Key Takeaways

- LUNA’s price has risen by more than 100% in the past 10 days.

- Investors could now take profits as suggested by the technicals.

- A spike in selling pressure could see prices dive toward $77.

Share this article

Terra’s native token LUNA has enjoyed significant gains over the past 10 days, outperforming much of the crypto market. Now, it appears to be preparing for a brief correction before prices head higher.

LUNA Is Primed for a Brief Correction

LUNA seems to be bound for a brief correction after doubling in price, with more than 106% gains since Feb. 20.

The altcoin appears to be overbought, and recent price action suggests that a spike in profit-taking is close at hand. As such, LUNA’s price could drop before it resumes its uptrend.

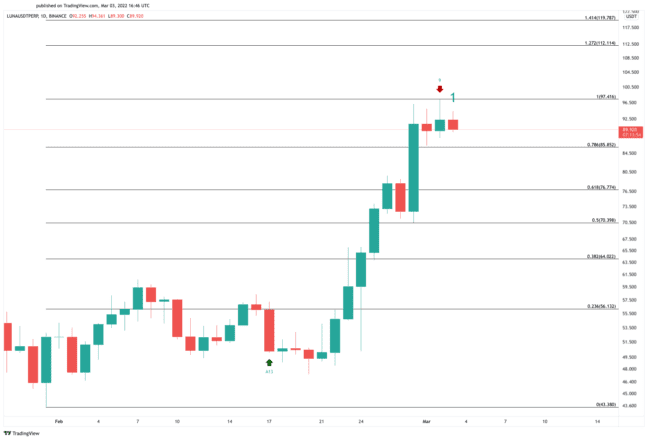

Based on the technicals, a short-term pessimistic outlook seems imminent. The Tom DeMark (TD) Sequential indicator presents a sell signal on LUNA’s daily chart. A bearish formation has developed in the form of a green nine candlestick; if validated, LUNA could retrace for one to four daily candlesticks until it finds stable support.

The Fibonacci retracement indicator, measured from Jan. 31’s low at $43.40 to Mar. 2’s high at $97.40, suggests that the potential price correction could extend to $77 if LUNA prints a daily close below $86. This fundamental support level could be strong enough to prevent further losses and serve as a route for sidelined investors to re-enter the market by purchasing the altcoin.

Furthermore, market participants may experience “FOMO” if LUNA closes above its recent high of $97.40. Breaching this critical resistance level could increase buying pressure behind the asset, pushing prices into new all-time highs. LUNA could then find resistance as it approaches prices of $112 to $120.

LUNA is currently the seventh-largest cryptocurrency with a market capitalization of around $33.2 billion.

Disclosure: At the time of writing, the author of this piece owned BTC and ETH.

Share this article

This article first appeared at Crypto Briefing