Raydium recorded a strong rally over the past month, putting it in the overbought zone. But its funding rate shows the possibility of a further hike.

Raydium (RAY) is up 83% over the past month and gained 33% in the last seven days alone. The native token of the Solana-based automated market marker reached a 31-month high of $3.59 earlier today—a level last seen in April 2022.

RAY saw a small drop over the past few hours and is trading at $3.25 at the time of writing. At this point, the token is down by 81% from its all-time high of $16.93 on Sept. 13, 2021.

With a market cap of $858 million, Raydium is currently the 75th-largest digital asset in the market.

Can RAY rally again?

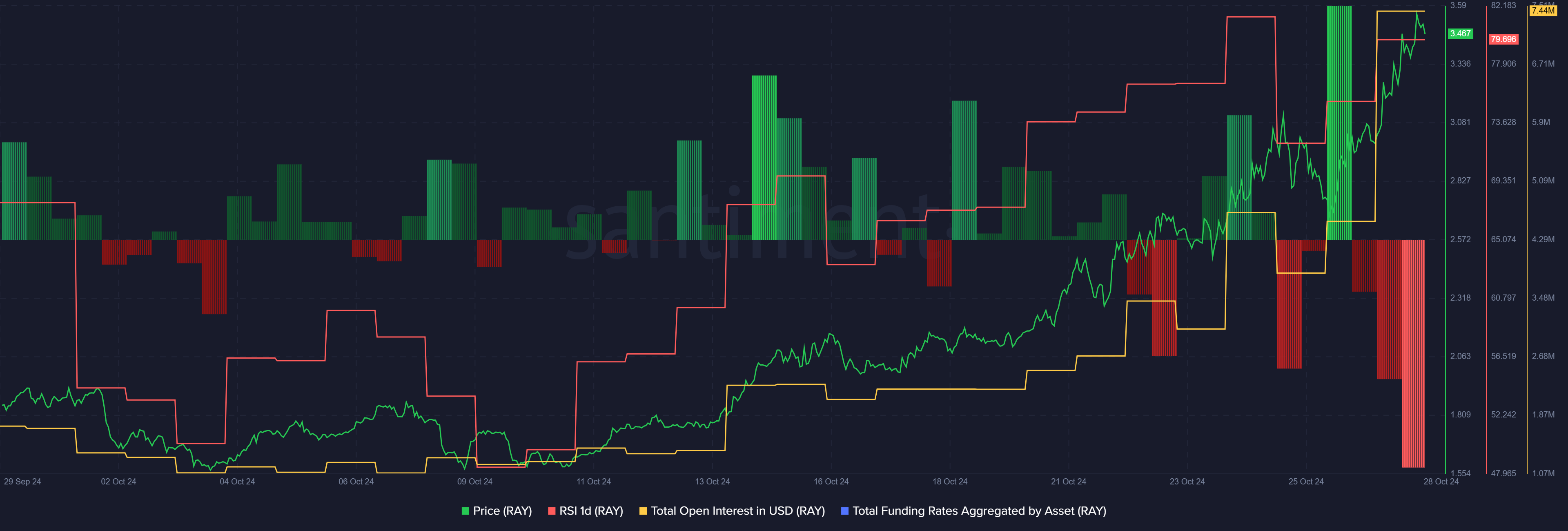

According to data provided by Santiment, Raydium’s Relative Strength Index is sitting close to the 80 mark. The indicator shows that the asset is overbought and potential profit-taking could be on the way.

Raydium’s total open interest, however, increased by 65% over the past day—from $4.5 million to $7.4 million, per Santiment.

A sudden surge in an asset’s open interest usually leads to higher price volatility due to increased liquidations.

RAY’s open interest grew with a wave of traders betting on the token’s price fall. Data from Santiment shows that the total Raydium funding rate shifted from 0.06% on Oct. 26 to -0.06% at the reporting time.

The funding rate shows an increased amount of short trades, dominating RAY’s open interest.

If short RAY liquidations begin to rise, the asset could likely witness another bullish momentum. However, the increasing open interest and RSI hint at high price volatility as the market is still wandering in uncertainty.

This article first appeared at crypto.news