Quant has dropped sharply this month, erasing some of the gains made between November and December last year.

Quant (QNT) price has dropped to $110, down by almost 36% from its highest level in December.

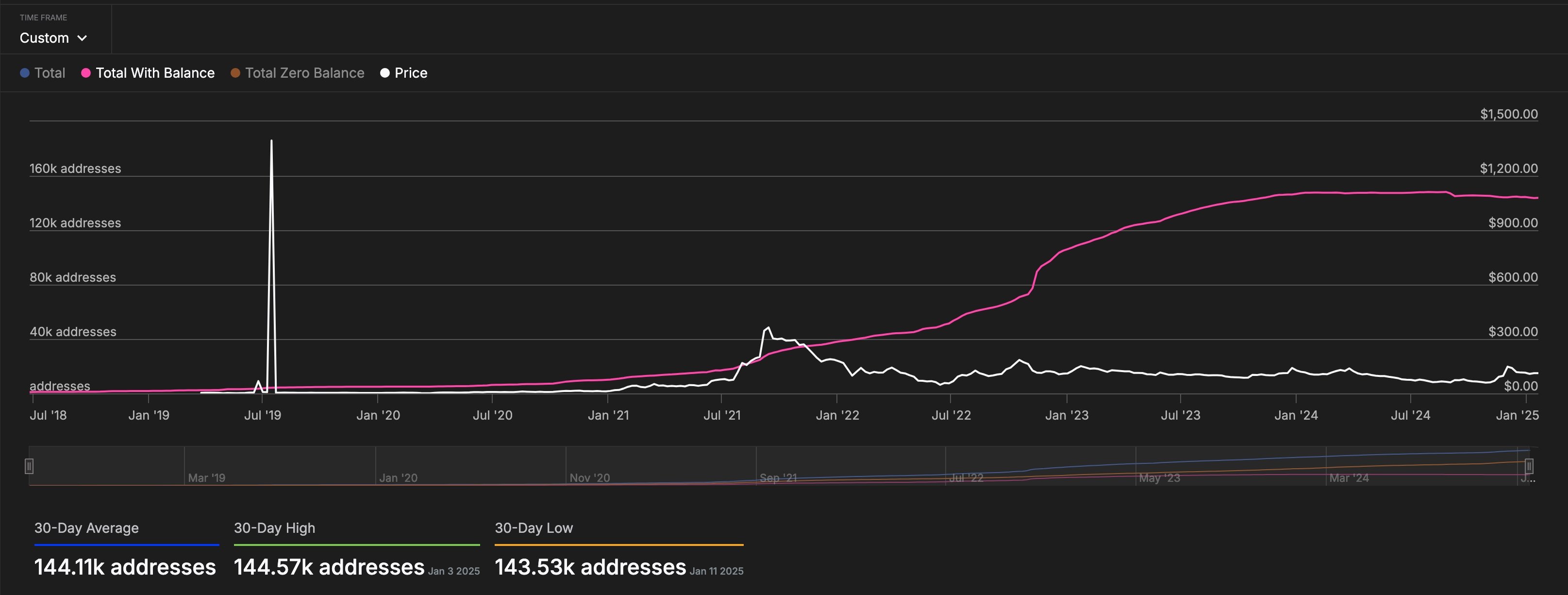

The coin’s decline happened as on-chain data pointed showed that the number of addresses in the network is no longer growing. According to IntoTheBlock, the total addresses with balance has stagnated at 144,000. As shown below, the account growth has been stagnant since January last year.

More data shows that the number of new addresses in the network has dropped to less than 300 a day. This slow growth is likely because many crypto traders have rotated from many traditional coins to newer tokens like Official Trump (TRUMP) and Fartcoin.

Quant is a popular crypto project that provides services in the payment, capital markets, and supply chain solutions. It has become a major player in the Real World Asset or RWA tokenization industry, through its overledger solution.

Overledger is an enterprise-ready solution that lets participants issue interoperable tokenized assets between different blockchains. Analysts believe that RWA will be a big deal in the future as many physical assets are tokenized. For example, McKinsey estimates that the industry will be worth $2 trillion by 2039, positioning Quant and Chainlink (LINK) as key players.

Quant price has formed a risky pattern

The daily chart shows that the QNT price has formed a high-risk chart pattern that could lead to a strong bearish breakdown. It peaked at $171.3 in December and then plunged to $95 this month. It has now been in a consolidation phase, forming a bearish flag pattern. This pattern has a long line followed by a rectangle pattern and is usually followed by a strong bearish breakdown.

Quant price has also dropped below the Ichimoku cloud indicator and the 50-day moving average. The MACD indicator has also moved below the zero line.

Therefore, the QNT price will likely have a bearish breakdown, with the next point to watch being at $80.6, its highest swing in September last year.

This article first appeared at crypto.news