Key Takeaways:

- Stablecoin transfer volumes surpassed Visa and Mastercard combined in 2024, reaching $27.6 trillion.

- Bot activity accounts for 70% of stablecoin transactions, most of which occurs on blockchains like Solana and Base.

- The stablecoin market cap has surged past $200 billion, signaling further growth in the cryptocurrency industry.

2024 was an eventful year in the global economy as stablecoins played a dominant role. These digital currencies which are linked to the US dollar have really been standing out in the recent past. This has been clearly shown by the fact that the total amount of stablecoin transfers in 2024 has been even bigger than that of both Visa and Mastercard. More importantly, this surge reflects the key change in the already evolving financial sector which is increasingly witnessed by the fact that transactions are currently done on the blockchain.

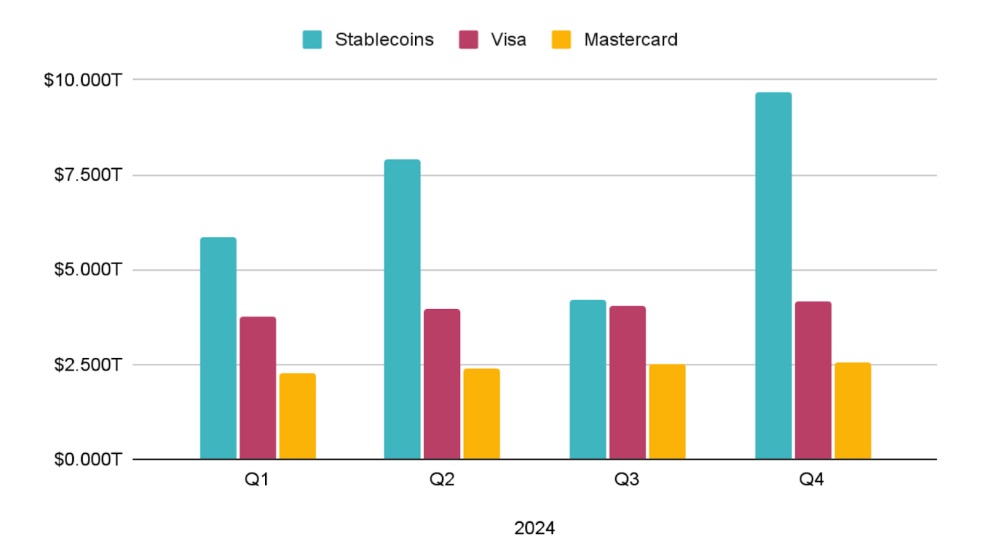

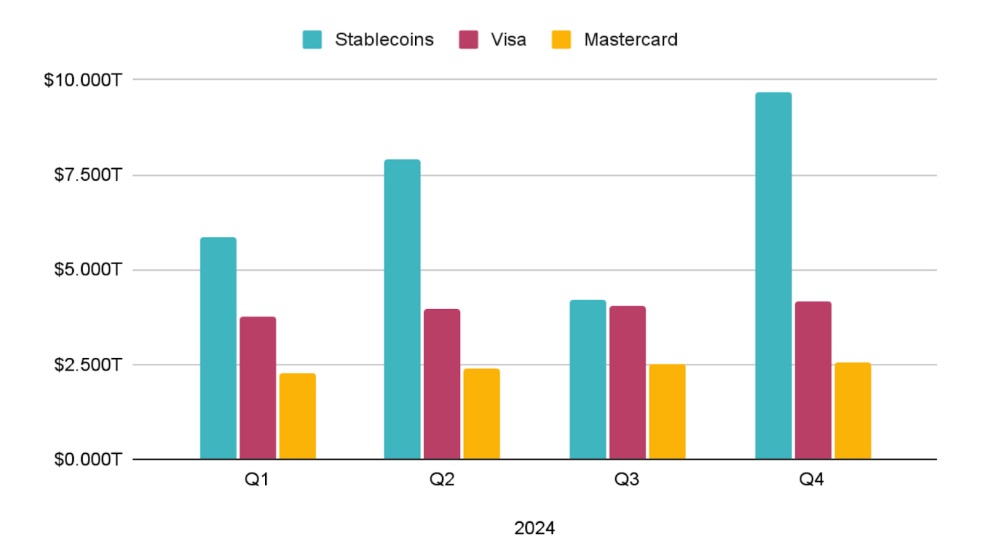

Stablecoin Volume Eclipses Visa and Mastercard

A recent study conducted by the CEX.io revealed that the overall stablecoin transfer value totaled $27.6 trillion in 2024. According to this calculation, the combined transfer volume increased by only 7.68% when compared to the separate volumes of spreadings carried out by Visa and Mastercard. This milestone highlights the growing adoption of digital assets in the global economy and signals a shift from the traditional financial system, despite a slowdown in the third quarter.

Volumes of stablecoins, Visa and Master

Therefore, the burst in volume shows that stablecoins are now operating beyond a niche crypto application and are starting to become a mainstream way to move and store value. CEX.io analysts saw a post-election spike in crypto activity and the result was a record high stablecoin usage. For instance, the fourth quarter registered a doubling of the volume of stablecoin compared to Visa and Mastercard.

The Growth of the Supply of Stablecoins

Along with the transfer of volume, the stablecoin supply also saw significant growth. The stability and sustainability of the stablecoin supply increased by 59% during 2024 whereby its value eventually became 1% of the US dollar supply as a whole. This extensive expansion not only signifies the increased demand for digital currencies that guarantee stability and the ease of transfer but it also showcases the increase in the total market cap of stablecoins. The total stablecoin supply reached a record high, though CEX.io also reported a 13.5% decrease in its market share.

More News: The Surge of Stablecoins at the End of 2024 and What to Expect in 2025

The Dual Nature of Stablecoins: Trading vs. Real-World Use

Although some users are making use of stablecoins for savings and remittance transfers, the main use case is in the cryptocurrency trading and decentralized finance (DeFi) sectors. According to Illia Otychenko, a company that provides tools for making money in the crypto market, stablecoins are “blood” of these ecosystems, which allow the transaction processing to be smooth and efficient. This flexibility allows stablecoins to cater to users from different backgrounds.

The Power of Automated Trading

The transfer volume of stablecoins in 2024 was majorly caused by bot activity (approximately 70%). These automated trading systems are mostly used on networks such as Solana and Base. They contribute to as much as 98% of the total volume. While the prevalence of trading bots might be perceived as a threat to the fairness of manipulators, they also play a significant part in promoting market efficiency as a result of practices like arbitrage and gas fees coverage, according to CEX.io. These systems can also be an indicator of the development of some networks. For example, bots may manage the implementation of smart contracts and the conducting of transactions on a periodic schedule.

Stablecoin Network Landscape: Beyond Ethereum and Tron

For the longest time, Ethereum and Tron have been the top networks for stablecoins to be in circulation on. In 2024, they commanded more than 83% of the total market. Nevertheless, there were several reports about the diversification of stablecoins on various public networks apart from Ethereum and Tron. Namely, Solana, Arbitrum, Base, and Aptos have been inducted into the bear market long enough to signify the existence of a drift from the traditional networks which were dominant in the past. This has been most evident with Tron that saw its market share plummet from 38% to 29% during 2024.

Stablecoin distribution chart by network

Ethereum’s stablecoin market cap grew by 65%, reaching an all-time high after the Dencun upgrade, largely due to lower transaction fees. This uplift took place in the month of March and it made the network suitable for a larger pool of users.

Solana’s Ascendancy

Solana has transitioned from a minor player to a major force in the stablecoin market, surpassing Ethereum and Tron in transaction volume by early 2024. The ever-increasing use of the network is in line with the total Solana ecosystem development, and the fast completions and cheap costs of the network have made it a DeFi Application and trading option. It should be noted that USDC became the predominant stablecoin for on-chain transactions, hence 70% of the total transfer volume was counted to it.

For example, 73% of Solana’s stablecoin supply was connected to USDC transactions in 2024. It was a clear sign when in December, the network’s decentralized exchange (DEX) traded 56% meme tokens in the trading volume.

What does the Future Hold for Stablecoins?

Shifting Market Dynamics

Tether is the largest stablecoin but it is now dealing with increasing competition and tighter rules from the government. A situation like this may lead to Tether’s market getting thinner and its success on some chains, for example, Tron, losing power. On the other hand, Ethereum’s upcoming Pectra update, which will be released in the first quarter of 2025, will make the network more attractive for stablecoins due to its higher scalability and lower gas fees.

The Role of Stablecoins in Driving the Next Crypto Rally

According to CryptoQuant, the doubling of stablecoins during the past year might push the next cryptocurrency rally. Outwardly, the inflow of liquidity through stablecoins puts a connection with the time of raising of the crypto market’s trade. Quite interestingly, such important figures are stablecoin’ s market cap doubling from $200 billion to $204 billion in the past year. Tether’s USDT takes the lead in this case study. For example, USDT deposits on centralized exchanges have gone up from $30.5 billion in November 2024, to $43 billion.

Stablecoins as a Source of Liquidity

The total value of stablecoins represents a very useful pool of the most liquid crypto assets for trading on the exchanges and the transactional volume will generally be associated with higher price levels of cryptos. It is interesting to see that the CEX.io report also shows that profit-bearing stablecoins have taken the general stablecoin market by storm and account for over 3% of the total thereby gaining a mere 414% more in the market cap of tokenized treasuries.

This post describes the dynamic development and change in the stablecoin market in 2024, revealing their enlargement as a tool for trading, a method for transfers, and a possible indicator for future market activity.

This article first appeared at CryptoNinjas