Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

As 2025 unfolds, Real-World Assets are emerging as a key investment opportunity in the crypto space, with stUSDT leading the charge as a secure, high-yield option for investors.

After a year of steady groundwork in 2024, many crypto institutions and KOLs are expecting to see web3 investors showered with a cascade of investment opportunities in 2025. Against this backdrop, real-world assets (RWAs) are billed as the next big thing in the web3 landscape.

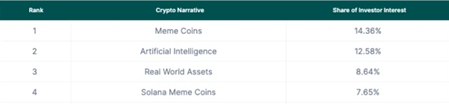

According to CoinGecko, memecoins, AI, and RWAs are the top three most popular crypto narratives among investors in 2024. Meme coins, which thrive on marketing hype, remain more of a side dish on the broader investment menu, while AI, a promising main course, still requires the right touch in technological breakthroughs before it can truly take off. In contrast, only RWAs have emerged as a ready-to-serve option after years of refinement. Some even argue that RWAs herald a new chapter of DeFi narratives.

From an investment perspective, RWAs have been around for over eight years since their inception in 2017 or so, steadily winning over investors thanks to their proven value and market potential. Research reports from Citibank, BlackRock, JPMorgan, and more predict that the RWA market could scale to tens of trillions of dollars over the next decade.

Goldman Sachs has taken this optimism further by planning to launch a crypto trading platform focusing on tokenization in the next 12 to 18 months. On the other hand, the blockchain sector has paved the way for RWAs to achieve mass adoption: a range of Ethereum Layer 2 solutions, alongside high-performance networks like Solana and TRON, have made substantial headway in building the foundation for large-scale tokenization.

As for crypto policies, optimism is high that the next U.S. administration, following Donald Trump’s return to office, will adopt a more open and supportive approach to the crypto sector. Other governments will likely follow suit, pivoting from previous stances to embrace this rapidly evolving industry.

When investors first hear about RWAs, they often think of Ondo, a star player among tokenized U.S. Treasuries. However, there’s another “small but mighty” contender worth noticing: stUSDT. By staking USDT, users receive stUSDT, and the USDT staked in the stUSDT-RWA Contract then flows into real-world investments such as high-grade short-term government bonds. As the first rebase RWA platform on the TRON network, stUSDT has been dubbed the web3 equivalent of Yu’E Bao, China’s largest money market fund.

Investors may stake USDT in the stUSDT-RWA Contract to get stUSDT, which complies with both the TRC-20 and ERC-20 standards, and the staking rewards are distributed in stUSDT via a daily rebase. Users seeking the same yields but a broader DeFi compatibility can deposit their stUSDT into the Wrapper contract to get wstUSDT, which, unlike stUSDT, doesn’t operate via the rebase mechanism, keeping its balance unchanged. However, the value of each wstUSDT grows over time as it accumulates underlying rewards, eventually surpassing the value of one stUSDT.

Official data shows that since its launch in July 2023, stUSDT has generated $58.6 million in solid returns for more than 353,000 investors. On top of this, ChainSecurity has completed a thorough security audit of the stUSDT smart contract, and the resulting audit report and whitepaper confirm that no critical or high-risk vulnerabilities were detected. This combination of steady yields and robust security makes stUSDT a go-to choice for those seeking low-profile yet lucrative investment options.

Meanwhile, early January 2025 witnessed another milestone in the TRON ecosystem: the USDD 2.0 Beta release. This upgraded version boasts a more decentralized and flexible minting mechanism, earning widespread praise from investors. As a result, growing interest in the TRON network could very well channel fresh attention toward stUSDT.

Disclosure: This content is provided by a third party. crypto.news does not endorse any product mentioned on this page. Users must do their own research before taking any actions related to the company.

This article first appeared at crypto.news