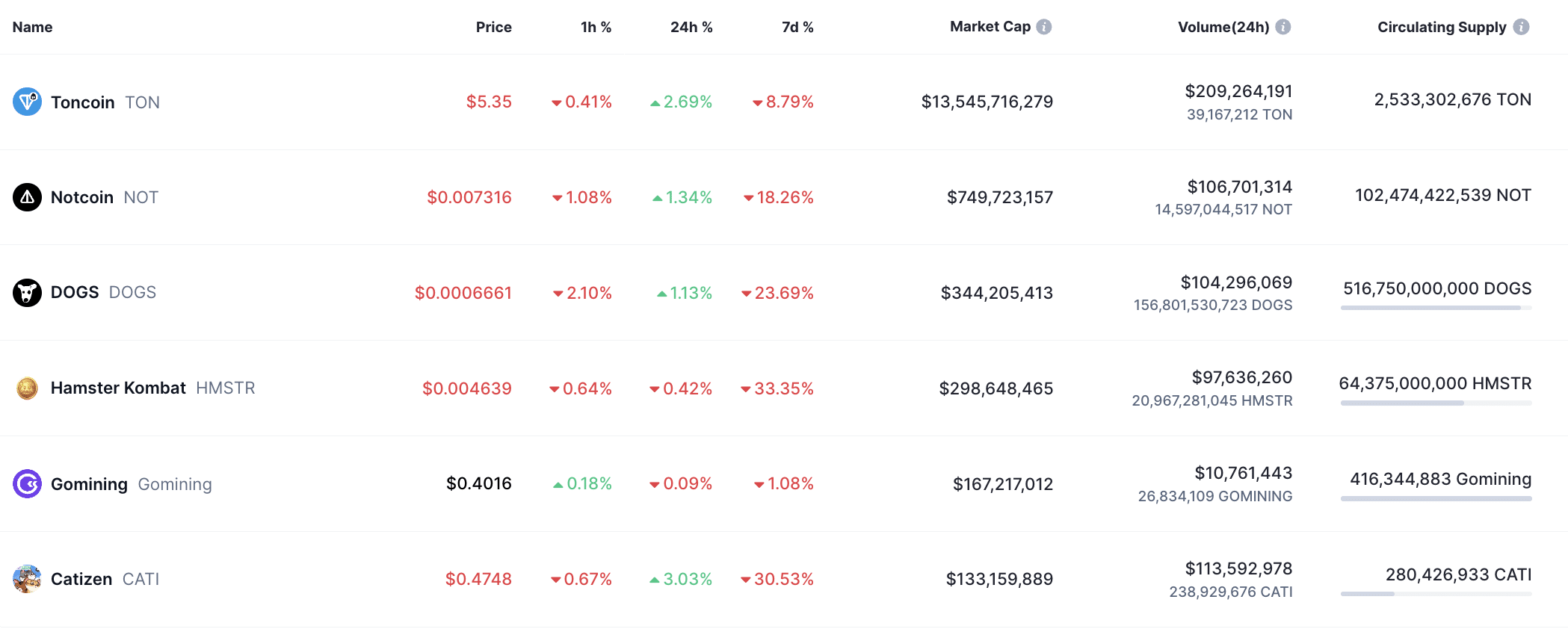

TON ecosystem tokens recently listed on major crypto exchanges have significantly dropped.

The largest tokens by market capitalization in the TON ecosystem have seen a sharp decline in the past few days. Relative to the all-time high (ATH), the drop has reached 30-50%.

Notably, many of them were recently listed on major crypto exchanges. These include Dogs (DOGS), Hamster Kombat (HMSTR), and Catizen (CATI). The Toncoin (TON) token has also dropped significantly — more than 8% in a week.

The market capitalization of the TON ecosystem tokens continues to decline — trading volumes fell by more than 27% to $675 million. The ratio of buy and sell orders on the Binance crypto exchange suggests that traders are rushing to get rid of once-coveted tokens.

DOGS plummeted by 58%, but developers have a plan B

Since its listing on Aug. 26, the DOGS token, 81.5% of which was supplied by the community, has plummeted by more than 58% to $0.0006599. It is noteworthy that there is no vesting period, therefore users were able to trade their DOGS immediately after the airdrop and, as a result, sell them immediately after the listing.

Amid the late token price collapse at the end of September, the DOGS team announced an upcoming token burn to reduce the total DOGS. Typically, token burning aims to increase its value — the number of unclaimed coins that need to be removed from circulation will be voted on by the asset holders.

Hamster Kombat did not live up to expectations after the airdrop

The excitement of the Hamster Kombat community turned bearish shortly after the token distribution. Despite the initial interest in the project, the active selling of HMSTR tokens led to their significant depreciation last week.

At the moment of listing, the coin price on some exchanges reached $0.014, but massive sell-offs quickly reduced the token’s value. Since its launch on Sep. 26, the token has lost 50% in value.

The catalyst for the fall was apparently the unsuccessful airdrop and listing. Users repeatedly complained about the unfair distribution of rewards, the postponement of dates and changes in rules, the low starting price of the HMSTR token trades, and the problem with selling HMSTR: the reward for many project participants for tapping the hamster was only a couple of dollars.

Such users needed help selling tokens since many exchanges restrict opening orders.

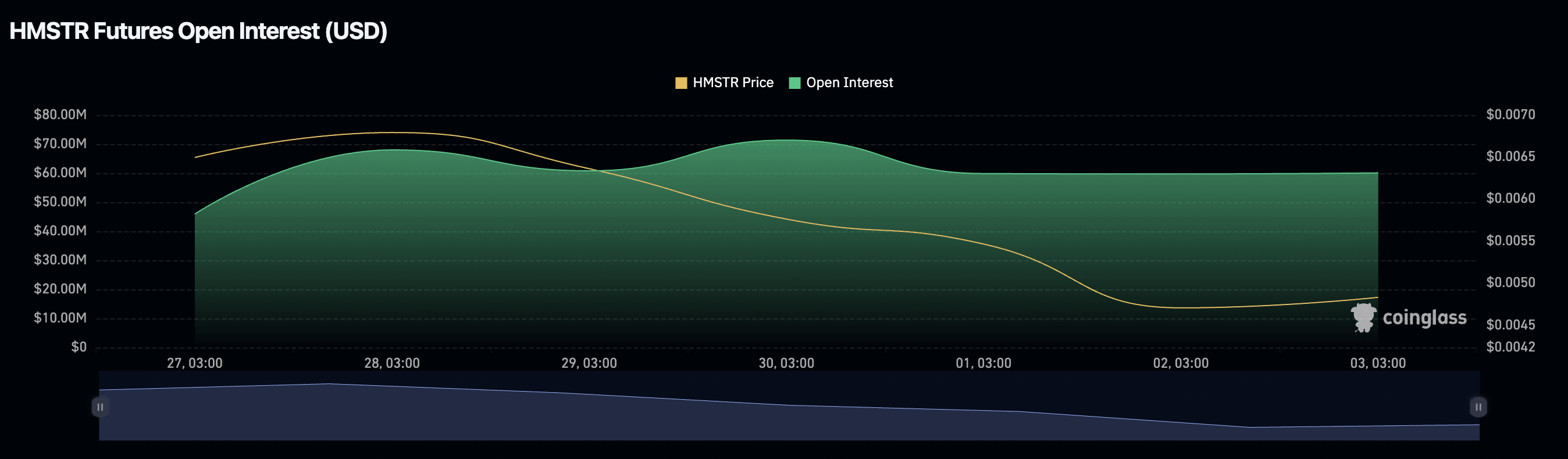

However, despite the rapid fall in the rate, open interest in HMSTR Futures remains stable. According to Coinglass, this figure has been at $60 million since the beginning of October.

In many ways, Hamster Kombat repeated the story of Catizen — another Telegram-based project that disappointed users after the airdrop.

An unexpected change in the rules of the game or why they started to dump CATI

CATI also announced the rating of the leaders of the fall of tokens in the TON ecosystem: like other similar projects, the coin’s price has fallen by 50% since Sep. 20.

The rise and fall of Catizen are reminiscent of the path of Hamster Kombat. Shortly before the start of the distribution, the team unexpectedly changed the rules of the game.

Initially, 43% of the total supply of CATI tokens was intended for players. However, the developers unexpectedly changed the conditions, so the community got only 30%.

The community’s discontent was not limited to this. Soon after the airdrop, it turned out that user spending in the game influenced the criteria for distributing tokens. Those who invested money in the game, not time, received a significant advantage.

After this, many players shared stories about how they took leading places but received very few rewards. As a result, a wave of discontent with the hashtag #catizenscam swept through social networks.

Why Telegram project tokens continue to fall

Airdrops are considered one of the most popular strategies for attracting users. Many projects launched on the Telegram platform used them.

For example, Dogs, Hamster Kombat, Catizen, and similar projects actively awarded users coins for simple actions. As a result, tokens distributed through airdrops cannot maintain long-term interest or preserve their value.

Airdrops, used to increase project engagement and distribute tokens more widely among users, have probably lost their former influence as users have become oversaturated with such strategies.

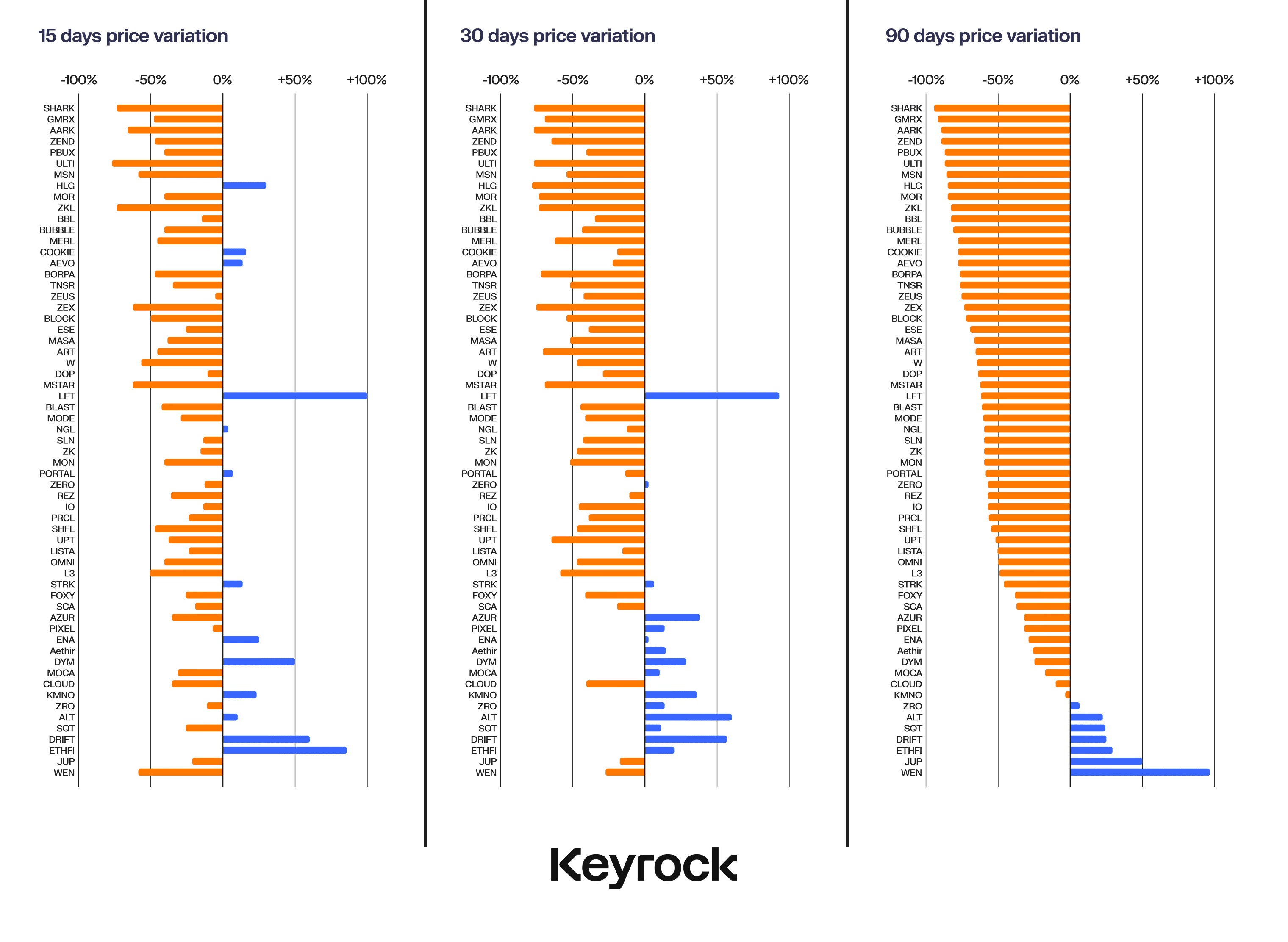

For example, KeyRock experts analyzed 62 airdrops in six blockchains since the beginning of 2024. The data showed that 88.7% of the tokens demonstrated a significant price decline within 90 days after the distribution. Only a few of them showed sustainability.

At the same time, small airdrops have shown greater resilience in the short term. This is probably due to the low selling pressure during the token launch. However, in the longer term, tokens still fall over three months.

Moreover, Telegram-based games are still young, and investors may still determine whether the demand for them will last. This also fuels users’ tendency to sell off tokens, which ultimately negatively affects their price.

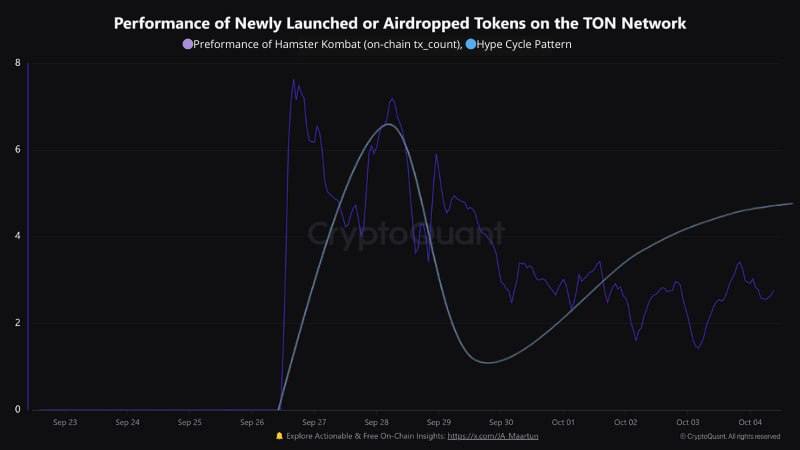

CryptoQuant analyst Maartunn told crypto.news that newly launched tokens in the TON ecosystem often follow a typical hype cycle.

“Initially, short-term expectations tend to be excessively high, while long-term expectations are often underestimated.”

Maartunn, CryptoQuant analyst

He also visualized the number of Hamster Token transactions relative to all TON transactions. The trend line illustrates the classic hype cycle model.

Among other recently launched coins, Hamster Kombat is one of the most popular. However, Maartunn noted that many meme coins will eventually fail; only those with good fundamentals and a strong network can survive.

This article first appeared at crypto.news