Raydium jumped 65% over the past week, making it the top gainer among the 100 largest cryptocurrencies.

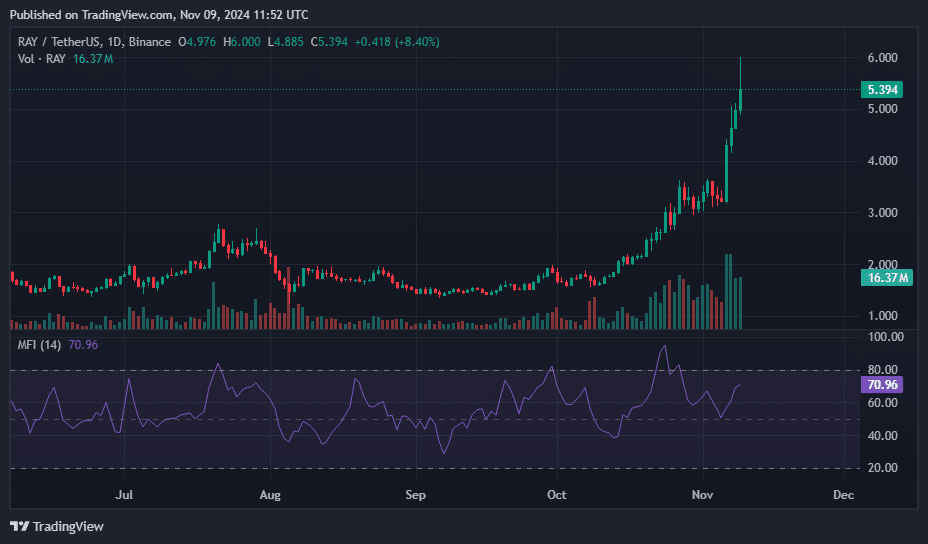

Raydium (RAY), the largest decentralized exchange on the Solana Blockchain rose for four consecutive days, to reach a 34-month high of $5.97 on Nov. 9.

The altcoin has been the top-performing asset over the past month, with gains exceeding 262%, pushing its market cap above $1.51 billion and delivering substantial returns for holders. One trader reported making over 28.5x since July 2023.

Raydium’s rally came as crypto exchange Coinbase announced that it will add RAY perpetual futures on its Coinbase International Exchange and Coinbase Advanced platforms, scheduled to launch next week on Nov. 14.

Typically, a listing announcement on a tier-1 exchange such as Coinbase reignites significant interest among traders and leads to price appreciation for the related token in the following days.

The altcoin price surge aligns with its growing presence within the Solana ecosystem, where the protocol has averaged daily fees between $2 million and $3.5 million since mid-October.

Raydium jumps ahead of Uniswap, Solana and Tron

Raydium is currently ahead of several popular blockchain platforms, surpassing Uniswap, Solana, and Tron in daily earnings, and ranking just behind giants like Ethereum, Tether, and Circle, per data from DeFi Llama.

Further, Raydium’s share of global DEX volume jumped over 130% quarter-over-quarter to surpass 10%, making it the third-largest DEX by volume in Q3, just behind PancakeSwap and Uniswap, and overtaking Orca, per a Messari report.

All the recent bullish developments surrounding RAY and the rising interest from the crypto community have propelled it to become a top-trending altcoin on CoinGecko.

Community sentiment remains highly favorable, with over 91% of 5,571 traders on CoinMarketCap bullish on the altcoin.

Trend strength remains strong

Riding on monthly gains over 250%, the altcoin’s upward trend shows no signs of slowing, according to market observers.

On the one-day RAY/USDT price chart, the Moving Average Convergence Divergence indicator shows a widening gap between the MACD line and the signal line, indicating that the trend strength remains strong.

The Average Direction Index at 60 further confirms the continuation of the trend.

Meanwhile, the Money Flow Index, which tracks buying and selling activity, shows strong buying pressure is still in play, while the altcoin’s weighted funding rate has moved higher into the positive zone, indicating increased demand from leveraged long positions and reinforcing the bullish sentiment.

With strong technical indicators backing the rally, analysts are increasingly optimistic about the altcoin’s potential to reach double-digit prices.

In a Nov. 9 X post, Analyst World Of Charts noted that RAY has broken out of a symmetrical triangle pattern and has the potential to rally over 150% from current levels.

On a similar note, another analyst pointed out that RAY is in Wave 3, which is usually the strongest phase in an Elliott Wave cycle, hinting that the uptrend still has plenty of room to run, with double-digit prices potentially on the horizon.

At press time, Raydium was exchanging hands at $5.8 still down 66.1% from its all-time high of $16.83 seen on Sep. 12, 2021.

This article first appeared at crypto.news