SUI surged 115% in September, becoming the top-performing altcoin and reaching a five-month high.

At press time Sui (SUI) was trading at $1.77 recording a 7% price jump over the day while its market cap surged past $4.925 billion setting a new all-time high. Moreover, the Layer-1 blockchain’s daily trading volume also rose 164% hovering around $1.06 billion in the last 24 hours.

Sui, often regarded as a competitor to Solana, has seen impressive growth driven by increasing interest from users and developers. Data from DeFI Llama shows that the total value locked in its ecosystem has surged to an all-time high of $1 billion, up from just $383 million recorded in August.

Some of the most notable Sui dApps that have seen significant growth in TVL are NAVI protocol, Cetus, Suilend, and Scallop Lend, each accumulating over $165 million in assets.

Sui’s push into the blockchain gaming sector, a key area for blockchain adoption, has been a major driver behind its recent surge.

In early September, Mysten Labs, the developer of the Sui blockchain, opened preorders for the SuiPlay0X1 gaming handheld, which integrates Sui’s blockchain technology with a Linux-based OS, supporting both traditional PC and blockchain-based games.

To build excitement, users who preordered were given the opportunity to create a wallet, which will receive a unique NFT upon the device’s delivery.

Another key driver of SUI’s September run is Grayscale’s decision to open its Sui Trust to accredited investors, which adds credibility and attracts institutional interest in Sui.

Moreover, Sui’s recent integration of USDC into its ecosystem and its partnership with MoviePass, the U.S. movie subscription service also contributed to the bullish momentum.

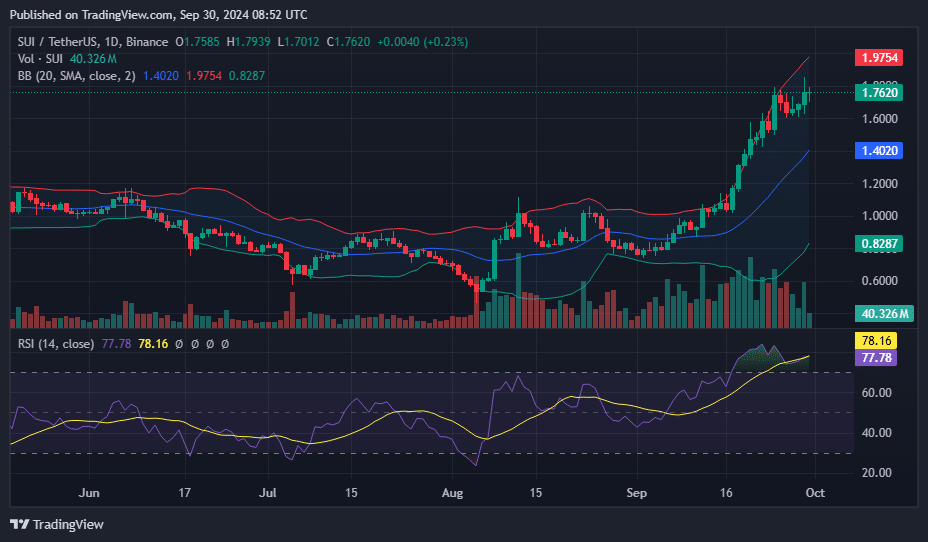

Technicals point to bullish momentum

Sui has seen a notable rise in futures open interest, reaching an all-time high of $485 million on Sept. 30.

The altcoin is currently trading above its 50-day and 200-day moving averages, which formed a golden cross on Sept. 22—a key bullish signal in technical analysis.

When writing, SUI’s price had moved close to the upper Bollinger Band at $1.9754, while the Relative Strength Index had risen to 77.

These indicators suggest strong bullish momentum for Sui, with the potential for further short-term gains. If this trend continues, the next key resistance level is $2.1839, which marks its March high and sits 24% above the current price.

However, SUI’s price could be at risk of a correction, as roughly 64.2 million SUI, valued at $108.5 million and representing 2.4% of the circulating supply, are set to be unlocked on Oct. 1, according to Token Unlocks.

A significant portion—61%—of these tokens will be allocated to early investors from the project’s Series A and B funding rounds. If these investors opt to liquidate their holdings, it could introduce considerable selling pressure, potentially offsetting the recent bullish momentum.

This article first appeared at crypto.news