Key Takeaways

- Solana is almost 70% short of its November 2021 all-time high.

- Now, the Layer 1 token appears to sit in oversold territory.

- Slicing through the $88 resistance could result in an upswing to $120.

Share this article

Solana has not recovered the lost ground from its peak despite the bullish momentum seen in other Layer 1 tokens. Still, the technicals forecast that SOL’s trend could soon reverse to the upside.

Solana Prepares to Recover

Solana could finally be ready for an upward move.

The Layer 1 token is currently in a downward spiral, but several technical indicators suggest its trend might be improving.

After declining from its Nov. 6 peak, SOL is almost 70% short of its all-time high. That’s a stark contrast to other Layer 1 tokens such as Terra’s LUNA, which has shaken off rocky market conditions and broke a new all-time high Wednesday. SOL, meanwhile, is lagging. Still, there are a few reasons to believe that Solana’s corrective phase could soon reach exhaustion.

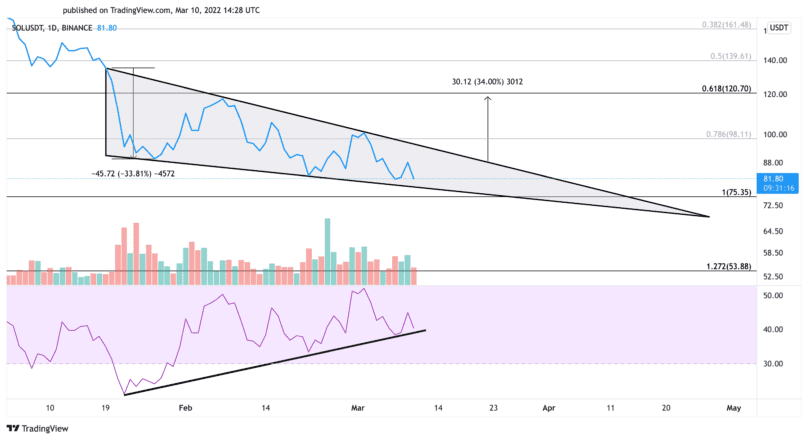

SOL’s price appears to be forming a bullish divergence against the Relative Strength Index on its daily chart. While it continues to make a series of lower lows, the RSI has been making a series of higher highs. Such market behavior indicates rising upward momentum, hinting that a break from oversold territory could be near.

Moreover, the recent downward price action appears to have led to the formation of a falling wedge on Solana’s daily chart. As SOL moves closer to the pattern’s apex, it could be preparing to break through resistance. A decisive close below the wedge’s upper trendline could result in a 34% upswing toward $120.

Given Solana’s poor performance over the past few months, it remains to be seen whether it will be able to gain the strength it needs to breakout. Breaching the $75 support level could show further signs of weakness, encouraging market participants to exit their positions. A spike in sell orders could invalidate the optimistic outlook and result in a steep correction to $54.

Disclosure: At the time of writing, the author of this piece owned BTC and ETH.

Share this article

This article first appeared at Crypto Briefing