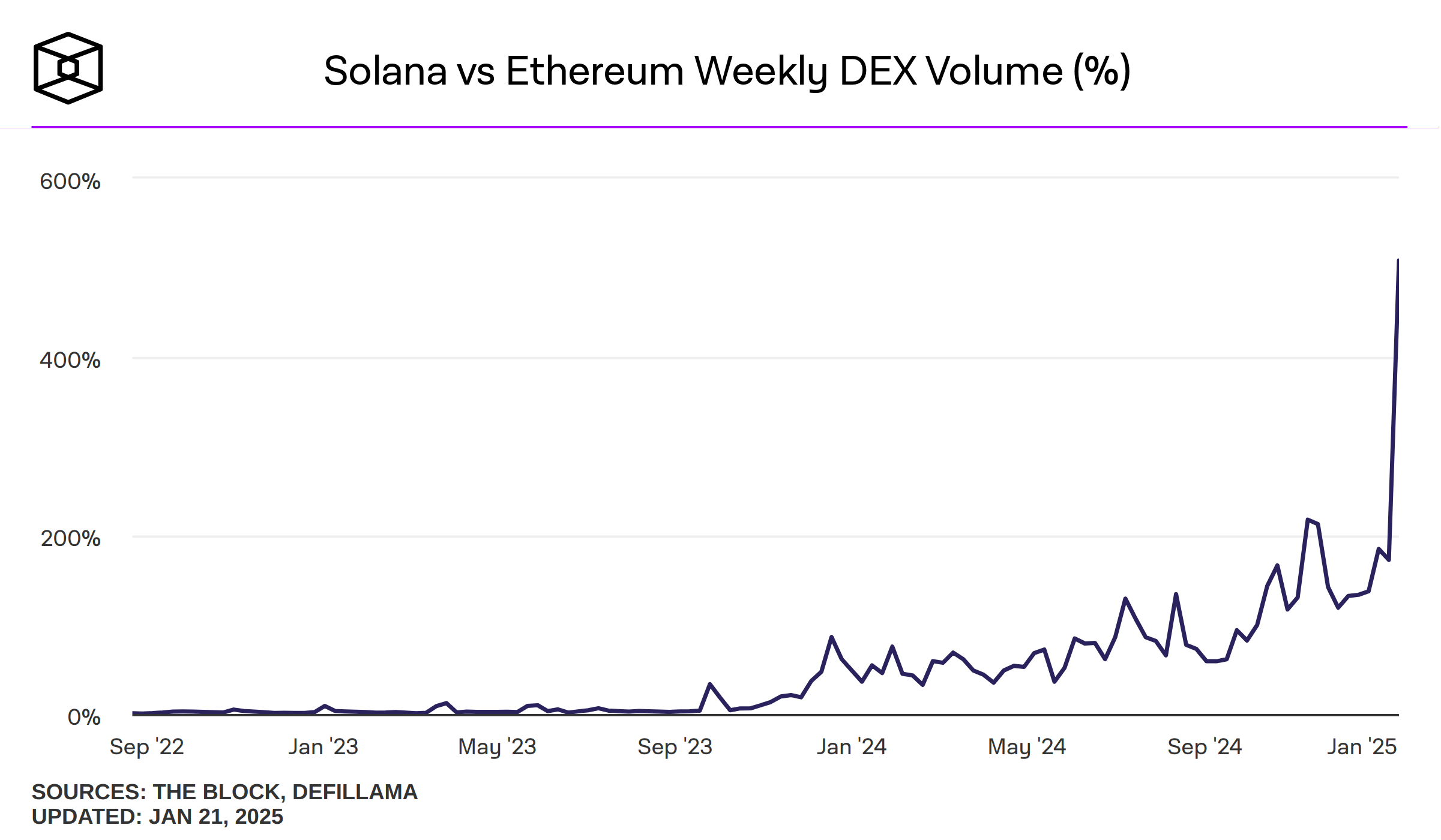

As of Jan. 21, Solana saw $120.6 billion in its DEX trading volume, a 323.3% premium over the last seven days. Now, analysts wonder if it can compete with Ethereum and position itself as the top Layer 1 blockchain in 2025.

According to data from DeFiLlama, Ethereum (ETH) weekly DEX trading volume ballooned to $24.7 billion, an uptick of 47.58%. Compared to Solana, this surge was largely driven by Uniswap, which accounted for over 73.7% of the trading volume and contributed $17.46 billion to Ethereum’s DEX activity.

On the other hand, Solana’s top DEX was Raydium (RAY) saw a 236% weekly change, handling $52 billion to Solana last week. After Raydium, Meteora added 13,379% to Layer 1’s weekly volume.

Comparatively, Solana will appears poised to make gains on Ethereum for DEX activity, given it is gaining attention from DEX traders, says analyst Knox Ridley of I/O Fund

Will Solana overtake Ethereum as the top Layer 1?

Ridley believes Solana’s unique “proof of history” protocol will make it a market leader. The blockchain’s PoH enables a high throughput of 65,000 transactions per second without second layers, making it faster and more efficient than Ethereum‘s protocol, proof of stake, which clocks in at a maximum recorded TPS of 62.34, as per Chainspect.

In addition, Solana’s new update called Firedancer, built by Jump Crypto, aims to bootstrap development on the Layer 1 by boosting scalability and improving the network’s overall vulnerability to bugs and attacks.

Such new technical advantages, it is believed, will allow Solana to act as a more scalable and secure Layer 1 Blockchain — a real challenger to Ethereum, particularly in applications where speed and efficiency matter, believes Ridley.

Another factor adding to Solana’s popularity is its stablecoin infrastructure. While Ethereum still leads in stablecoins, Solana is rising, with a 67.48% gain in its stablecoin market cap, sitting at $9.8 billion as of Jan. 21, 2025.

Solana’s volume-to-market cap ratio exceeds Ethereum

Interestingly, Solana’s (SOL) 13.13% volume-to-market cap ratio suggests that it’s witnessing a surge of trading activity against Ethereum’s (ETH) 10% ratio, as per CoinMarketCap.

Activity that underlies Solana’s growth. DEXes like Raydium and Meteora validate this growth, driving high liquidity. In contrast, Ethereum’s low ratio indicates a slower growth for Ethereum.

Further, Bitwise Europe analysts also believe SOL’s price could increase by 3,000% by 2030 due to what they call the ‘iPhone moment‘, making the blockchain more susceptible to overtake Ethereum in 2025.

This article first appeared at crypto.news