Polkadot price has underperformed other major cryptocurrencies like Bitcoin and Solana this year, but one analyst expects it to stage a strong comeback soon.

Polkadot (DOT), has dropped by 65% from its highest point this year, bringing its valuation to $6.2 billion. As a result, it has moved from being a top ten coin to the 16th largest cryptocurrency in the industry.

Polkadot’s performance has mirrored that of Cardano (ADA), one of the biggest ghost chains whose token has fallen by 60% from the year-to-date high.

A likely reason for this price action is that Cardano and Polkadot have been left behind by the likes of Solana, Sui, and Base in terms of development.

A closer look at Polkadot’s ecosystem shows that it is significantly smaller than other chains. For example, Moonwell, which launched on Polkadot in 2022, saw little traction until it expanded to Base, where its total value locked has risen to a record high.

Other significant players in the Polkadot network like Moonbeam, Acala, Phala Network, and Astar have also not scaled as initially expected.

In contrast, Solana has become a major player in the blockchain industry, powering meme coins worth over $12 billion, as well as several games and non-fungible token projects.

Base, a layer-2 network launched by Coinbase, has also become a top-ten player in the decentralized finance industry.

Still, Ali Charts, a popular crypto analyst, expects that Polkadot price will bounce back soon, citing its chart patterns.

A potential catalyst could be a new proposal known as the Westend, which would reduce DOT’s inflation from 10% to 8%, with 15% of these funds allocated to the treasury.

Polkdot technicals are sending mixed signals

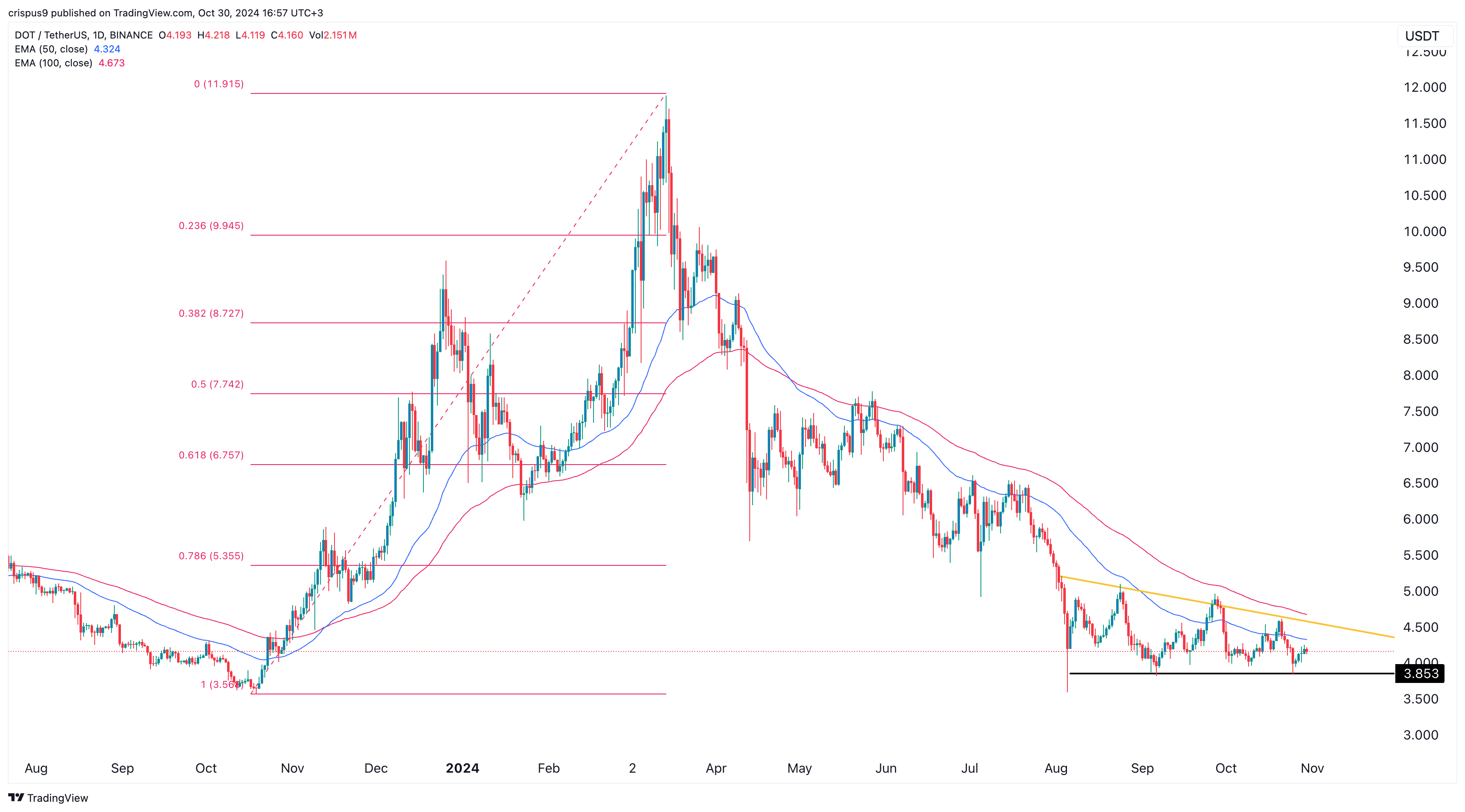

Polkadot token has traded sideways in recent weeks. It has remained slightly above the key support point at $3.853, which it has not fallen below since September.

DOT has also stayed below the 50-day and 100-day moving averages, indicating that bears are currently in control.

More upside will be confirmed if the price rises above the descending trendline that connects the highest swings since Aug. 14.

This article first appeared at crypto.news