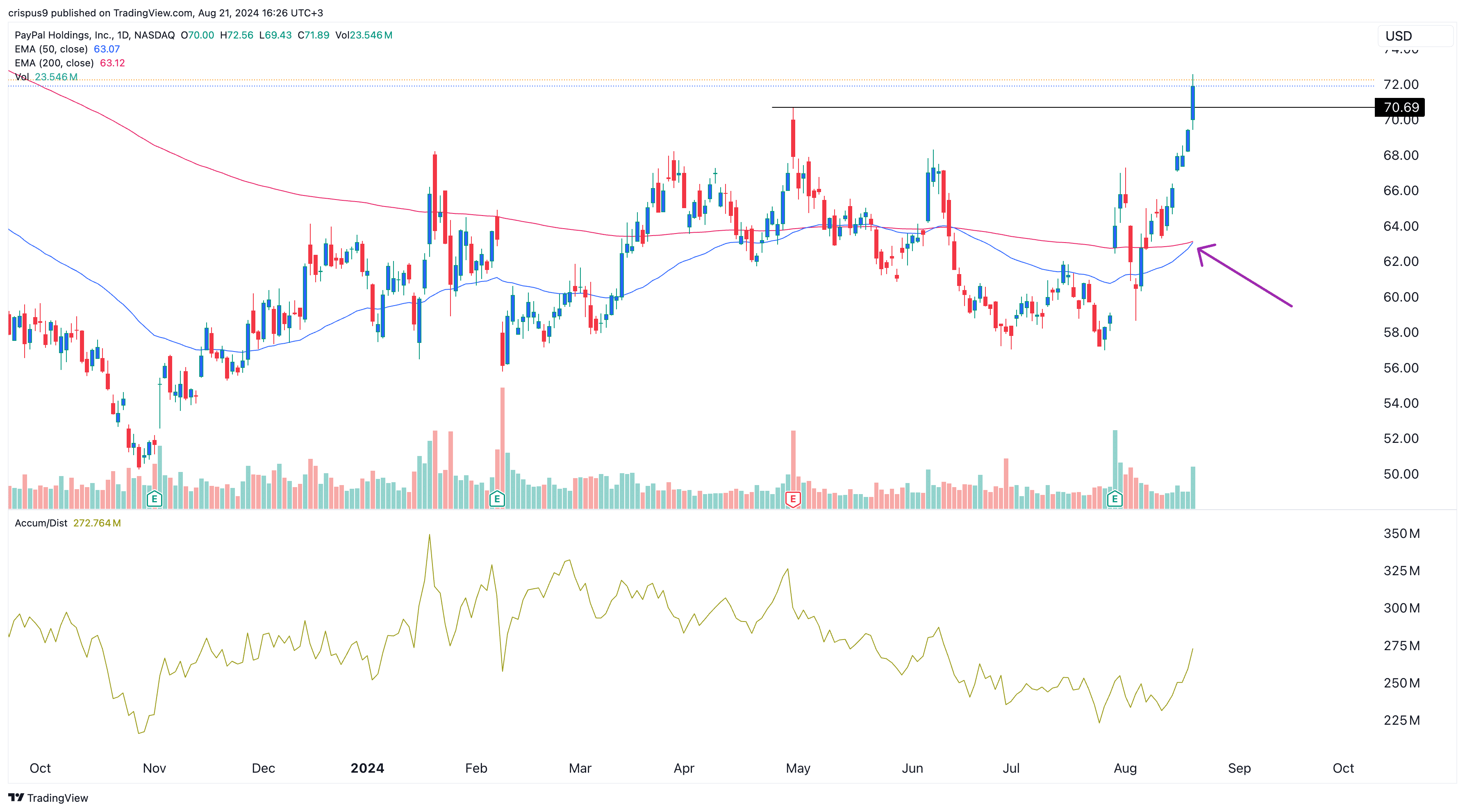

PayPal stock has moved into a bull market, rising by over 26% from its lowest point this month.

PayPal USD stablecoin’s market cap

PayPal USD (PYUSD), the company’s stablecoin launched in August 2023, has been performing well.

Data shows that its market cap has jumped sharply in the past few weeks, crossing the psychological level of $907 million on Aug. 21. This marks significant growth for a stablecoin whose market cap started the year at $264 million.

Stablecoin issuers like PayPal make money in two main ways: interest rates and transaction costs. With U.S. interest rates between 5.25% and 5.5%, PayPal could earn over $50 million annually in interest.

Tether (USDT), the biggest stablecoin, with over $117 billion in assets, made a quarterly profit of over $4.5 billion in the first quarter of 2024. Most of this revenue came from interest, while the rest was from mark-to-market gains on assets like Bitcoin and gold.

PayPal’s challenge is that the stablecoin industry has become highly competitive. In addition to Tether, Circle’s USD Coin (USDC) has become popular, having over $34 billion in assets. Ripple is currently developing its stablecoin offering, RLUSD, which will be backed 1:1 with the US dollar.

Additionally, Ethena launched USDe, which has accumulated over $3 billion in assets, while Ondo OUSD has $340 million in assets. These stablecoins are becoming popular because they reward their holders with monthly returns. USDY has a 5.35% AP derived from U.S. Treasuries investments.

PayPal stock has soared

PayPal’s stock is also benefitting, having risen to its highest level in over 52 weeks, pushing its valuation to over $71 billion. Still, the stock remains much lower than its pandemic-era high of $309 when its valuation peaked at over $300 billion.

The stock jump happened after analysts at Daiwa upgraded the stock from neutral to outperform, noting that the company will prevail despite substantial competition from companies like Apple, Google, and Affirm.

Analysts at Argus Research also upgraded the stock from a buy to a hold, while those at Mizuho, JPMorgan, and Barclays maintained their outperform rating.

The recovery also happened after PayPal published mixed second-quarter financial results. Revenue rose by 85 to $7.8 billion while active accounts fell again to 429 million. PayPal also continued returning cash to investors through stock buybacks.

While it is still early, the stock may continue rising now that it is forming a golden cross-chart pattern. This popular bullish pattern happens when the 50-day and 200-day Exponential Moving Averages cross.

Notably, the stock has crossed the crucial resistance level at $70.69, the previous year-to-date high. The recovery also happens in a high-volume environment while the accumulation/distribution indicator has pointed upward.

This article first appeared at crypto.news