Solana meme coins like Slerf have bolstered on-chain activity on the altcoin network as pre-sale projects stack millions in SOL within hours.

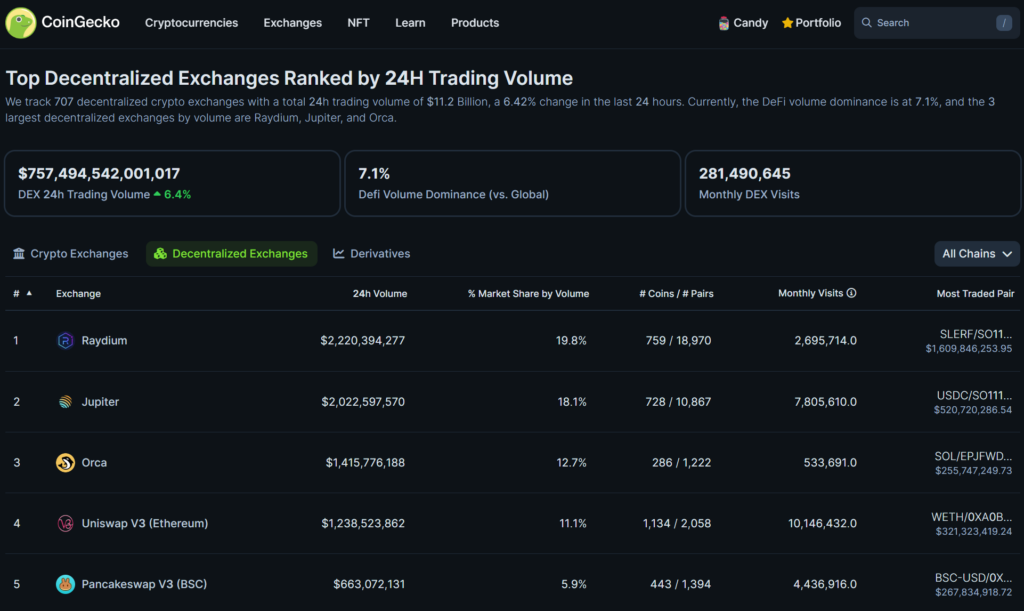

Solana (SOL) decentralized exchanges (DEX) outperformed Ethereum-native platforms, such as Uniswap, and Binance Smart chain-based solutions, like Pancakeswap, in trading volume over the last 24 hours amid a memecoin marathon.

According to CoinGecko, Raydium, Jupiter, and Orca secured the top three spots for daily transaction activity across all indexed on-chain swapping venues. Raydium’s $2.2 billion, Jupiter’s $2.1 billion, and Orca’s $1.4 billion edged ahead of $1.2 billion and $682 million recorded by Uniswap and Pancakeswap, respectively.

Solana’s Slerf, others fuel crypto gambling

CoinGecko also marked the hottest Raydium pair as SLERF/SOL, a meme coin that obliterated $10 million in SOL raised by speculators and early investors during its pre-sale round.

The project’s website said its top contributor injected $200,000 or around 1,000 SOL into the meme coin pre-launch. The investor could not realize profits due to an error by the Slerf developer, who claims to have burned all SOL tokens raised by liquidity providers.

Slerf surged from $1.5 million to nearly $1 billion in market cap, generating hype and garnering multiple centralized exchange listings before it crashed below a $300 million valuation. Traders swapped over $2 billion of the meme coin within its first 12 hours.

The trend of raising millions in SOL in hours of a pre-sale announcement is fast becoming common in Solana’s ecosystem. As crypto.news reported, NFT project Milady attracted $18 million in two hours after sharing its latest offering dubbed Milady wif hat.

The idea is inspired by the viral meme play Dogwifhat (WIF), which earlier this month grossed a market cap of $3.2 billion.

Sustained interest in Solana’s ecosystem has also benefitted the SOL token. In the last week, SOL increased over 35% above $200, less than 25% off its previous all-time high of $259, achieved in November 2021.

This article first appeared at crypto.news