The U.S. Securities and Exchange Commission (SEC) has filed charges against NovaTech Ltd. and its principals, Cynthia and Eddy Petion, for allegedly organizing a crypto fraud that defrauded over 200,000 investors worldwide, including many within the Haitian-American community.

The SEC’s complaint details that NovaTech, under the leadership of the Petions, was promoted as a multi-level marketing (MLM) and crypto asset investment program.

$650 Million Crypto Ponzi Scheme

According to an August 12 press release, the SEC accuses the Petions of running a fraudulent scheme that raised more than $650 million in crypto assets between 2019 and 2023.

Investors were led to believe that their funds would be safely invested in cryptocurrency and foreign exchange markets, with Cynthia Petion reassuring them that their capital would yield profits from day one.

However, instead of investing most of the funds as promised, the SEC claims that NovaTech used investor money to pay existing investors and cover commissions for promoters, classic characteristics of a Ponzi scheme.

A huge portion of the funds was also allegedly siphoned off by the Petions for personal use. As the scheme began to unravel, most investors found themselves unable to withdraw their funds, resulting in significant financial losses.

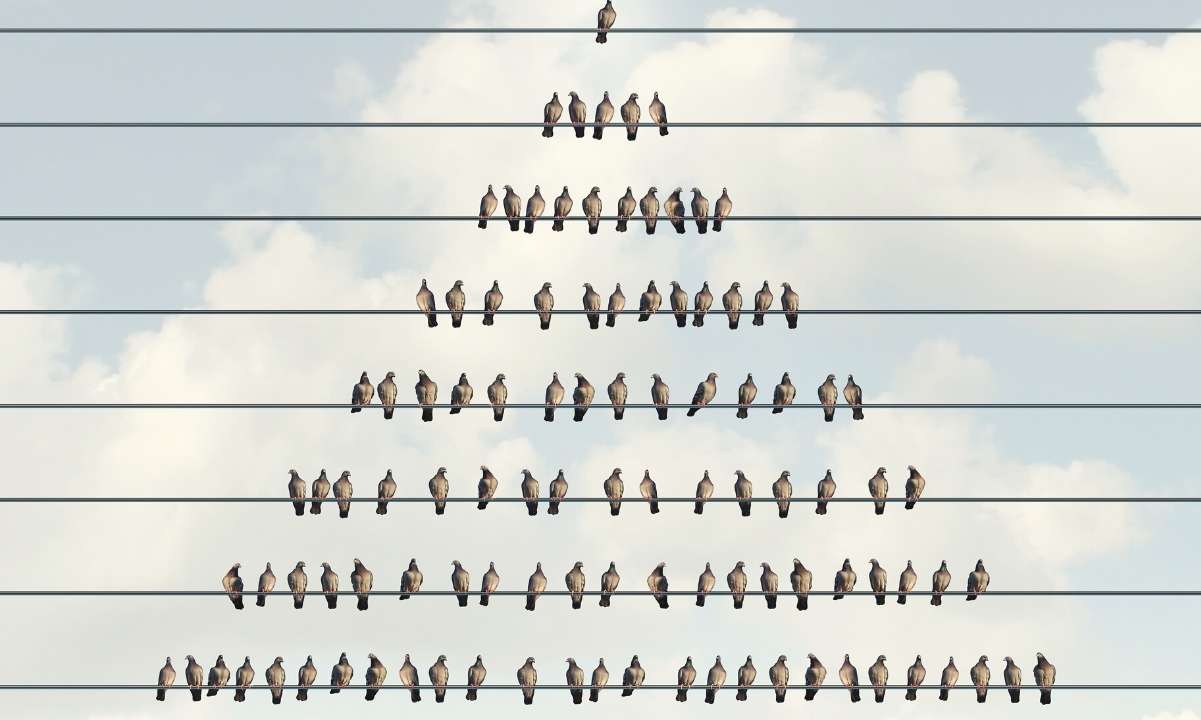

Eric Werner, Director of the SEC’s Fort Worth Regional Office, stated that NovaTech and the Petions caused significant losses to tens of thousands of victims globally. He emphasized that large MLM schemes rely on promoters to thrive and asserted that the SEC will hold accountable not only the primary architects of such schemes but also the promoters who unlawfully solicit victims.

SEC Charges Six NovaTech Promoters

The SEC has also charged six top NovaTech promoters—Martin Zizi, Dapilinu Dunbar, James Corbett, Corrie Sampson, John Garofano, and Marsha Hadley. They are accused of recruiting a broad network of investors while downplaying critical red flags regarding the company’s operations.

These red flags included regulatory actions taken against NovaTech by U.S. and Canadian authorities, which the promoters allegedly ignored while continuing to solicit new investments.

The SEC’s complaint seeks permanent injunctive relief, the disgorgement of ill-gotten gains, and civil penalties against all defendants. Meanwhile, Zizi has agreed to a partial settlement of the SEC’s charges but hasn’t admitted or denied the allegations.

Zizi consented to a $100,000 civil penalty and agreed to be permanently enjoined from future violations of the charged provisions. Pending court approval, the final determination of other monetary remedies against Zizi will be decided at a later date.

This article first appeared at CryptoPotato