pessimistic. Michaël van de Poppe suggests that some utility-focused coins might catch the attention of institutions. He asserts that “real utility coins” may “take the spotlight as institutional interest continues to grow.” Van de Poppe also proposes that Ethereum (ETH) could be a howler, setting out the possibility of an ETH surge as “the most hated rally of 2025.” This point of view acknowledges the possibility of individual digital currency’s head becoming successful because of institutional usage and its presence in the real world. For instance, a blockchain platform that provides verifiable solutions for supply chain control could be considered a real utility project.

Coinbase Re-evaluates Listing Strategies in Face of Token Explosion

To add to the complexity of the market, Coinbase CEO Brian Armstrong has publicly admitted the necessity of reimagining the exchange’s token listing process. Considering that the number of new tokens is estimated to be in the millions, and that they are being created on a weekly basis, the manual evaluation of each token is easier said than done. This indicates a business-wide concern that encompasses the problem of how to manage the exponential growth in new cryptocurrency projects.

Coinbase CEO Brian Armstrong

The “allow list” approach, which is about to be discarded, is to be replaced by the “block list” one, as expressed by Brian Armstrong. Instead of various token evaluation procedures, Coinbase will concentrate on finding and denying access to those tokens which seem to give rise to troubles or hazards. This modification involves admitting current procedures’ weak points and, thus, striving to develop a better method for supervising new token offerings.

Apart from this, he also mentions the use of user feedback and the results of the on-chain data analysis as the main means leading users to a wiser choice of investment. The envisaged modification aims to render the process of token assigning a more collectivistic and distributed one, which means there will be less reliance on the evaluation issued by the centralized exchange and more contribution from the members who came to be more knowledgeable and critical in the technical aspect.

More News: Coinbase Asks a Court to Declare Crypto Not a Security: A Landmark Legal Battle with the SEC

Community Feedback and the Move to Decentralization

The proposals submitted by Armstrong have different impressions. Justin Sun, the founder of Tron (TRX), criticized Coinbase for the lack of transparency that, in his opinion, has hindered the listing of TRX for seven years. Sun has further stated that Coinbase demanded $330 million for a listing, a statement that, though, cannot be verified, has raised doubts about the listing policy. This case is a reflection of the worry about the possibility of bias in the centralized exchange’s selection processes.

Another cryptocurrency entity, Ansem, holds the view that the most effective method for Coinbase to deal with the problem is by hiring professionals with vast experience to evaluate tokens instead of relying on procedural checks only. Ansem suggests that in this way the exchange’s chances to reveal the best projects at an early stage would be increased. Those disapprovals emerge the community demand for a more precise and faster token listing model.

Besides the listing change, Coinbase will turn its focus on the integration of DEXs. The plan is to offer users with the best experience no matter if the transaction is centralized or decentralized. This path is a clear indication that the other side of the cryptocurrency market, decentralized finance (DeFi), is growing and thereby the entire cryptocurrency ecosystem is moving toward a more distributed one.

It should be stated that the recent u.S. Securities and Exchange Commission’s approval of spot Bitcoin ETFs among other recent happenings show the increasing connection between the traditional financial and the cryptocurrency areas. The exchanges like Coinbase also need to deal with the regulation and at the same time, maintain their business with the fast-growing innovations in the crypto industry.

This article first appeared at CryptoNinjas