The U.S. Securities and Exchange Commission (SEC) has expressed a lack of opposition to postponing the Terraform co-founder Do Kwon’s crypto fraud trial and, instead, is open to waiting until he is extradited.

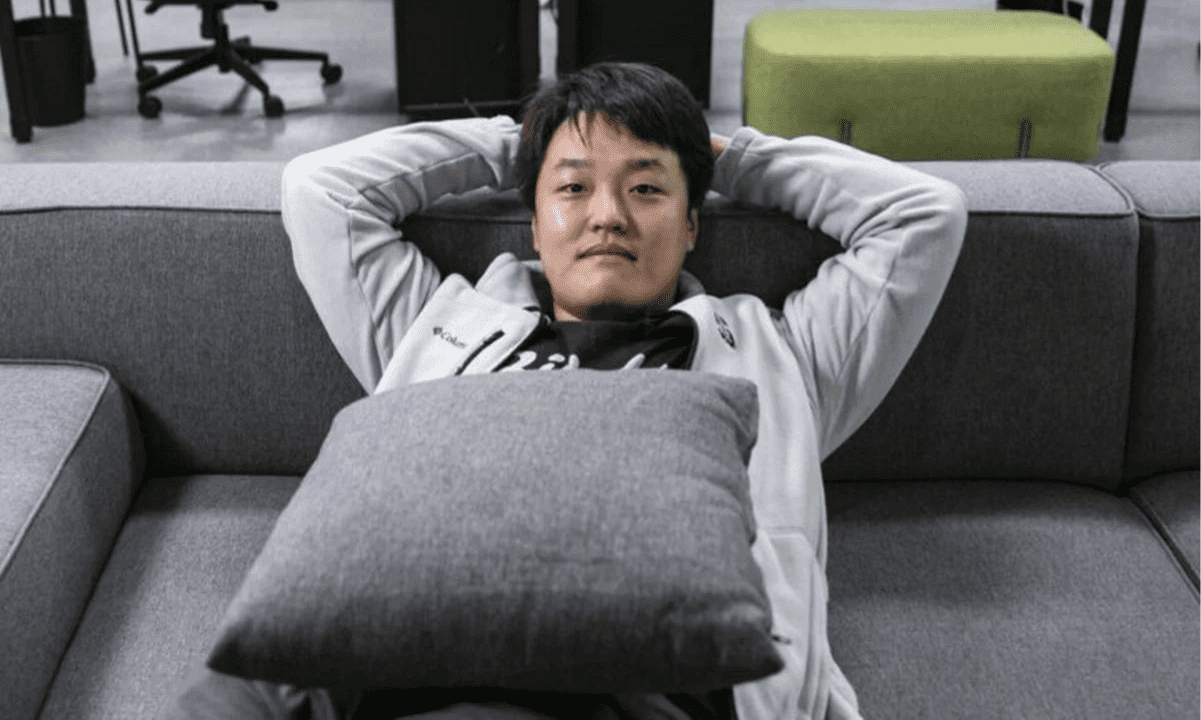

Two court filings were submitted by federal prosecutors, outlining the case against Kwon and Terraform Labs concerning the $40 billion collapse of TerraLuna (LUNC) and TerraUSD (UST) in May 2022.

SEC Consents to Delay in Terraform Case

The SEC has consented to a “modest adjournment” of the Terraform case until April 15, allowing for ongoing extradition proceedings for Kwon in Montenegro.

In a letter to Judge Jed Rakoff on January 11, Kwon’s legal team requested a delay in the January trial until he could participate in his defense in person. They cited the slower-than-expected progress of the extradition proceedings, initiated after Kwon’s detention in Montenegro.

While the SEC agreed to postpone the trial potentially, it opposed separating Kwon’s case from Terraform’s. Both were named defendants when the agency filed charges in February 2023, alleging their involvement in a “multi-billion dollar crypto asset securities fraud” related to the formerly TerraUSD (UST) and LUNA tokens.

The SEC argued that it would unnecessarily require witnesses, including agency whistleblowers and retail investors with limited financial means, to testify twice about identical facts in different trials.

Do Kwon’s Troubles Are Far From Over

The former tech billionaire has reportedly filed another appeal to overturn a Montenegro High Court ruling that upheld extradition requests from his native South Korea and the United States, where he faces charges.

His attorneys argue that the High Court’s decision disregarded a bilateral extradition treaty with the U.S. and the European Convention on Extradition. Despite winning an appeal against extradition requests in November, the High Court in Podgorica, where he was arrested, reinstated its ruling in December.

Kwon and Terraform were accused of deceiving users and investors about the stability of UST, an algorithmic stablecoin pegged to the U.S. dollar. The failure of UST to maintain its promised $1 price resulted in a collapse within Terra’s ecosystem. This crash had major effects, leading to bankruptcies and marking the beginning of the crypto winter of 2022.

In a recent ruling, Judge Jed Rakoff determined that Terraform and Kwon violated U.S. law by not registering TerraUSD and Luna. Kwon also faces related criminal charges in the U.S. and an extradition request from South Korea.

This article first appeared at CryptoPotato