Solana’s (SOL) price witnessed significant declines over the past week after registering consistent gains in December.

SOL is down by 4.5% in the past 24 hours and is trading at $90.7 at the time of writing. The asset’s market cap fell to $39.2 billion, creating a $6 billion gap with the fourth-largest cryptocurrency, BNB.

However, Solana’s daily trading volume recorded a 39% surge, reaching $2.9 billion.

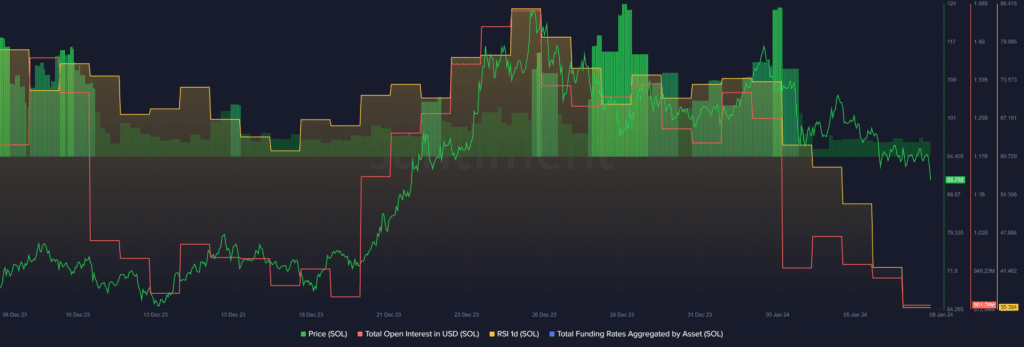

According to data provided by Santiment, the Solana Relative Strength Index (RSI) is currently hovering around the 35 mark. Per the data provider, the asset’s RSI has been constantly falling over the past week — SOL’s RSI was 73 on Jan. 2.

This indicator shows that Solana could face a notable rally as there is less selling pressure than when the asset was trading at around $110 last week.

Solana’s RSI would need to stay below the 50 mark to record a price rally.

Moreover, data from Santiment shows that the total open interest (OI) in SOL declined from $1.3 billion on Jan. 1 to roughly $880 million at the reporting time.

The total funding rates aggregated by Solana is currently standing at 0.008% — recording a 90% drop over the past seven days. This shows that long-position holders have a slight dominance over short-position holders until further movements.

The declining OI suggests that investors have either faced strong liquidations or closed their trading positions with Solana’s decline below the $100 mark.

This article first appeared at crypto.news