American crypto exchange Coinbase appears to be losing traction in global trading volume amid fierce competition sparked by the launch of spot Bitcoin ETFs in the U.S.

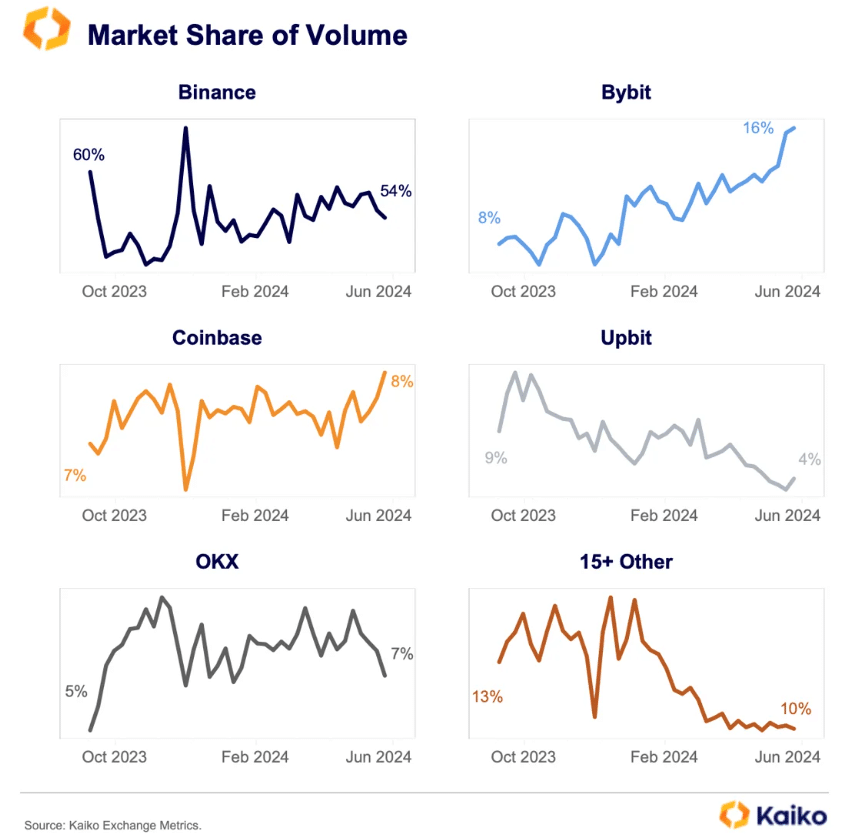

Crypto exchange Coinbase is no longer the second largest brand in terms of global trading volume, according to data compiled by blockchain analytics firm Kaiko. Since October 2023, Coinbase has seen its market share drop from 11% to 8% while rival Bybit now accounts for about 16% of global trading volume.

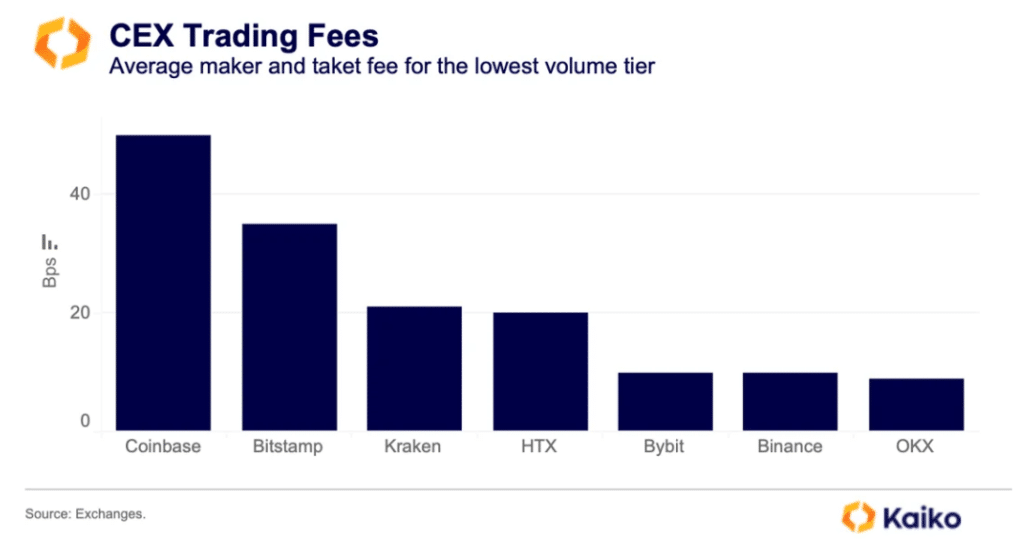

Kaiko notes that Bybit’s efforts to capture trading volumes by lowering its trading fees has translated to market share growth. Kaiko highlights that lower costs was “not the only reason for its rise,” implying that the exchange “benefited from Binance’s regulatory troubles.”

“Analyzing spot trade volumes by asset reveals that the increase in volume on Bybit has been driven by both BTC and ETH, whose market share has risen from 17% to 53% since last year,” analysts at Kaiko say.

For comparison, Binance has seen a “stronger increase in altcoin volume,” the firm said, adding that even though the exchange still holds the first place in terms of market share (54%), its share of Bitcoin and Ethereum originated volume “has declined to 43% this year from 59% a year ago.” Kaiko suggests the change might be driven by “swings in risk sentiment and tends to decline more during bear markets.”

Despite Bybit’s progress, Wall Street seems to be distancing itself from the exchange. In late May, reports emerged that Citadel Securities-backed prime brokerage firm Hidden Road stopped offering its clients access to Bybit due to a disagreement over the exchange’s KYC/AML procedures. Bybit has not publicly addressed the matter, but a spokesperson for the exchange said the platform is “committed to transparency and will provide further updates as the review progresses.”

This article first appeared at crypto.news