The price of Shiba Inu has made a recovery days after it hit a near-term low.

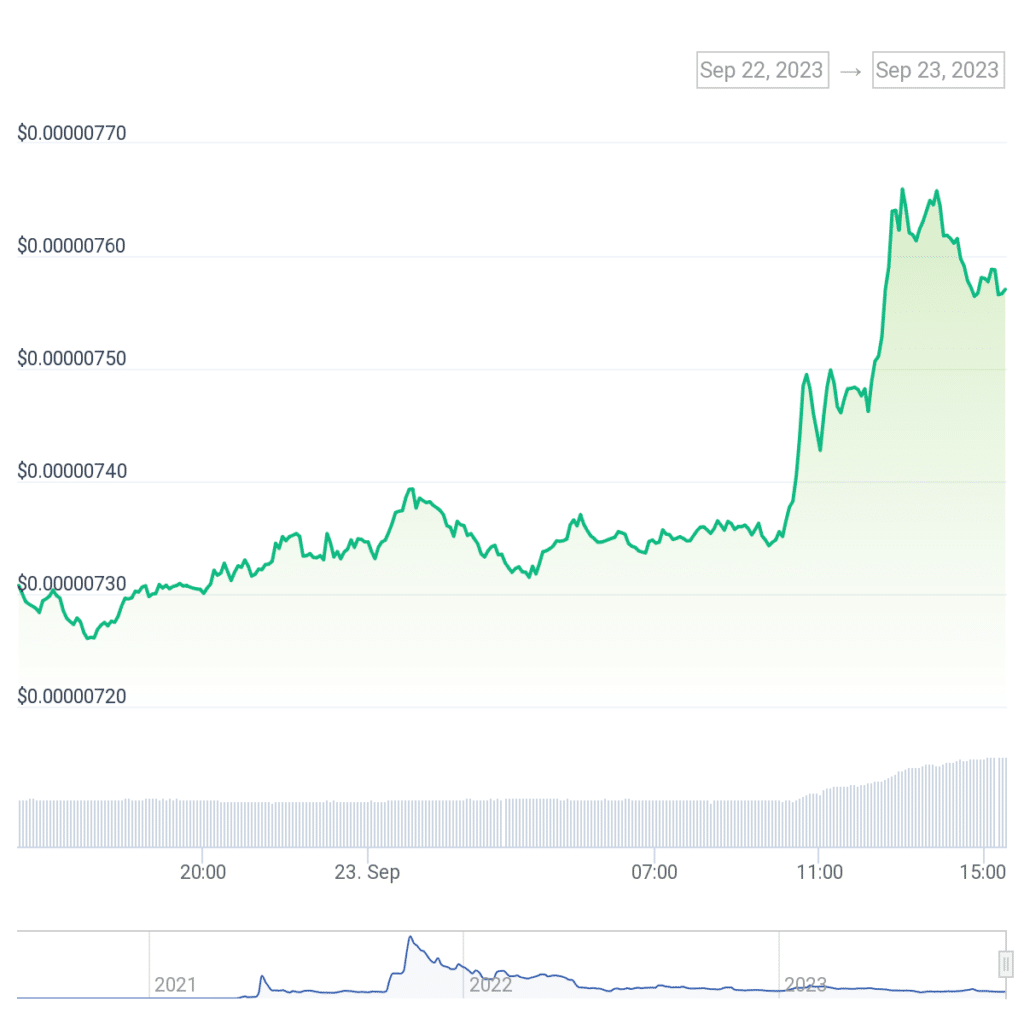

Shiba Inu (SHIB), the meme coin with the second-largest market capitalization, has shrugged off the bearish grip that had held it in the last few days, culminating in a near-term low of $0.000007195 on Sept. 21.

At the time of writing, SHIB had witnessed robust buying activity, with data from CoinMarketCap indicating a figure of $123,205,529. It was a near-80% improvement from the previous 24 hours and played a significant role in pushing up the SHIB price by at least 3.6% to $0.00000757.

According to analysts, this current price is head and shoulders above SHIB’s exponential moving average (EMA) 100 trend line, which signifies it is breaking out of the previous bearish pattern.

According to blockchain tracker and analytics platform Whale Alert, Shiba Inu’s improved trading volumes were primarily achieved on the back of significant whale activity.

On Sept. 22, Whale Alert signaled that nearly 4.6 trillion SHIB tokens valued at approximately $33.38 million were moved from a wallet belonging to Amsterdam-based crypto exchange Bitvavo to an unknown wallet.

Further, data from Coinglass indicates a notable increase in short liquidation of SHIB, with as much as $110,000 worth of positions liquidated on Sept. 23.

Despite the excitement surrounding Shiba Inu’s layer-2 network Shibarium, the meme coin has been increasingly bearish. Its volatility rate has remained steady at 33.5%, suggesting additional price swings may not be in the offing, which could be good news for sellers.

The meme coin market has had a mixed few days, with tokens like HarryPotterObamaSonicInu (BITCOIN) and Bad Idea AI (BAD) gaining 5.9% and 9.5%, respectively on their previous prices, while more established coins such as Pepe (PEPE) and Floki (FLOKI), and Baby Doge Coin (BABYDOGE) losing anywhere between 1.2% and 5.2% of their values.

This article first appeared at crypto.news