Disclosure: The views and opinions expressed here belong solely to the author and do not represent the views and opinions of crypto.news’ editorial.

Memes have come a long way, from niche internet jokes to full-blown speculative trading instruments. Now, with Goatseus Maximus (GOAT), we even have the first AI agent millionaire. While I had initially written off meme coins as gambling chips at the crypto casino, it takes foresight to see what they truly signify. Murad Mahmudov’s presentation at TOKEN2049 in Singapore opened my eyes.

From Dogecoin (DOGE) or Shiba Inu (SHIB) to Bonk (BONK) or Pepe (PEPE), crypto memes are rallying points in today’s hyper-digital world. They provide folks with a shared language and identity—the assurance of belonging—where legacy institutions and market structures are failing them. Murad says we’re in a ‘meme coin supercycle,’ and tribal loyalty and community sentiments drive markets more than utility. I think he’s totally on point—the signs are everywhere, in the trenches and also outside.

As an OG, I’ve had to question whether or not traditional business advice is mostly useless in web3. The ‘token is the product’ here. So innovators and devs might be wise to focus on building based tribes and tight-knit communities, not just some abstract underlying utility.

Neither more infra nor more apps

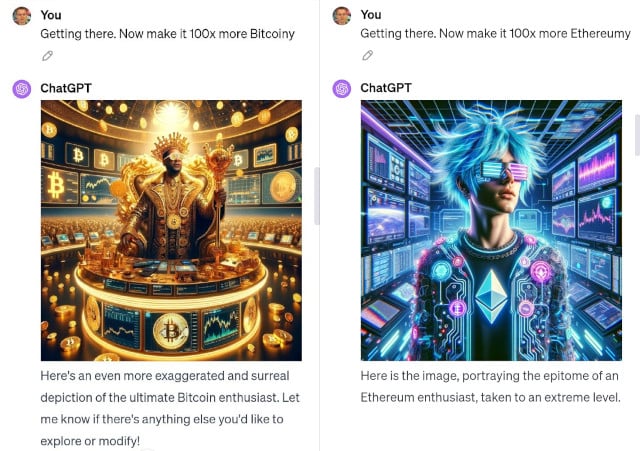

Starting with Bitcoin (BTC) and Ethereum (ETH), a culture of anarchy together with cutting-edge tech defined crypto’s value proposition. It came with the promise of a decentralized and trustless world built around individual autonomy. But more than fifteen years later, crypto-tech hasn’t quite fulfilled its promises … yet.

While more infra and more apps might increase the coolness of blockchain and crypto, what it truly needs—especially for mass adoption—is more emotional touchpoints and narratives around which people can huddle.

The next billion users don’t care about the tech or which big-shot VC is investing in the next shiny object. They care about having fun with a community of like-minded people. The ‘public good’ or social impact projects created downstream from here—are the cherry on top.

Take DOGE, the OG crypto meme coin, for example. It was born with satirical intent and no groundbreaking tech or VC funding to back it up. I was in the room at the Ethereum Foundation in Zug when DOGE was launched. It was an intentional joke; tech bros said, “Let’s not take ourselves too seriously.” Yet it now has over 6.9 millionholders, and the community is using its money to fund water wells in Kenya. That’s what you call bottom-up utility creation.

Rather than deep-pocket investors dumping ‘use-cases’ and overvalued coins on retail, meme coins foster genuinely decentralized community formation. That’s the core strength and beauty of meme coins.

Speculation aside, they incentivize geographically, culturally, and ideologically discreet people to form groups around a shared idea—mostly a fun, humorous one. And because there’s typically no ulterior, long-term end in sight, memecoin communities come together for the community’s sake.

Vibing in a disconnected world

Tribalism isn’t new in crypto. Bitcoin maximalism or Ethereum loyalty, for example, is nothing short of quasi-religious sentiments. The Genesis Block is a holy symbol enshrined in mathematics, game theory, and mythology.

This begs the question—why are meme coins booming now? The short and lazy answer would be that crypto works in cycles, and now is the time for meme coins. All of them will go to zero once the hype passes. But no.

The world is becoming increasingly distraught, and younger generations are having a hard time making sense of it. There’s an utter lack of meaning—and disillusionment—as established institutions either crumble or betray their dark, anti-individual underbelly.

Memes are the antidote to such banality, not just in crypto but everywhere. Even the US presidential elections were largely being fought on memetic identities like ‘Kamala is Brat’ or ‘Bro Vote’ more than hardcore policy, performance, or ideology.

Earlier Brexit saw sharp divisions into ‘Leave’ and ‘Remain’ camps, with tribal language like “Remoaner” and “Brextremist” characterizing polarized conversations across the board. Although a negative manifestation, this shows how integral tribalism is to modern times and culture.

Meme coins are great because they channel this rising demand for belongingness and connection into something positive and monetizable. Thousands vibed with the ‘Goatse Gospel,’ and many more will do so without caring if LLMs can make typos or not.

Popcat (POPCAT), the Solana-based meme coin, is another example of fun vibes and community traction erasing the need for technical promises. Bonk thrived on similar lines to become the ‘social layer’ of Solana.

Overall, the meme coin supercycle underlines a reality where identity is the new utility. No matter what right-curve narrative or gigabrain tech innovations projects subscribe to, a community-first approach will separate winners from losers.

Without a based community, even the best tech would find its place in the dumpster. Whereas even the most mundane, uninteresting tech can go to the moon with active, loyal community support. Intrinsic value has acquired a new form altogether.

Younger consumers give as much importance to fun, identity, and emotional connection as functionalities. Web3 projects, like everything else, must pass the vibe check. Builders—mainly those with web2 backgrounds—must rewire themselves to build tribes, not mere tools.

AI might not take your job, but failing to serve the demands of the time surely will. The lesson is simple: community is currency, and identity is the ultimate asset.

This article first appeared at crypto.news