Are we witnessing a seismic shift in the crypto market as Ethereum inches closer to Bitcoin in market cap?

Bitcoin (BTC) and Ethereum (ETH) represent the twin pillars of the crypto market, collectively commanding nearly 70% of its total market cap.

Over time, Bitcoin evolved from a novel concept to a global financial asset, gaining traction among institutions. As of Feb. 26, BTC’s market cap is valued at over $1 trillion.

Companies like MicroStrategy and Tesla have amassed significant Bitcoin holdings, solidifying its popularity. Moreover, the recent approval of spot Bitcoin exchange-traded funds (ETFs) by the U.S. Securities and Exchange Commission (SEC) signals growing institutional acceptance.

In contrast, Ethereum emerges as the second-largest player, with a market cap nearing $370 billion. Ethereum’s blockchain technology underpins a diverse ecosystem of decentralized applications (dapps).

Moreover, the platform’s transition to a proof-of-stake consensus mechanism through “The Merge” in 2022 marked a crucial technological advancement aimed at addressing scalability, energy consumption, and security concerns.

The cryptocurrency community has long speculated about a potential event known as “the flippening,” where Ethereum’s market cap could surpass Bitcoin’s. Can Ethereum overtake Bitcoin in the long run?

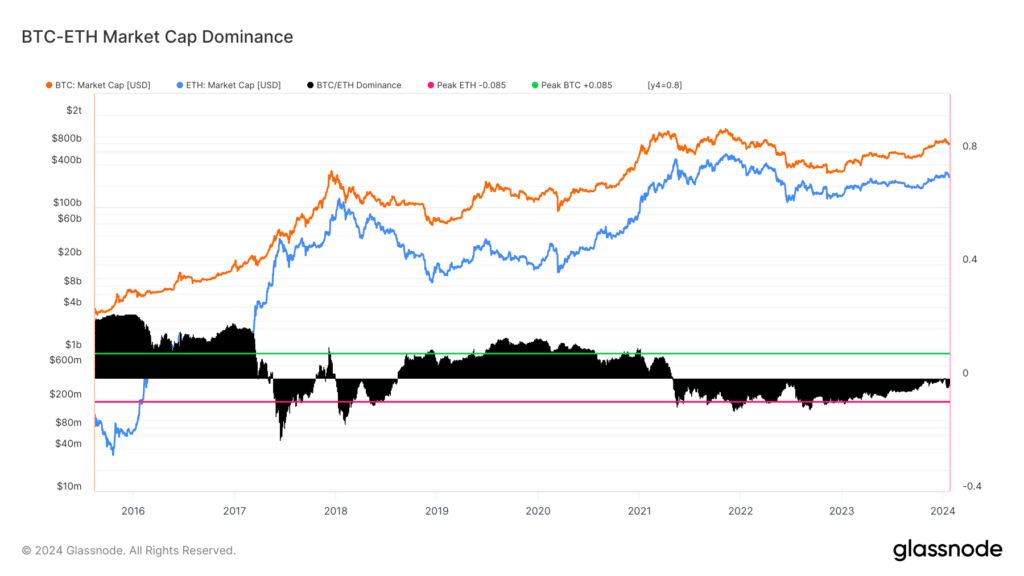

BTC vs ETH: market cap and dominance

Since its inception in 2009, Bitcoin has held its position as the leading crypto, dominating the market with a staggering market cap that has outstripped its competitors to date.

At the outset, Bitcoin’s market cap was a mere $1 million in early 2011, but by early 2013, it had surged to $1 billion, marking an unprecedented 1000x increase. By the close of 2013, Bitcoin’s market cap had surpassed $9 billion.

2017 proved crucial for Bitcoin, witnessing its market cap soar to over $300 billion for the first time. This surge was propelled by a retail and institutional investment frenzy and a rising interest in cryptocurrencies as a novel asset class.

However, this meteoric rise was not without its setbacks. By Nov. 2021, Bitcoin’s market cap had breached the $1 trillion mark, only to plummet to around $320 billion by Dec. 2022.

In contrast, Ethereum embarked on a more gradual trajectory. Despite its modest beginnings upon its launch in 2015, Ethereum quickly asserted itself among the top five cryptocurrencies by market cap.

In Dec. 2015, while Bitcoin’s market cap stood at over $6 billion, Ethereum’s was a modest $60 million, marking a stark difference of 100-fold.

Meanwhile, the introduction of initial coin offerings (ICOs) in 2017, followed by the subsequent defi and NFT booms, catalyzed Ethereum’s exponential growth.

By Dec. 2017, Ethereum’s market cap had surged to $73 billion from $60 million in Dec. 2015, representing an astounding 1210x increase. This growth significantly narrowed the ratio between Bitcoin and Ethereum’s market caps to 3.25:1.

Concurrently, the concept of “Bitcoin dominance” – Bitcoin’s market cap as a percentage of the total cryptocurrency market – emerged as a crucial metric for assessing the dynamics within the crypto space.

Initially exceeding 90%, Bitcoin’s dominance dwindled to below 45% by Dec. 2017 as altcoins, spearheaded by Ethereum, gained traction. As a result, this ratio further narrowed to approximately 2:1 in Dec. 2021, with Bitcoin’s market cap at around $960 billion and Ethereum’s at $483 billion.

As of Feb. 25, the ratio stood at approximately 2.75:1, with several bullish scenarios for Bitcoin, including the anticipation of the Bitcoin halving in Apr. 2024 and the SEC’s approval of spot BTC ETFs in Jan. 2024, potentially tipping the scales in Bitcoin’s favor in the short term.

Real-world contributions of Bitcoin and Ethereum

The contributions of Bitcoin and Ethereum to the crypto space have become increasingly distinct, each carving out unique use cases and driving innovation in different directions.

Bitcoin’s expanding ecosystem

Bitcoin has witnessed strong growth in its ecosystem, particularly with the advent of new technologies and platforms.

The launch of spot Bitcoin ETFs in Jan. 2024 is expected to have a substantial impact, not only in enhancing Bitcoin’s accessibility and appeal but also in fostering its position in global finance.

Trust Machines reported an “explosive growth in Bitcoin use cases” in the first quarter of 2023, highlighting the increasing developer interest in building atop Bitcoin.

This growth is attributed to the Stacks (STX) blockchain, which enables smart contracts, defi applications, NFTs, and apps directly on Bitcoin, thus broadening its utility beyond just a store of value.

Amid this, Ordinals, introduced in Jan. 2023, have added a new dimension to Bitcoin’s use cases by allowing information to be attached directly to individual satoshis through a process called “inscribing.”

This innovation has enabled the creation of Bitcoin-native NFTs, marking a crucial evolution in Bitcoin’s functionality beyond its original scope as a digital currency.

Meanwhile, the ECB’s working paper highlights Bitcoin’s significant adoption in Emerging and Developing Economies (EMDEs), where it serves not only as an investment but also as a hedge against currency depreciation and a means to facilitate cross-border transactions.

Ethereum’s diverse utility

Ethereum, on the other hand, has been a frontrunner in facilitating a wide range of dapps, defi platforms, NFTs, and so on, thanks to its inherent smart contract capabilities.

While the introduction of Ordinals and the ability to mint NFTs directly on the Bitcoin blockchain has been a significant development, Ethereum continues to hold a competitive edge in the NFT domain.

Ethereum’s established standards, like ERC-721 and now with Ethscriptions, have made it the go-to platform for NFT creation and trading, offering a more straightforward process compared to Bitcoin’s more recent entry into the space.

Moreover, Ethereum is the backbone of the defi sector, facilitating lending, borrowing, and trading through permissionless financial services. According to DefiLIama, as of Feb. 26, Ethereum has a total value locked (TVL) of around $48 billion, the largest amongst all other chains.

Ethereum has also emerged as the most used blockchain for the tokenization of real-world assets so far. This process involves converting rights to an asset into a digital token on the Ethereum blockchain, enhancing the liquidity and accessibility of various asset classes. Citi has predicted that tokenization could become a $4 trillion market by 2030.

Can Ethereum overtake Bitcoin in the long run?

While Bitcoin is often regarded as digital gold, serving as a secure store of value, Ethereum is likened to digital oil, powering an expansive range of applications beyond mere financial transactions.

Goldman Sachs, in a 2021 analysis, highlighted Ethereum’s substantial “real use potential” due to its foundational role in running applications like defi protocols.

This utility, according to Goldman, positions Ethereum to potentially eclipse Bitcoin’s value in the future. However, it’s worth noting Goldman’s predictions come with their fair share of misses, adding a layer of skepticism to such forecasts.

Meanwhile, Jim Cramer of “Mad Money” has also thrown his weight behind Ethereum, citing its prevalent use in purchasing NFTs and other digital assets as a reason for its potential dominance over Bitcoin.

Cathie Wood of Ark Invest projects a future where Ethereum reaches a staggering market cap of $20 trillion by 2030 while also predicting Bitcoin price to reach $1 million.

Such forecasts paint a picture where Ethereum’s broad utility could redefine its position relative to Bitcoin.

The road ahead

While speculations about “the flippening” persist, the reality is that both Bitcoin and Ethereum are likely to coexist and thrive, each serving unique purposes within the broader crypto market.

The potential for Ethereum to overtake Bitcoin in market cap speaks to its expansive utility and the growing demand for its technology.

However, Bitcoin’s entrenched status as digital gold and its broadening use cases ensure its continued relevance and resilience.

As we move forward, it will be essential to keep an eye on how these platforms adapt to emerging challenges and opportunities in the quest to redefine money and commerce in the digital age.

This article first appeared at crypto.news