Polygon retreated for the first time in 10 days, even after seeing encouraging metrics on its non-fungible token and decentralized finance ecosystem.

DEX volume and NFT sales rise

Polygon (MATIC) retreated to a low of $0.53, down from last week’s high of $0.582. It remains 60% higher than its lowest point this month as the countdown to MATIC’s transition to POL on Sept. 4 continues.

Polygon’s pullback happened after the developers regained control of its X account after a recent hacking incident.

Third-party data shows that Polygon’s ecosystem is doing well. According to CryptoSlam, weekly NFT sales rose by 111% to over $12.7 million. The number of buyers jumped by 35% to 88,000 while sellers rose to 25,000.

Polygon handled 356,700 transactions, while the wash volume fell by 12% to $9.2 million. It was the fourth-biggest player in the NFT market after Ethereum (ETH), Solana (SOL), and Bitcoin (BTC).

Polygon has also done well in the DEX industry, where its volume rose by 7.32% to $770 million. It was the seventh-biggest player after the likes of Ethereum, Solana, and Tron. Some of the most active DEX networks in the ecosystem were Uniswap, Quickswap, Woofi, Dodo, and Retro.

Additionally, Polygon’s total value locked in the DeFi ecosystem has risen by over 10% in the last seven days to $951 million.

Still, the network is seeing substantial competition in the layer-2 industry from the likes of Arbitrum (ARB) and Base, which have accumulated over $2.82 billion and $1.6 billion in assets. Arbitrum has also become one of the most active DEX networks, handling over $3.7 billion in the last seven days.

The next development in Polygon’s ecosystem will be the transition from MATIC to POL, which will introduce new capabilities in the network. It will be used to provide services to any chain in the Polygon network, including AggLayer.

It will also be the native gas and staking token for Polygon’s proof-of-stake network. Polygon could see more volatility towards the POL launch.

Polygon remains above the 50EMA

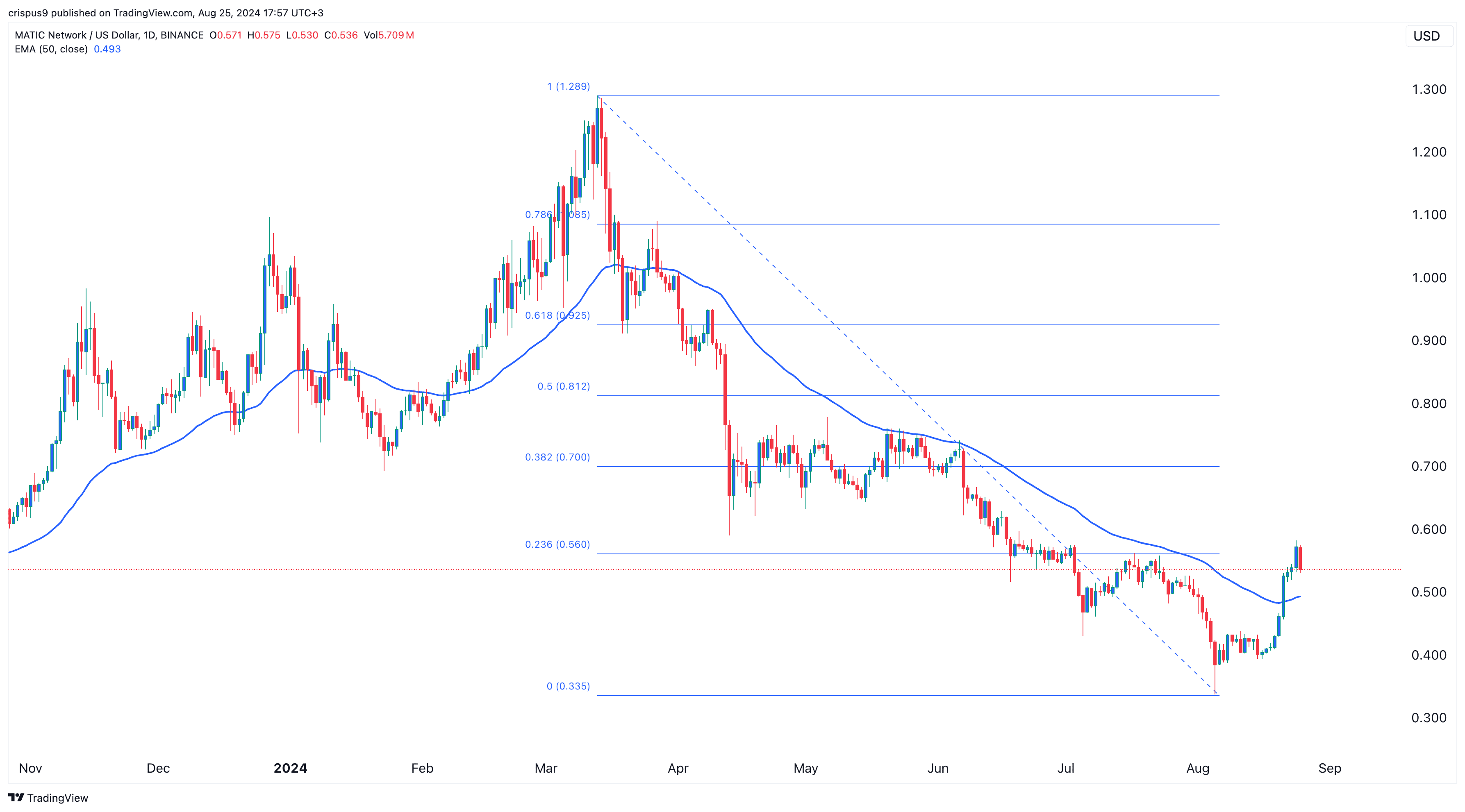

Technically, Polygon has crossed the 50-day moving average and is hovering at the 23.6% Fibonacci Retracement point.

Previously, it failed to move above that retracement point in July this year.

The token has since formed a bearish engulfing candlestick pattern, pointing to a potential pullback, possibly to the 50 EMA level at $0.493.

This article first appeared at crypto.news