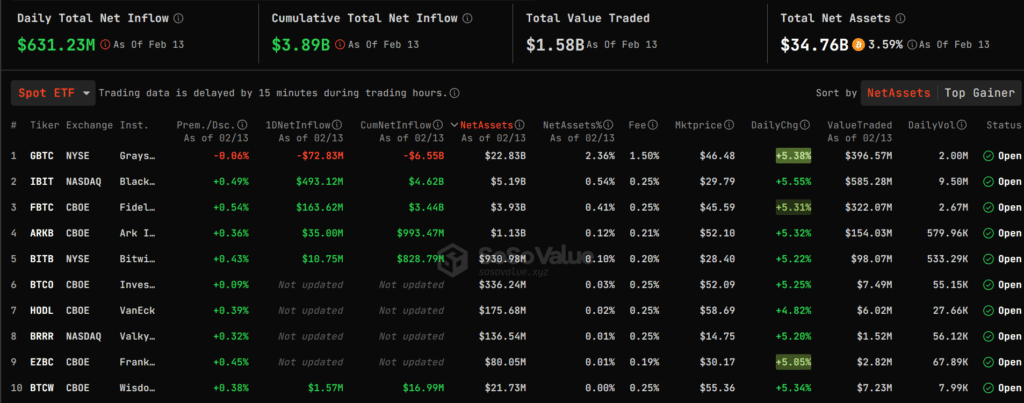

Spot Bitcoin ETFs set a record high for daily net inflows, with over $631 million flowing into funds on Feb. 13, coinciding with dwindling outflows from Grayscale’s converted GBTC.

Excluding GBTC, nine spot Bitcoin (BTC) ETF issuers saw $704 million in inflows as demand for exchange-traded funds underpinned by crypto’s largest assets trended upwards and consistently amounted to hundreds of millions of dollars daily.

BlackRock accounted for the lion’s share of inflows, recording 70% of the day’s influx of trading worth $493 million, according to sososvalue.xyz.

Feb. 13 marked a new historical high for spot Bitcoin ETFs and the 13th consecutive day of net inflows since trading opened on Jan. 11, following approval from the U.S. SEC a day before.

Substantial outflows from Grayscale’s GBTC marked the first few trading days, the only close-ended fund converted into a spot BTC ETF. While GBTC saw over $4 billion leave its fund, most of the Grayscale sellers were attributed to single large entities like bankrupt crypto exchange FTX.

GBTC only experienced $72 million in net outflows per the latest spot Bitcoin ETF data at press time. Grayscale still holds over 467,000 BTC for its GBTC ETF against over 216,000 BTC amassed by other issuers in less than three months. These entities have also recorded $4 billion in inflows since launch, per CoinShares analysts.

BTC reclaims $1 trillion market cap on spot Bitcoin ETF demand

Demand for spot Bitcoin ETFs also seems to have impacted BTC market prices. The world’s leading cryptocurrency achieved a 25-month high after breaking the $51,000 mark for the first time since December 2021.

Why is Bitcoin going up? There are more buyers than sellers. No need to overcomplicate it. ETF inflows are massive.

Scott Melker, BTC proponent

Bitcoin is up more than 20% in the last week and has reclaimed a $1 trillion market capitalization. BTC is only eclipsed by Meta, Silver, Amazon, Google, Nvidia, Saudi Aramco, Apple, Microsoft, and Gold. The crypto is less than 25% from its previous $69,000 all-time high.

This article first appeared at crypto.news