Pendle revealed the introduction of two new Liquid Restaking Tokens on the Arbitrum network has boosted PENDLE’s price.

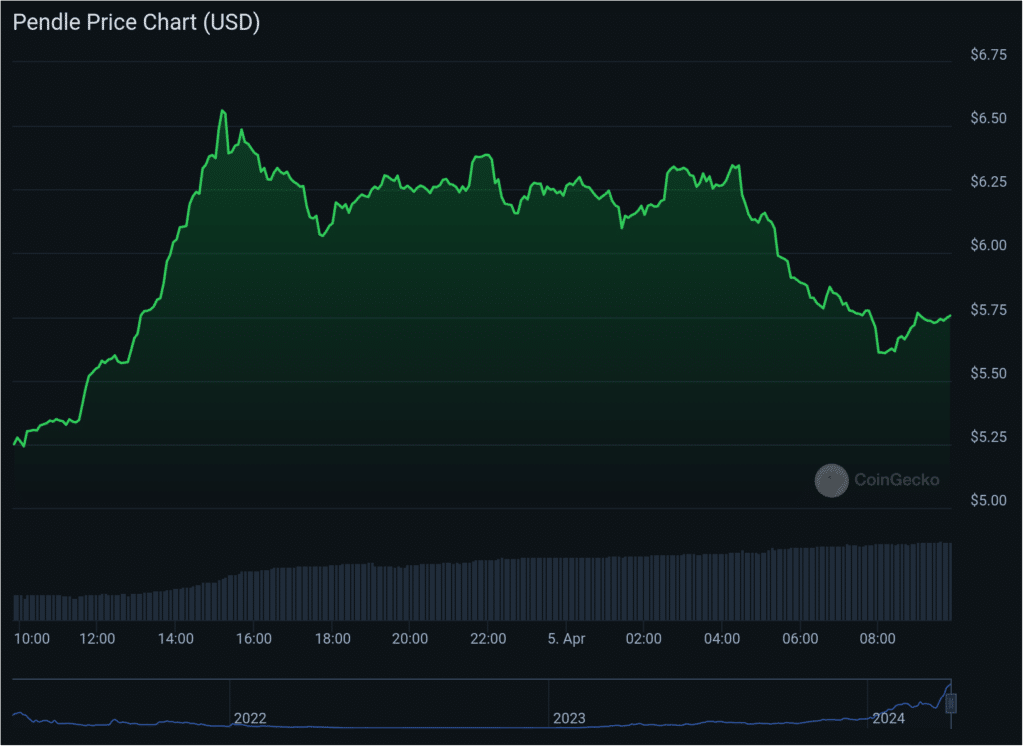

The expansion has led to a notable surge in Pendle’s market activity, with its value climbing 9.5% to $5.75. The addition of these assets aims to diversify the options available to users for yield farming and liquidity provision, potentially enhancing the protocol’s appeal and utility within the decentralized finance (defi) landscape.

Pendle, established in July 2021 by a team led by developers Tong and Josh, has carved a niche by facilitating trading, yield farming, and liquidity provision of tokenized yield assets.

Through its user-friendly platform built on the Ethereum (ETH) blockchain, Pendle enables crypto holders to participate in yield farming by lending their assets to liquidity pools in exchange for rewards, thus democratizing access to defi activities.

Since its inception, Pendle has attracted significant attention and investment, securing $3.5 million in a September 2021 funding round that included contributions from Mechanism Capital and other prominent venture capital firms.

The funds were necessary to enhance the protocol’s offerings and expand its user base. Following this, Pendle launched its V2 version in October 2021, introducing multi-collateral pools and an upgraded user interface to improve the user experience further.

According to DefiLlama, Pendle has reached a total value locked (TVL) of over $3.9 billion and has formed partnerships with defi protocols like Aave and Curve to offer users more opportunities for yield farming and liquidity provision.

This article first appeared at crypto.news