As torrential rains drenched the streets of Dubai during Blockchain Week’s Token2049 event, the city found itself inundated not only with water but also with a flood of announcements, partnerships, and promises from the crypto community. In this week’s edition of the #hearsay column, we take you behind the scenes of Blockchain Week in Dubai, UAE.

Disclosure: The views and opinions expressed here belong solely to the author and do not represent the views and opinions of crypto.news’ editorial.

Every week, crypto.news brings you #hashtag hearsay, a gossip column of scoops and stories shaping the crypto world. If you have a tip, email Dorian Batycka at [email protected]

In spite of the total chaos imposed by the rain early in the week in Dubai, the world’s attention turned to the desert city for a glimpse into the future of finance. There among the botox’d influencers, biz dev girls, and Hasbullah sightings (who was there promoting his newly launched web3 and memecoin launchpad hasbiland.io), your trusted columnist found himself drowned out, desolate, and nearly swept away by the rain.

Arriving in Dubai early in the week, I immediately drowned myself in familiar territory: art. At the Blockchain Life conference on April 15, I stumbled upon the 10101.art booth, a new platform selling NFT tokens/shares of original works by the likes of Andy Warhol, Dali, Picasso, and Banksy. At their launch party at Monada Gallery in Dubai’s financial center (DIFC), a limited number of presale tokens were on offer. The business model—not altogether dissimilar from masterworks.io, only with an added layer of cryptocurrency NFTs—aims to democratize access to art by offering shares in bluechip artworks as an investment vehicle for people who cannot afford to own 100% of the real thing. Can’t afford to drop a couple of million on a Picasso? Just buy a $100 slice!

And then it happened. The great biblical flood of Dubai 2024 completely drowned out on the second day of the Blockchain Life conference, as well as just about everything else in the Gulf petrostate. In the span of only 12 hours, Dubai, accustomed to arid conditions, endured a deluge equivalent to a year’s worth of rainfall, leaving homes and businesses across the emirates grappling with the absence of essential utilities like running water and electricity. Your humble columnist, trapped downtown, was forced to walk 17 km, or 10.5 miles, back to my hotel—most of which I did barefoot due to my water-logged shoes pruning my feet.

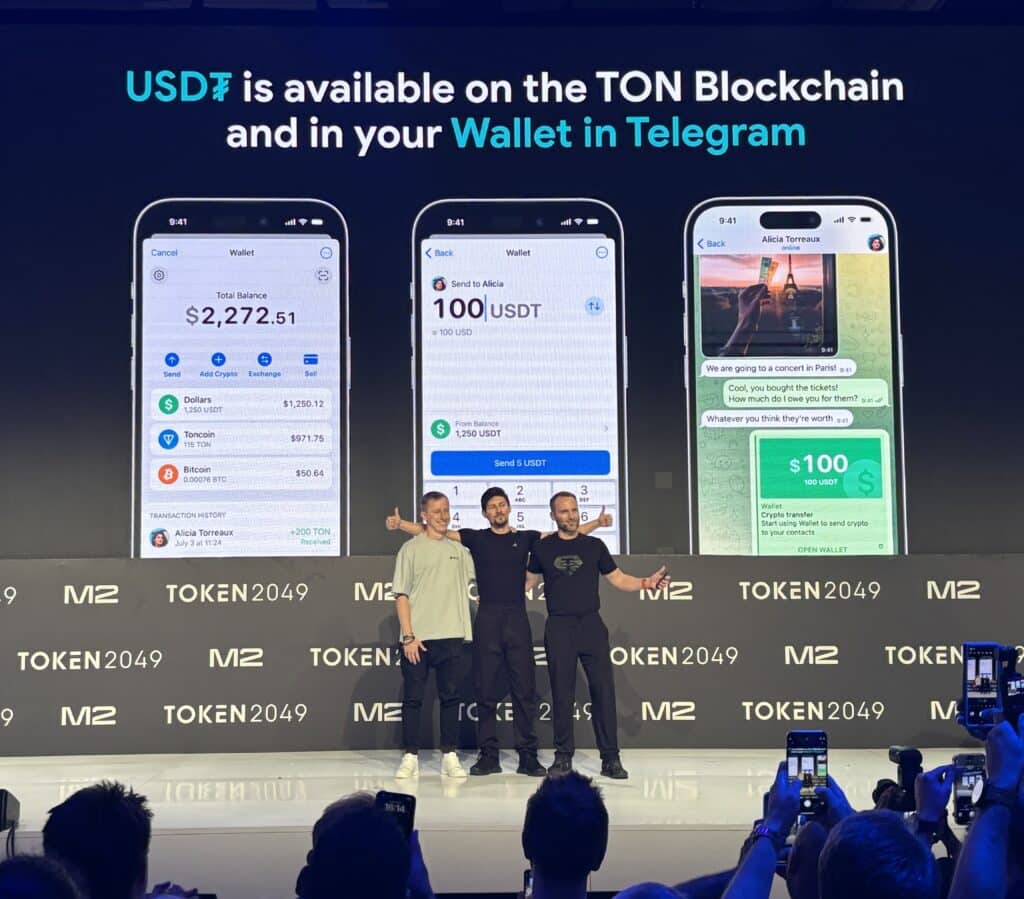

The rains did not stop Token2049 but did cause some serious delays to people arriving from out of town. Taking some much-needed heat away from Dubai’s flooded streets, Pavel Durov, the enigmatic and elusive founder of the Telegram messenger, made waves at Token2049 with several announcements aimed at bolstering and doubling down on Telegram’s crypto functionality. Durov unveiled plans for ordinary Telegram users to dive into the TON ecosystem, initiating payments in TON for advertising to Telegram channel admins and enabling tipping in TON for content creators. Not stopping there, Durov floated the idea of trading stickers in TON as NFTs, with artists set to reel in 95% of the proceeds. With the floodwaters of announcements not stopping there, Durov invited Paolo Ardoino, Tether’s CEO, to the stage, where the two announced they would be integrating USDT into the TON blockchain. My two cents: with USDT having its own issues with auditing and transparency, a native TON stablecoin may have shaken the industry up even further.

The backroom deals did not stop there, Singapore-based QCP and Further Ventures announced they were diving in the waters of Abu Dhabi. Together, the two will form a “strategic partnership” aimed at expanding digital asset innovation in Abu Dhabi and the MENA region. Details are being sparse (as with most “strategic partnerships” in the MENA region), but what we do know is that QCP plans to open an office in the Emirate, while Further Ventures will use its broker-dealer license and custodial products to facilitate sales.

Abra also made a splash this week with the announcement of SEC-approved offerings Abra Prime and Abra Private. The integrated digital asset solution will be tailor-made for institutional and private clients, along with approval from the SEC for its subsidiary, Abra Capital Management LP, to operate as a registered investment advisor. Abra now aims to connect on-chain and off-chain ecosystems for private clients and institutions, a splash into the vibrant (and sometimes murky) waters of earn-bearing yield and borrowing against crypto—which hopefully will not implode like many other high yield-bearing promises we have seen over the years (shout outs Voyager).

Other insights this week included Drift announcing a DAO and airdrop of a new governance token, with its genesis airdrop destined to reward Solana DEX traders. As the rains across Dubai subsided, Drift users found themselves caught in a downpour of newly minted governance tokens, marking a new era for the platform with 10% of the tokens, amounting to 100 million, raining down to 180,000 of Drift’s users based on their activity on the platform.

The Data Ownership Protocol (DOP) also made a splash this week with a newly announced partnership with Bitcoin.com. Surfing into a new potential wave of growth, DOP’s new plans hope to integrate their native 48 million wallets and one million monthly active users, together with Bitcoin.com’s four million monthly news readers, signaling a new potential sea of growth among Bitcoin maxis, many of whom remain committed libertarians interested in privacy and sound money, censorship-resistant protocols, which I for one and keen to see and support.

Finally, let me tell you about the party of the century. Or so I thought. Will Heckman from TheStreet.com and Roundtable Media reached out, promising yacht dinners and afterparties galore during Blockchain Life and Token 2049. It sounded like the perfect blend of networking and fun, with promises of hobnobbing with industry elites. But as the week of April 15-20 came and went, my inbox remained as barren as a desert island. No invites, no yacht, just the echoing sound of being ghosted from the party of my dreams. I guess my RSVP got lost at sea or washed away during the great Biblical flood. And along with it any hopes of rubbing elbows with crypto bigwigs. Alas, maybe next year.

This article first appeared at crypto.news