Key Takeaways:

- M2 money supply growth (delayed until early 2025) might indicate another surge in Bitcoin’s price.

- But experts advise caution, noting that Bitcoin’s price is determined by many economic factors, not just a single one.

- Historically, there has been a strong correlation between increases in global M2 and Bitcoin price appreciation.

As ever in the circus of the cryptocurrency market, where an exciting new force of innovation meets the chaos of speculative volatility, Bitcoin price signals are actively promoted. As it turns out, one of the most tracked indicators is the M2 money supply. Its future trajectory and potential impact on Bitcoin make some analysts both excited and nervous. The crux of the matter: will the M2 money supply really cause a “parabolic” run for the top coin in 2025?

The M2 Money Supply Explained: Breakdown of what it is and its Impact

Before we get into the details of recent data and expert opinions, it is important to understand the fundamental idea of M2 money supply in the context of the broader economy. M2 is a broad measure of a country’s money supply, including cash, checking accounts, savings accounts and other near money that can be quickly converted to cash. In short, it is the plentiful purchasing power in an economy.

The Inflationary Link and Bitcoin as a Store of Value: Fluctuations in the M2 money supply, especially through the quantitative easing (QE) policies adopted by the central banks, are often accompanied by inflationary shocks. As more and more traditional currencies come into circulation, they lose their purchasing power. This depreciation sets the stage for the growth of scarcity; scarcity that makes assets such as Bitcoin with a capped supply much more attractive stores of value. And investors flock to these assets to protect their wealth from the ravages of potential inflation.

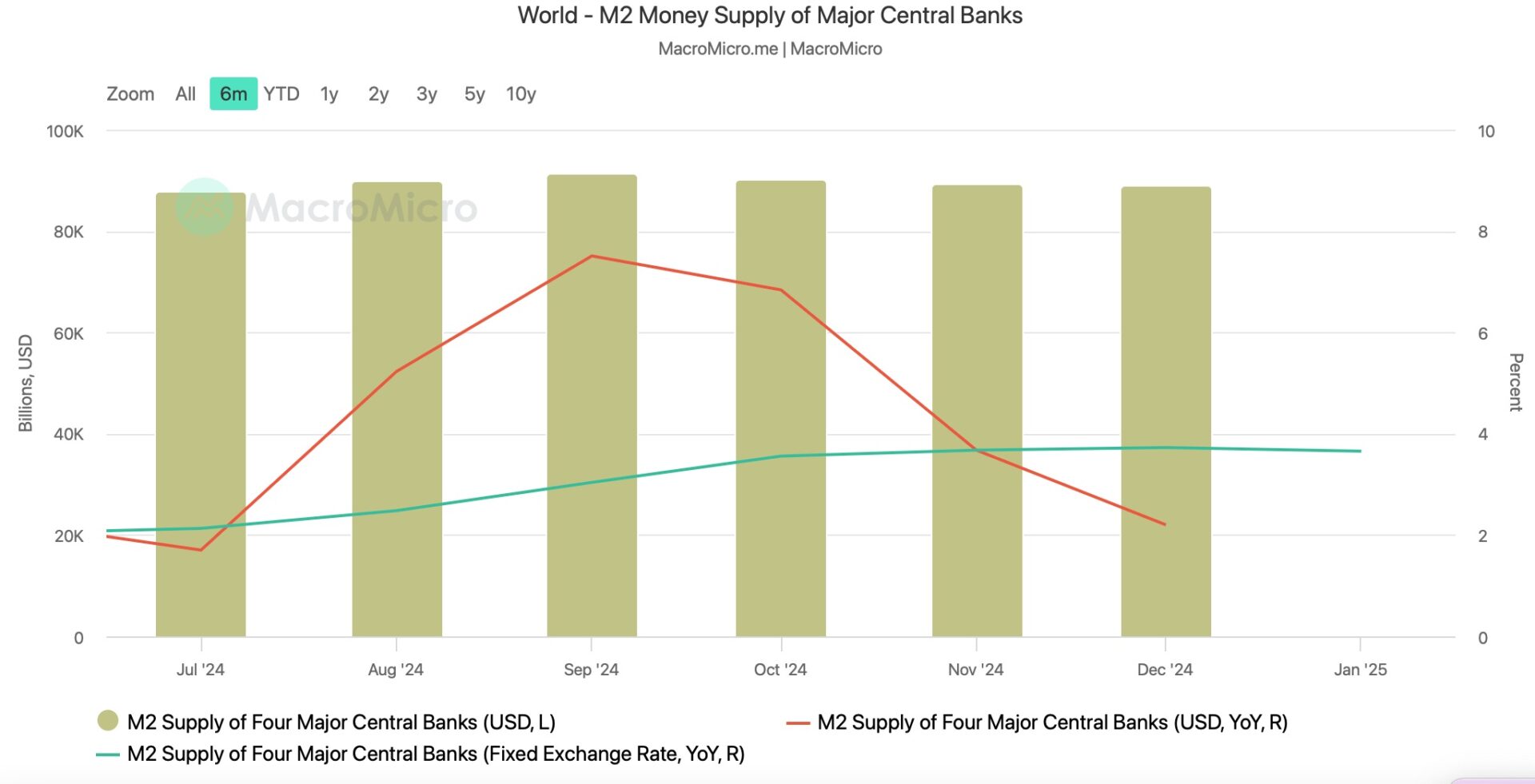

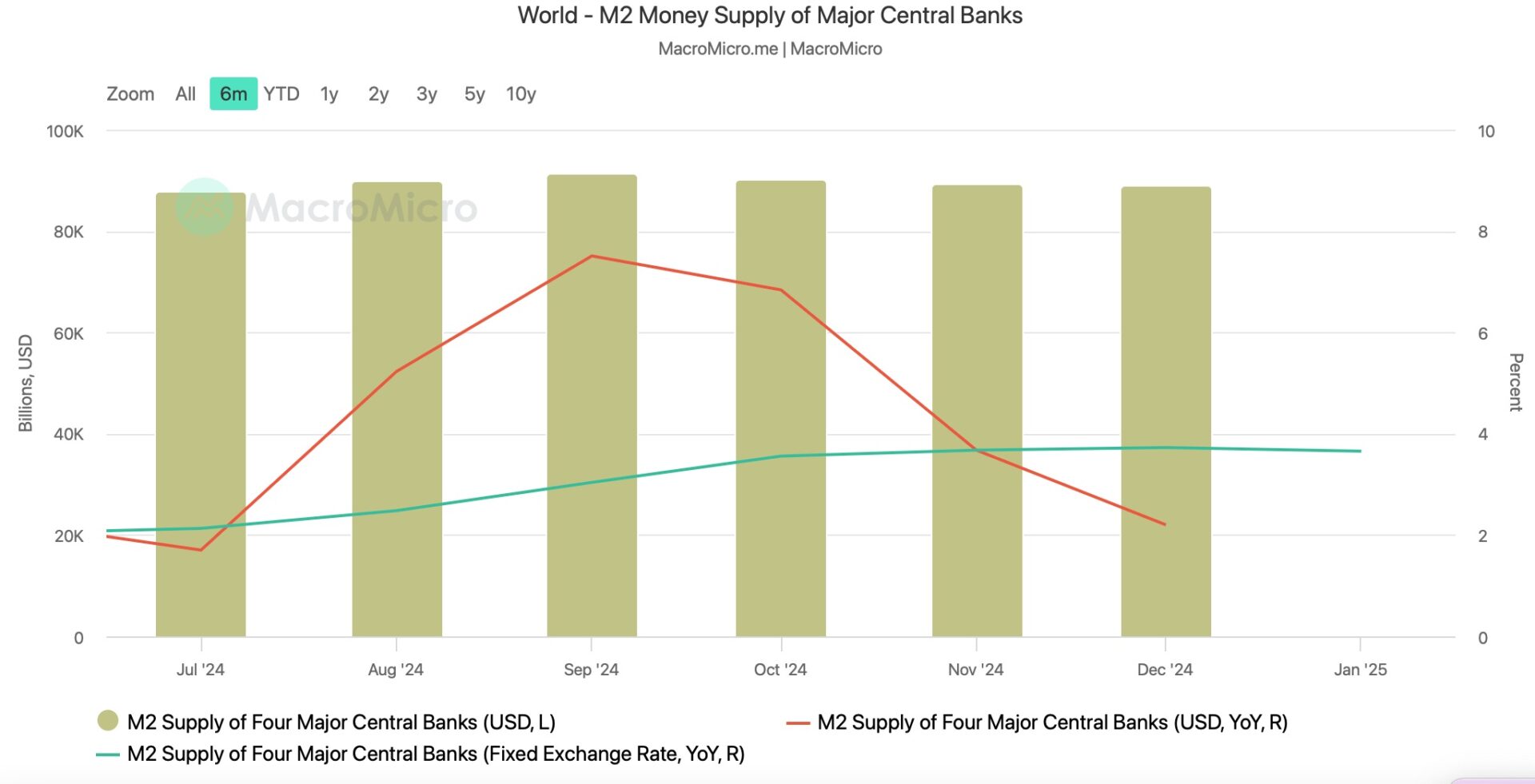

Is Bitcoin Looking Good? The Data Will Be Out in January 2025: Recent economic data provides a persuasive argument for a potentially bullish correlation between Bitcoin and the M2 money supply. According to MacroMicro data, as of January 2025, the year-on-year fixed exchange rate for the M2 money supply of the four major central banks stood at a remarkable 3.65%. The rising trajectory indicates an increase in global liquidity, an important factor that has reflected positively on Bitcoin’s price movement in the past. Such liquidity ramping can lead to more investment in risk assets such as Bitcoin.

The year-on-year fixed exchange rate for the M2 money supply of the four major central banks stood at 3.65% in January. Source: MacroMicro

The Historical Evidence: Lyn Alden’s Research And The M2-Bitcoin Correlation: The correlation between the M2 money supply and the price of Bitcoin is not hypothetical. Economist Lyn Alden highlighted this phenomenon in her popularized research report from September 2024 which noted compelling evidence that Bitcoin has historically moved around 83% of the time in the same direction as the global M2 supply. This demonstrates a strong correlation, suggesting that changes in the M2 money supply may be one of several key factors influencing Bitcoin’s future price movements. This relationship has attracted the eye of investors and analysts alike who view M2 to be a powerful forecasting tool.

An Example From Real Life: The Pandemic Era and its Effect on Bitcoin: The COVID-19 pandemic serves as an excellent real-world example of the impact of the expansion of the M2 on the price of Bitcoin. In response to the economic crisis, governments all over the world flooded their economies with unprecedented amounts of stimulus, which resulted in staggering increases in M2 money supply. When inflation fears started rising, Bitcoin became a “safe haven” for those looking to protect their wealth and was thus propelled by price spikes during this time. This period helped solidify the narrative of Bitcoin as an inflation hedge.

Expert Perspectives: Balancing Enthusiasm with Prudent Analysis

M2 analysis paints a potentially positive picture for Bitcoin. Could M2 signal a significant future movement in Bitcoin’s price?

Pav Hundal’s Measured Approach: Cautious Optimism on M2’s Impact: Pav Hundal, chief analyst at Australian crypto exchange Swyftx, acknowledges the potential for a positive market trend due to M2 expansion but warns against excessive speculation. He is urging a balanced approach, saying, “This isn’t a market to bet your whole stash on a quick correction, but our central scenario is still for a strong March and beyond.” This statement serves as a reminder of the inherent volatility of the crypto market and the potential for sudden corrections.

Bravo Research in Bullish Mood: Look at US Money Supply: Investment account Bravo Research stokes the debate by pointing out how far the US money supply has increased. They say the problem has recently gotten even worse, as “the US money supply has doubled in just 10 years,” and this “this liquidity surge could fuel Bitcoin’s parabolic run-up.” This optimistic view focuses on the possibility of a significant price surge due to the abundance of liquidity being introduced in the US economy. But according to Bravo Research, if Bitcoin were to reach gold’s market cap, it would be worth $1 million, raising the question of whether this is realistically possible.

The US money supply has doubled in just 10 years

This liquidity surge could fuel Bitcoin’s parabolic run-up

If Bitcoin reached gold’s market cap, it would hit $1 million

Is this really possible?

A thread 🧵 pic.twitter.com/hEACXMJ1Vz

— Bravos Research (@bravosresearch) February 24, 2025

Additional Factors: Also consider the fixed exchange rate of M2 money supply of 4 major central banks. According to MacroMicro data, the M2 money supply’s fixed exchange rate peaked at 3.65% in January, suggesting increased volatility in the crypto market. This also suggests that the U.S.’s growing debt could have broader market implications..

Spot Buyers Driving Momentum: “The data we have suggests that spot buyers are active right now, and the US has raised its debt ceiling by $4 trillion dollars,” he noted, mentioning potential tailwinds for Bitcoin given recent market dynamics. Those who buy Bitcoin for instant delivery, known as active spot buyers, show legitimate demand and bullish sentiment.

The M2 Mythos: 10 HARD CHARGED FACTORS Weighing on Bitcoin Price

Of course, we should note that Bitcoin price has other determinants than M2 money supply. The pricing dynamics of BTC are influenced by a multitude of interconnected factors, including regulatory developments, technological improvements, market spectators and global economic conditions. Thus, looking solely at M2 as a predictor can be deceiving.

This has been true time and again, and regulatory news can trigger immediate price action that dwarfs any changes to the M2. A positive regulatory announcement can increase investors’ confidence, leading prices upwards; however, negative news can lead to sell-offs and price drops.

Quantitative Easing and Its Effect

One of the key drivers of rising M2 is something called quantitative easing (QE)—it’s a fiscal policy. It is a non-traditional monetary policy in which central banks inject liquidity into the money supply by purchasing assets (typically government bonds or other financial securities) from commercial banks and other financial institutions — a practice known as quantitative easing (QE) — thereby increasing the monetary base and lowering interest rates.

Currently, active spot buyers are helping to counter selling pressure, driven by strong trading activity. Analysts note a significant number of active buyers in the spot market, reinforcing Bitcoin’s appeal to investors. It shows that investors are gaining confidence in Bitcoin’s long-term potential and that they are happy and able to buy BTC at current price levels.

More News: The Bitcoin ETF Reality: Only 44% of Purchases Are Intended for Holding

The Way Forward: Re-entering a Moving Market with Knowledge

The cryptocurrency market is highly volatile, and past performance is no guarantee of future results. Thus, investors should approach the market cautiously, subject companies to rigorous analysis, and be mindful of their own risk appetite when making decisions.

Meanwhile: The Role of Diversification and Risk Management: At the same time, diversification is still the key element of a sound investor strategy. Proper diversification across asset classes reduces the risk of significant losses from any single company or sector.

M2: A Leading Indicator of Bitcoin Price, Not a Crystal Ball: The M2 money supply is a key indicator of Bitcoin’s price trends but not an absolute predictor. But it’s equally important to understand its limitations and put it in the context of the broader market. Staying informed, exercising caution, and applying proper risk management can help investors navigate this dynamic space and make informed decisions that align with their investment objectives. In the long run, informed decision-making, prudent assessment, and disciplined portfolio management will yield long-term performance in this dynamic digital asset class.

This article first appeared at CryptoNinjas