Decentralized exchange PancakeSwap has presented details of the long-awaited v4 codebase.

According to a March 15 blog post, the new version of DEX will allow for the creation of custom liquidity pools and flash accounting designed to reduce gas costs for users and prevent volatile losses for liquidity providers.

Custom liquidity pools are another new feature of PancakeSwap v4. The pools are expected to prevent sharp price fluctuations during large token sales or purchases.

“Our vision for PancakeSwap v4 extends beyond just a DEX upgrade. We aim to foster the most comprehensive flexibility and functionality within the AMM space, built together by the Kitchen and DeFi developers in the crypto community.”

PancakeSwap team

In addition, developers plan to implement the Singleton solution, which combines all pools into one contract. The initiative will reduce deployment costs by 99%. The PancakeSwap team will also reduce gas consumption by offering collective settlement for transactions.

According to preliminary data, PancakeSwap v4 will begin operating on the Ethereum and BNB Chain networks in the third quarter of 2024.

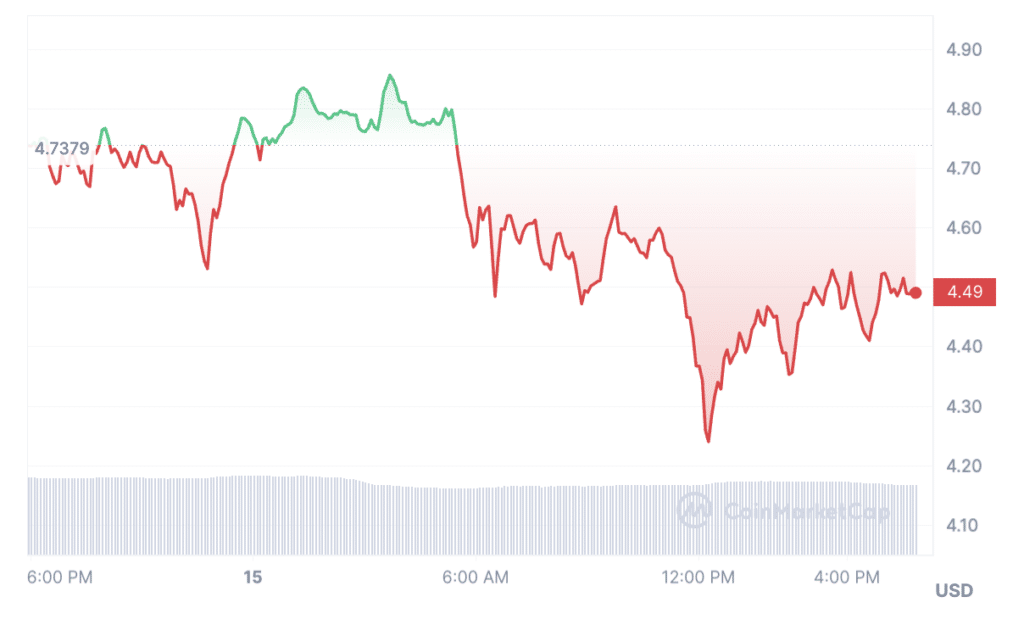

Amid the v4 announcement, the CAKE token fell by more than 5% in 24 hours and tested $4.29. Its capitalization also fell by 5%, to $1.1 billion, and trading volumes fell by as much as 10%, to $287 million.

Earlier in December 2023, the PancakeSwap community supported a proposal to reduce the issuance of CAKE from 750 million to 450 million. The coin has achieved a deflationary model over the past few months, and reducing the issue will strengthen its position. In January, updated data on the maximum circulating volume of CAKE was officially reflected on major digital asset tracking platforms.

This article first appeared at crypto.news