Analysts at QCP Capital believe that BTC’s capitulation to $50,000 will continue its upward trend through to March 2024.

BTC has again broken above the $50,000 level for the first time in over two years, an upward trend some an analysts expect will continue through March 2024.

The move comes from impressive inflows from BTC spot ETFs of around $500-650 million per day, amounting to 10,000-13,000 BTC being purchased daily.

Noting such trends, analysts expect these inflows to continue as global liquidity moves into spot ETFs.

“With the likes of Fidelity announcing a 1-3% cryptocurrency allocation in their All-in-One conservative ETF, the crypto asset class is now front and center for mainstream investors.”

QCP Capital analysts

In addition to spot inflows, there has been massive buying of BTC call options, analysts at QCP Capital points out. This week, about $10 million was spent on insurance premiums for 60,000-80,000 strikes, which expire from April to December.

“On the back of these flows, BTC can easily break all-time highs by the end of March”

QCP Capital analysts

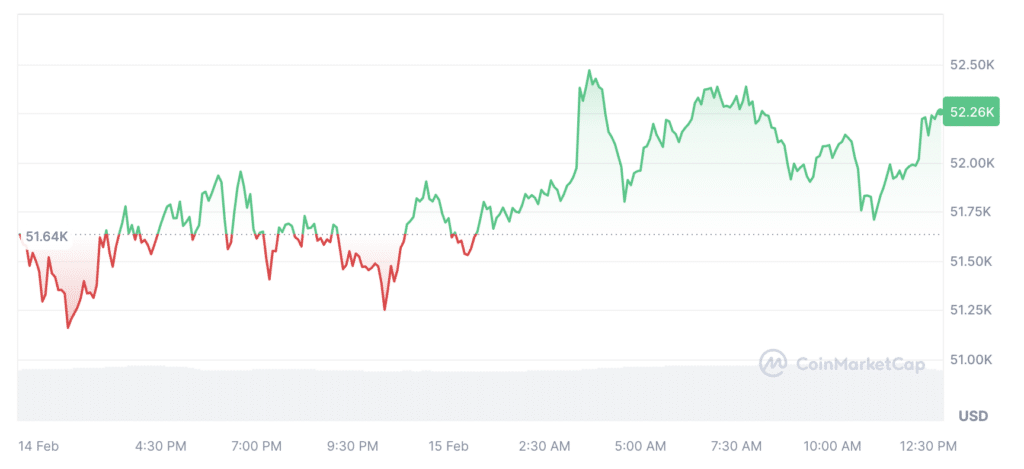

At the beginning of the week, the price of Bitcoin for the first time since December 2021 exceeded the $50,000 mark. BTC then broke through the $52,000 level on Feb. 14, according to CoinMarketCap data.

This article first appeared at crypto.news