The global crypto market built on the recovery push from two weeks back, recouping an additional $100 billion to close the week at $2.2 trillion.

Bitcoin (BTC) led the charge, as it briefly reclaimed the $64,000 territory. The bullish momentum led to substantial gains for most altcoins.

Here are some of the most noteworthy performers from last week:

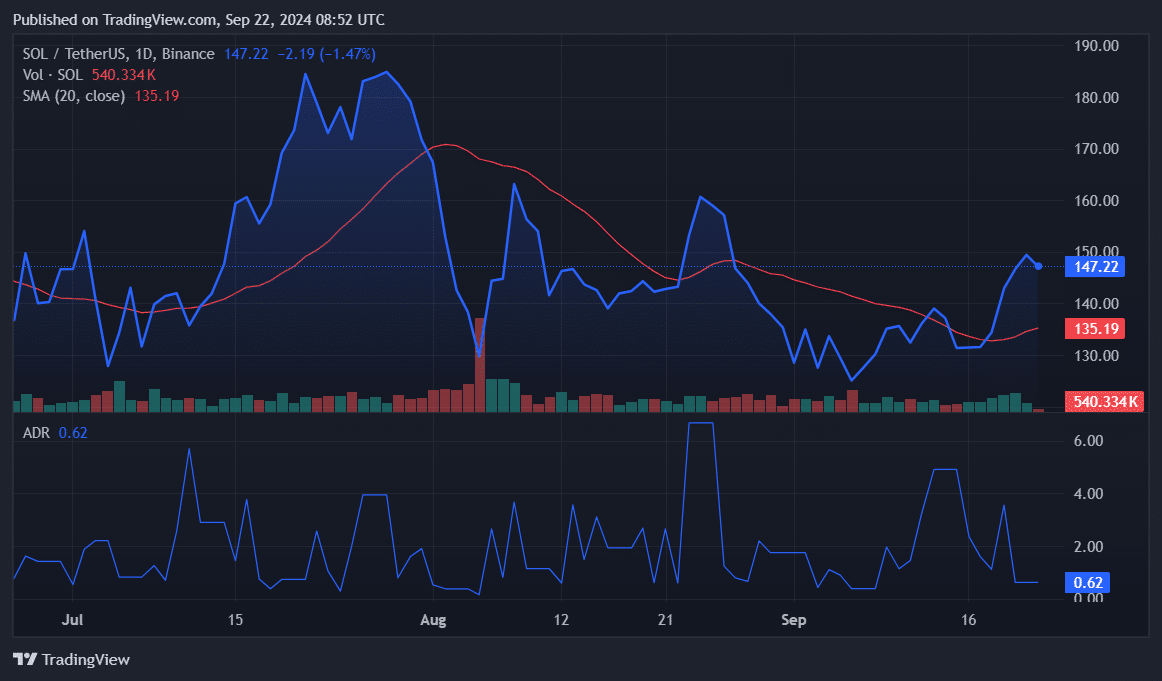

Solana breaches 20-day SMA

Solana (SOL) experienced a sharp 4.21% decline at the start of the week. However, following a period of consolidation, it rebounded strongly, spiking 13.01% from Sept. 18 to 21.

This was largely due to the crypto market’s positive reaction to the Federal Reserve’s 50 basis point rate cut, coinciding with the unveiling of Solana’s new phone — Solana Seeker.

Solana ended the week with an 8.76% gain at $149.41.

The asset broke above the 20-day simple moving average, or SMA, on Sept. 19. It has remained above it since. However, volume has declined since a 4.493 million SOL peak on Sept. 20. This indicates that the rally may be losing steam.

If the volume remains low, it could suggest weakening buying interest, which might lead to a reversal. Key areas to watch this week are the support around $135 (the 20-day SMA) and resistance near $150.

Solana was created by Anatoly Yakovenko, a former Qualcomm engineer. He founded Solana Labs in 2017, along with co-founder and fellow Qualcomm colleague Greg Fitzgerald.

Raj Gokal and a team of developers also helped launch Solana’s blockchain in March 2020.

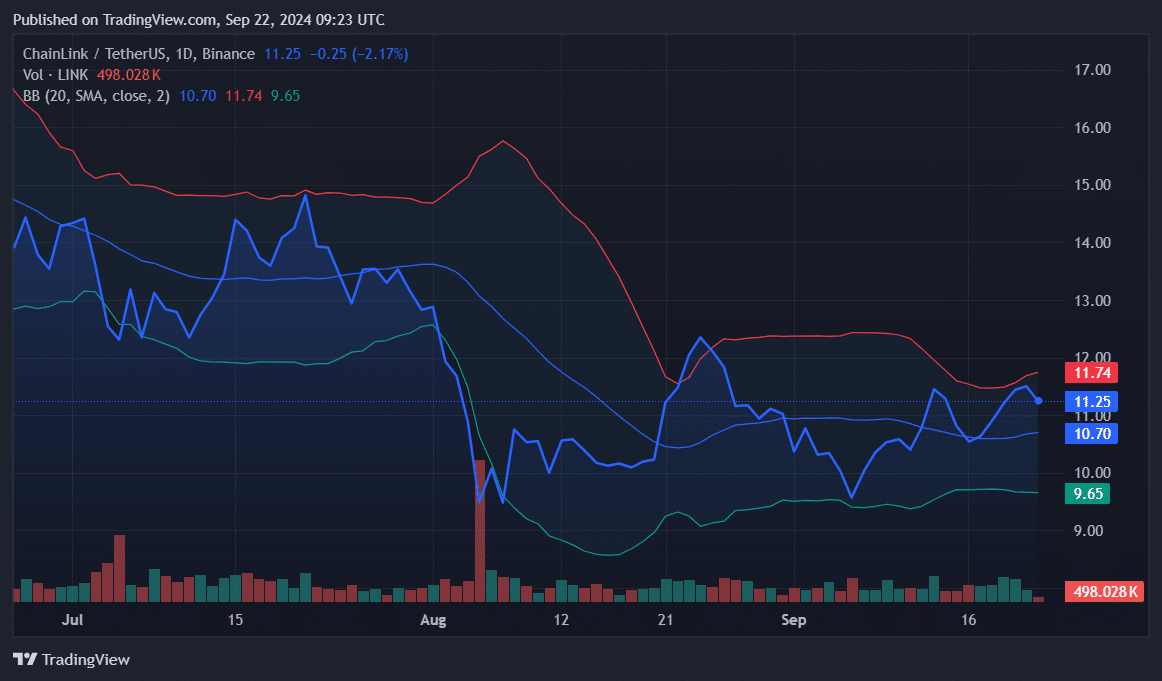

Chainlink targets $12

Chainlink (LINK) started the week by dipping with the broader market, but quickly recovered to hit a monthly high of $11.74 on Sept. 20.

LINK saw a slight pullback from this week, but managed to close with a modest 1.76% gain. The token was one of the underperformers of the week despite a partnership with Fireblocks for stablecoin issuance.

Currently, LINK trades above the middle Bollinger Band ($10.70) and is close to retesting the upper band ($11.74). A breach of the resistance at the upper band could grant the bulls enough strength to reclaim $12.

This week, traders should watch for a breakout above $11.74, which could signal a further upward move. However, a drop below the middle band at $10.70 would bring the support at the lower band ($9.65) into play.

Sergey Nazarov and Steve Ellis created Chainlink in 2017. The crypto was originally envisioned as a decentralized oracle network that connects smart contracts with real-world data.

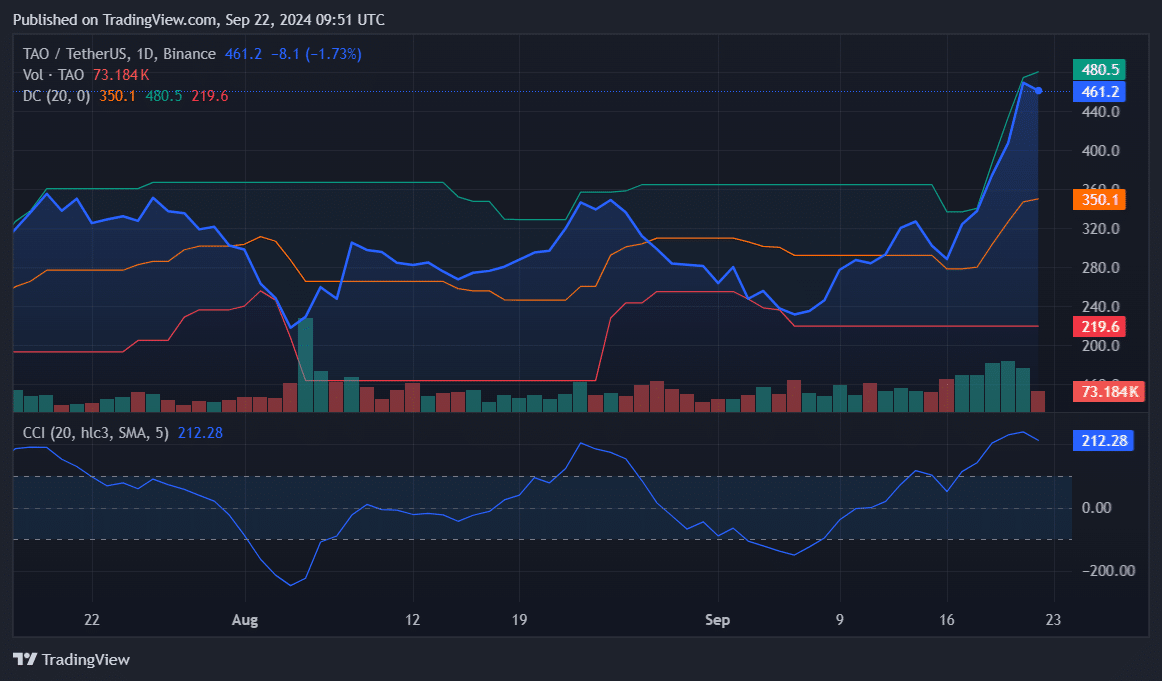

Bittensor rallies 43%

Bittensor (TAO) emerged as one of the top gainers last week. The decentralized, open-source protocol surged by 43%.

The rally pushed TAO to retest $480 for the first time since May, although it faced resistance at this level. Despite a slight drop, TAO is trading at a four-month high.

In the Donchian Channels, TAO is above the basis line ($350.1) and lower line ($219.6) but just shy of breaking the upper line ($480.5) This suggests that while bullish momentum is strong, further gains may be limited unless TAO breaches $480.5.

Additionally, the Commodity Channel Index has surged to 212.28, its highest since January, indicating that TAO may be overbought. This could lead to a short-term pullback unless strong buying pressure continues.

Bittensor aims to create a marketplace for artificial intelligence (AI) and machine learning models. The platform, created by Shen-Juan Ting and Kei Kreutler, is designed to allow AI models to interact, share data and incentivize through TAO tokens.

This article first appeared at crypto.news